AARP Hearing Center

CLOSE ×

Search

Popular Searches

Suggested Links

CLOSE ×

Search

Popular Searches

Suggested Links

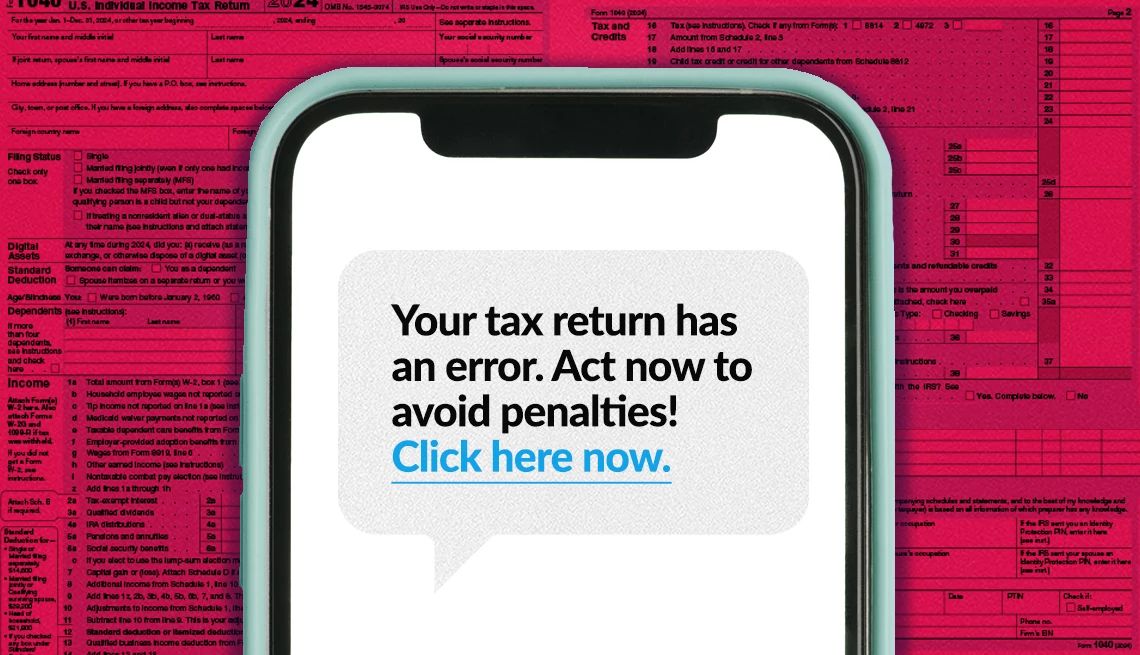

Scams & Fraud

Call Our Helpline If You Suspect a Scam

877-908-3360

Toll-free service is available Monday through Friday, 8 a.m. to 8 p.m. ET

About Scams & Fraud

AI-powered help from trusted AARP sources.

How can I tell if this email/text/call is a scam?

What are the most common scams right now?

I think I've been scammed-what should I do first?

What information should I never share with someone?

AARP’s use of your data is subject to our Privacy Policy. Avoid sharing sensitive details and verify results.

Learn about different kinds of scams

Scam News and Alerts

AARP IN YOUR STATE

Find AARP offices in your State and News, Events and Programs affecting retirement, health care and more.