Staying Fit

Federal officials on Wednesday announced sweeping criminal charges against 60 people accused of targeting older Americans and coercing them into paying for more than $300 million in unwanted magazine subscriptions, some costing aging victims more than $1,000 a month.

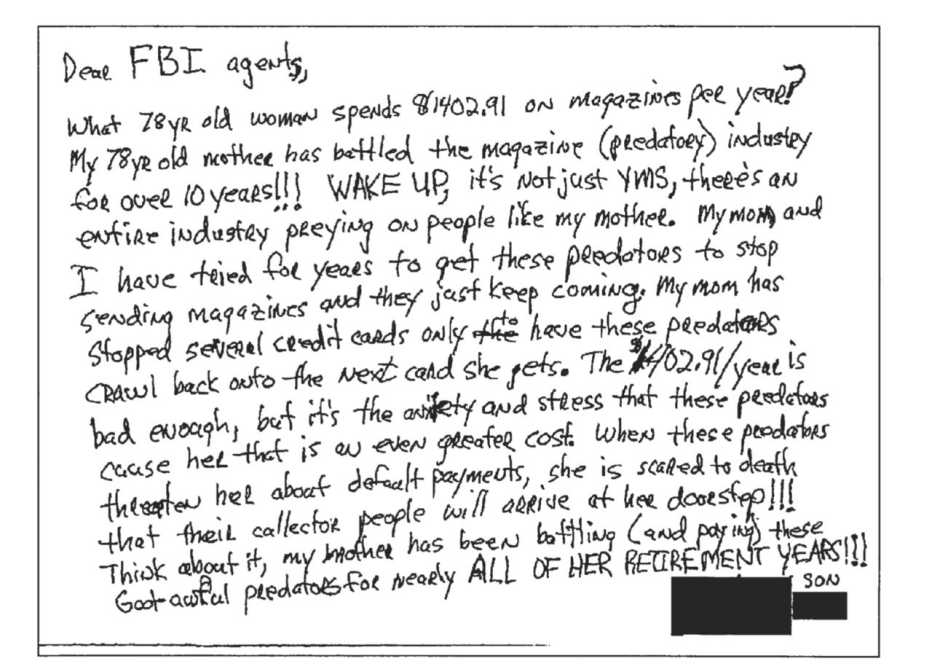

In what is being called one of the nation's largest elder fraud schemes, officials said more than 150,000 people in all 50 states were victimized in fraudulent sales schemes conducted by phone. In some instances the schemes went on for as long as 20 years, officials said, and many who paid for the magazines were older individuals, vulnerable and left financially devastated in retirement. Most magazines purchased never even arrived, officials said.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

One so-called mega victim lost a total of $60,000 to scammers, who officials said remained the targets of an ongoing probe.

'The thieving greed of fraudsters'

"The thieving greed of fraudsters who target senior citizens knows no bounds,” said Michael Paul, the top FBI official for Minnesota and North and South Dakota.

"Using a tactic like telemarketing magazine sales, these deceitful scam artists bilk hard-earned money from their aging victims,” Paul added.

Though glossy magazines have cachet, selling fraudulent subscriptions to them hardly hints at a Hollywood screenplay. Yet the large-scale investigation leading up to three separate indictments — each with multiple defendants — bore the trappings of a TV crime drama: a confidential informant, wiretapped phone calls, FBI stakeouts and undercover federal agents posing as consumers. Law enforcement officials served multiple search warrants and seized computer files, loads of cash and items that included a Breitling watch.