What's New

Helping Others Got Eileen Back Into the Workforce

Learn how this SCSEP participant turned her love of tinkering into new career success.

We Are a Better People When We Care for One Another

Terri Myers-Edwards serves her community by teaching children to be better readers.

Get Help

Digital Skills Training Meets Pressing Need

Digital Skills Ready@50+ initiative will help increase older adults' economic security with training focused on digital essentials.

Make Food More Affordable

Find resources and assistance to make healthy food more accessible and affordable for your family.

Build Your Employment Skills

Unemployed and looking for work? Find out how we can help unemployed and independent workers chart a course toward financial security.

Lower Your Student Loan Bill

See if you’re eligible for national and state repayment and forgiveness programs.

Apply for Property Tax Relief

Take advantage of property tax refund and credit programs in your area with AARP Foundation Property Tax-Aide.

Give Help

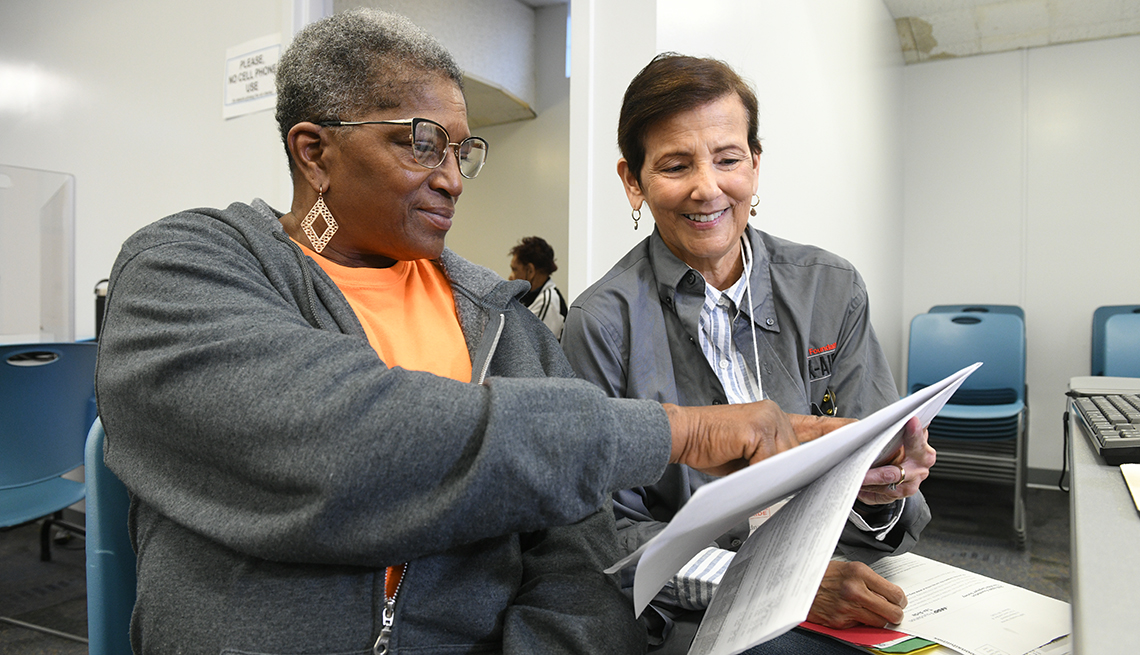

Help Older Taxpayers

Volunteer with AARP Foundation Tax-Aide and help taxpayers get the refunds and credits they’ve earned.

Tutor Young Readers

AARP Foundation Experience Corps connects students with caring older adult volunteers.

Get Involved

Learn how you can get involved and help AARP Foundation and Create the Good to help seniors.

Charity Rating

AARP Foundation earns a high rating for accountability from a leading charity evaluator.