AARP Hearing Center

Personal Finance

From building wealth to bargain hunting, great ideas to sharpen your money management skills

Living On a Budget

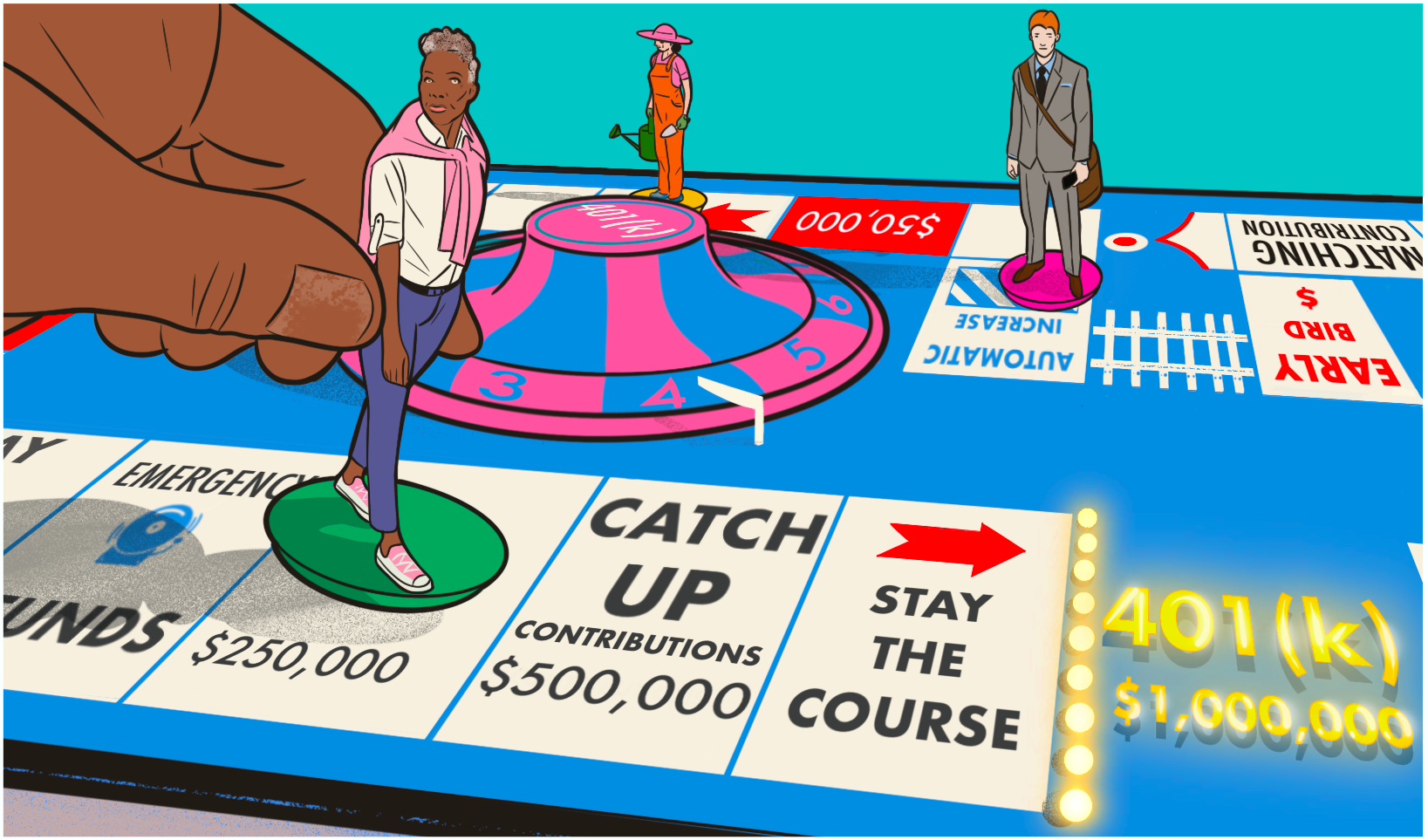

Saving & Investing

Your Money Videos

Save 25% when you join AARP and enroll in Automatic Renewal for first year

Get instant access to discounts, programs, services and the information you need to benefit every area of your life.

Managing Debt

AARP IN YOUR STATE

Find AARP offices in your State and News, Events and Programs affecting retirement, health care and more.