Staying Fit

Remember being nervous about getting cash from an ATM rather than from a teller? Fast-forward a few decades: For every financial task, there is a digital do-it-yourself tool that supposedly makes it easier, faster, cheaper or safer. But is that really true? Here’s what you need to know about the most common and popular online money tools.

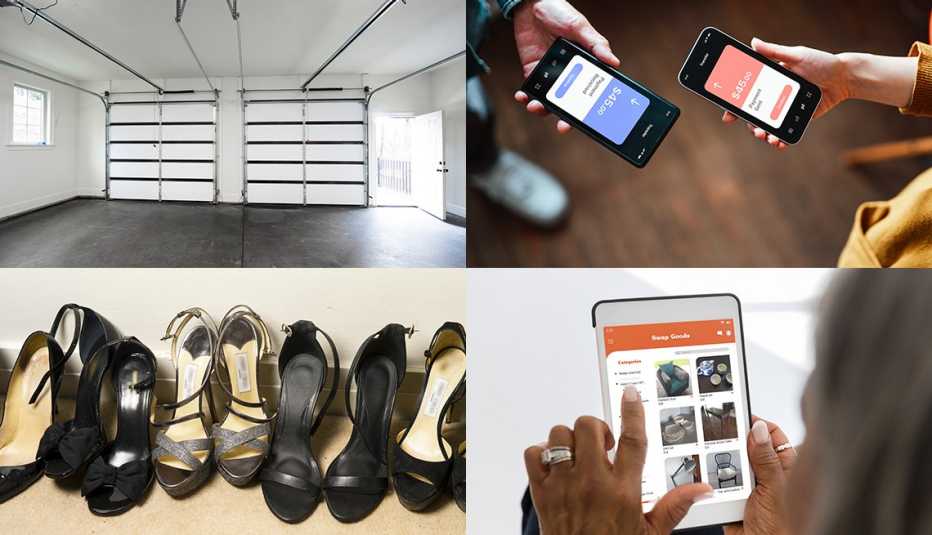

Task: Paying another person

Tool: Money transfer apps

How they work: Venmo, PayPal, Apple Pay and other “peer-to-peer” payment apps store your credit card or bank information and then let you send or receive payments from others who also have an account on that platform. Some stores now accept payments via these apps as well, although fees may apply. You can also use these tools on a computer to send or receive money — but again, only to those who have an account with the same service you use.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Are they safe? Some of these apps keep your money safe by “tokenizing” sensitive information, which means they replace your credit card or bank card number with a different, unique code, protecting your account info from potential hackers. Others may use bank-level encryption to protect your information. These security features make money transfer apps “more secure than carrying around a bunch of cash,” says Tom Kamber, founder and executive director of Older Adults Technology Services (OATS) from AARP and its Senior Planet program, which provide personal tech training.

Tips: With so many money transfer apps to choose from, it’s best to “find out what your friends and family members are using so you can get peer support,” Kamber says. “Once you get used to one of them, the others are quite similar.” Also, be sure to go into the platform’s settings to see that your transactions are kept private. Some services will make this information viewable to other users unless you specifically change that privacy setting.

Task: Paying your bills

Tool: Online payments

How they work: Utility companies, doctor offices and other ongoing service providers often offer an option to pay your bill online via their websites instead of mailing in a check. Just log in with your credentials and enter your credit or debit card information. This can be useful for occasional bills, such as for a doctor visit.