AARP Hearing Center

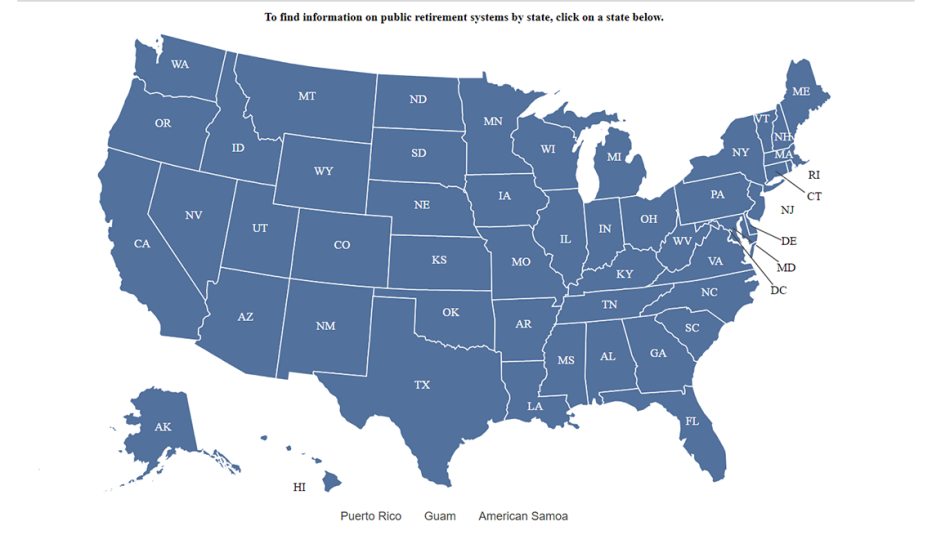

About The State Retirement Resource Center

Welcome to the AARP State Retirement Resource Center, your go-to resource for data, information, and public opinion research related to state legislation, program design, specific focus areas, and implementation of retirement savings. For additional research requests or other needs, please contact AARP Media Relations at media@aarp.org.

The Case for the Auto IRA

2027 Saver’s Match Could Supercharge Auto-IRA Participation

Pew Charitable Trusts research finds SECURE 2.0 provision coming in 2027 puts states on the clock to make prospective beneficiaries eligible for the matching contribution by adopting auto-IRA programs. Over four fifths of Americans express interest in participating in an auto IRA, and interest rises from 84% to 94% when the 2027 Saver’s Match is explained.

Customer Identification Program Rules Hamper Effectiveness of Automatic IRA Programs

To date, 17 states have passed legislation establishing auto-IRA programs, which provide an important retirement savings tool for workers who do not have employer-sponsored retirement benefits, and nearly 1 million workers in eight states have amassed over $1.7 billion in savings. Unfortunately, the CIP is preventing millions more from benefitting from these programs because they are not granted a common exemption for low-risk accounts.

Have State Auto-IRAs and Fintech Shifted Who Contributes to IRAs?

IRAs were created to help those without an employer plan to save, but most IRA assets are simply rollovers from 401(k)s, not new contributions. Recently, though, the share of households contributing to an IRA has ticked up – a little bit for low-income workers and a lot for those under 40.

Latest Research

ERISA and Auto Features: An RSPM Analysis of the Impact of Automatic Features on Retirement Security

The Employee Benefit Research Institute (EBRI) published a new research study that found that when automatic enrollment, automatic escalation, and automatic portability are used together, the impact can be substantial in reducing the likelihood that today's workers will run short of money in retirement.

Closing the Retirement Savings Gap: Early Results from the State Retirement Savings Programs

Early results indicate state retirement savings programs do increase access and have already accumulated almost $2 billion in assets. Studies also suggest that state mandates have resulted in the creation of new employer-provided retirement savings plans.

SECURE 2.0 Act Summary: New Retirement Savings Changes to Know

The SECURE 2.0 Act is a recently enacted significant piece of legislation that has brought about substantial changes to the retirement account rules in the United States. These changes affect retirement savings plans such as 401(k), 403(b), IRA, Roth accounts, and related tax breaks.

What Secure 2.0 Act Means for Your Retirement

Among the many changes it makes to retirement policy, the new law pushes back the required minimum distribution age for individual retirement accounts (IRAs), increases catch-up contribution limits for people over 50, and no longer requires employers to opt in; rather, once employees are eligible, employers will automatically enroll them into a retirement savings plan.

Resources for Researchers and Policymakers

Federal Retirement Legislation

Federal Auto-IRA Bill for Uncovered Workers Reintroduced in House

Representative Richard Neal has reintroduced federal legislation that would require employers with 10 or more employees to automatically enroll workers in individual retirement accounts (IRAs) if they do not already offer a retirement plan.

America Gets Bad Retirement News

Mercer CFA ranked the U.S. 29th out of 48 countries for its retirement income systems, including government retirement provisions and private-sector pension plans. The report says a C or C+ ranking is awarded to systems with "some good features but also has major risks and/or shortcomings that should be addressed; without these improvements, its efficacy and/or long-term sustainability can be questioned.

Video Spotlight

Additional Resources