01 COST

Older adults lose an average of 50% of their median net worth prior to a dementia diagnosis.[5]

(From an average of $217,000

to slightly over $104,000)

02 FREQUENCY

84% of financial professionals at a large investment firm reported having a client with dementia.[6]

financial professionals say they do not feel prepared to handle people experiencing cognitive decline[6]

03 OUTCOMES

Your employees may be among the first to recognize signs of cognitive decline in consumers. Here are ways you can help create better outcomes for your clients, customers or members.

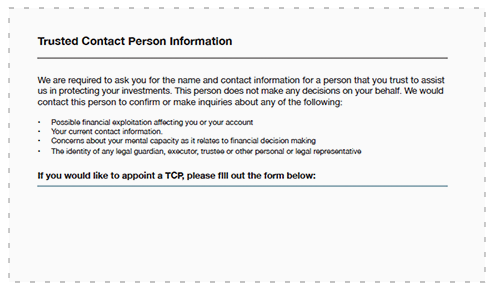

MANAGE

Create policies and programs to help better serve consumers

EMPATHIZE

Respond to each unique situation with care and understanding

RECOGNIZE

Know the signs of cognitive decline

SAFEGUARD

Use your position to steer the best possible outcomes for consumers and institutions