Staying Fit

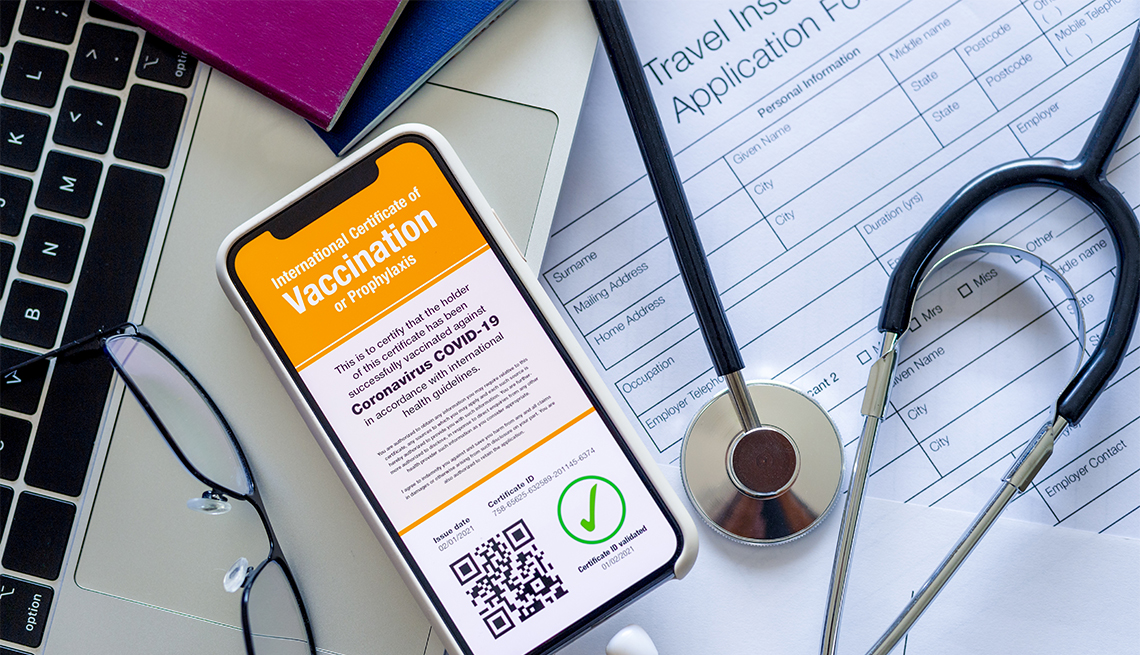

Before your next international trip, you may have to add an item to your packing list: proof of health insurance.

As the world begins to reopen to tourism, Americans are finding that some countries, including many Caribbean nations, now require arriving passengers to document that they have medical coverage. And a few, such as Costa Rica, are even demanding special policies that cover up to $2,000 for the expense of quarantining in a hotel if a visitor tests positive for COVID-19, as well as at least $50,000 of expenses relating to coronavirus care.

"We're seeing this more and more,” says Brook Wilkinson, an editor at travel-advice website WendyPerrin. “If someone wants an easy-breezy trip 2019-style, that's going to be tricky."

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

You may already be covered by a health insurance plan in the U.S. A health insurance policy for international travel may be necessary if you don't have your own health plan, if your plan doesn't cover medical care outside of the U.S. or if your destination requires a special country-specific plan.

Here are questions to ask when considering whether you need to purchase travel health insurance.