AARP Hearing Center

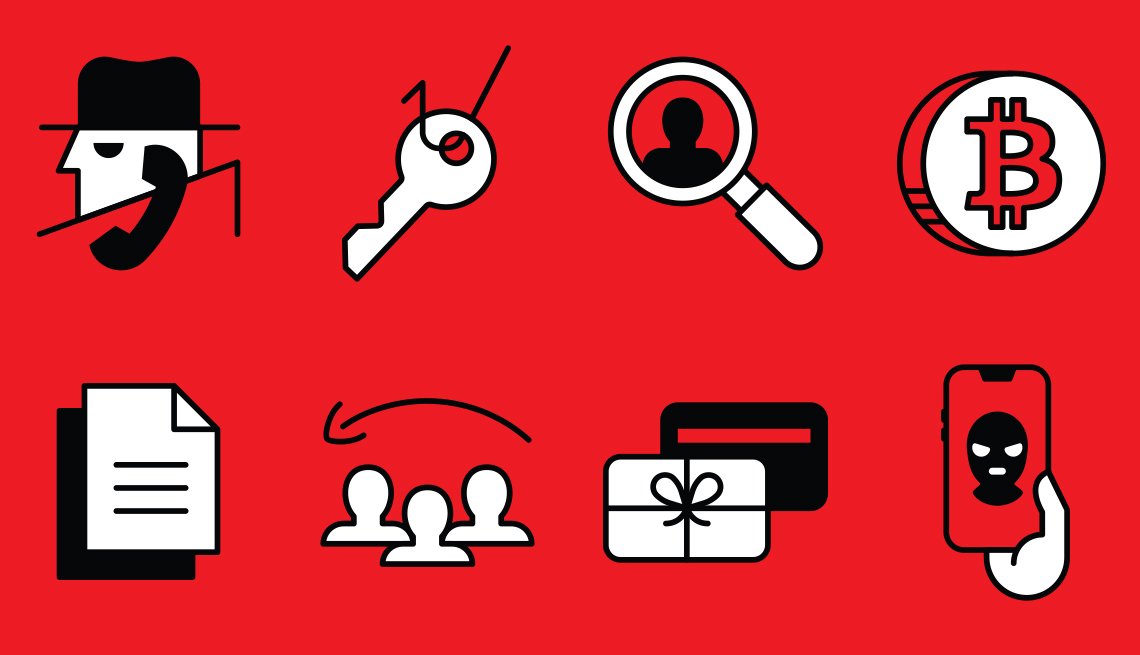

In their never-ending pursuit of your money and identity, criminals are constantly coming up with new cons. Here’s a closer look at eight relatively new types of scams that are becoming more common, along with expert advice on avoiding them. Check out the list of today’s hottest emerging frauds.

1. Google Voice Scam

Let’s say you’ve posted a notice online — an item for sale, for example, or a plea to find a lost pet — and included your phone number. In this scam the crook will call you, feign interest, but say they want to verify first that you aren’t a scammer. They tell you that you are about to get a verification code from Google Voice (their virtual phone and text service) sent to you, and ask you to read it back. What’s really going on: They are setting up a Google Voice account in your name. “They can go on to perpetrate scams and pretend to be you, hiding their footprint from law enforcement,” says Eva Velasquez, CEO of the Identity Theft Resource Center.

How to stay safe: “Never share verification codes with anyone,” Velasquez says. If you have fallen for this scam, you’ll find steps to reclaim your account at the Google Voice Help Center.

2. Rental Assistance Cons

As eviction bans in cities and states expire, renters should be on the lookout for rental assistance scams, says Deborah Royster, assistant director at the Consumer Financial Protection Bureau. Over 583,000 older adults were behind on their rent in mid-2021, opening the door for scammers to impersonate government or nonprofit employees and to request personal info and money up front for applications.

How to stay safe: Apply only to legit rental assistance programs run by government or nonprofit groups, Royster says. Find programs in your area at cfpb.gov.

3. Fake-Job Frauds

Scammers harvest contact info and personal details from résumés posted on legit job websites like Indeed, Monster and CareerBuilder. Then, pretending to be recruiters, they call, email, text or reach out on social media with high-salary or work-at-home job offers. Sometimes the goal is to get additional info about you; other times it’s to persuade you to send money for bogus home-office setups or fake fees.