AARP Hearing Center

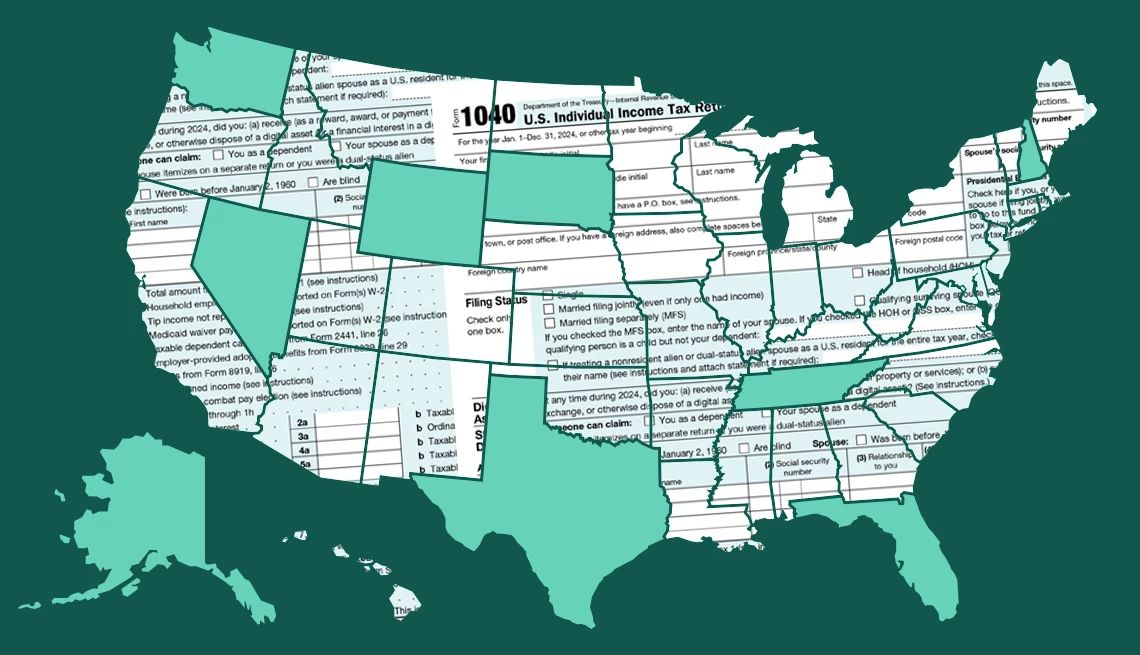

Taxes

Get tax tips to file federal and state returns, boost tax refunds, avoid IRS penalties and more

Federal Taxes

State Taxes

AARP Membership — $15 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

AARP IN YOUR STATE

Find AARP offices in your State and News, Events and Programs affecting retirement, health care and more.