Staying Fit

When Jim Sauer read the letter from the Social Security Administration (SSA) in October 2021, he was puzzled. Because he was claiming benefits a year after his full retirement age, he was expecting bigger payments than what the SSA said he would receive. So Sauer called the Social Security office near his home in Fairfield Township, Ohio, to address the problem. But after 12 conversations with local SSA customer service representatives and two calls to the agency’s national call center, Sauer remained not only puzzled but also frustrated.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

“It’s not just the issues themselves,” says Sauer, a former career employee at a Fortune 500 company who worked in international finance. “It’s when you call, you wait on hold forever. And then when you finally get ahold of someone, they seemingly just don’t care about helping you and are highly unqualified to answer your questions or to lead you to where you could get answers.”

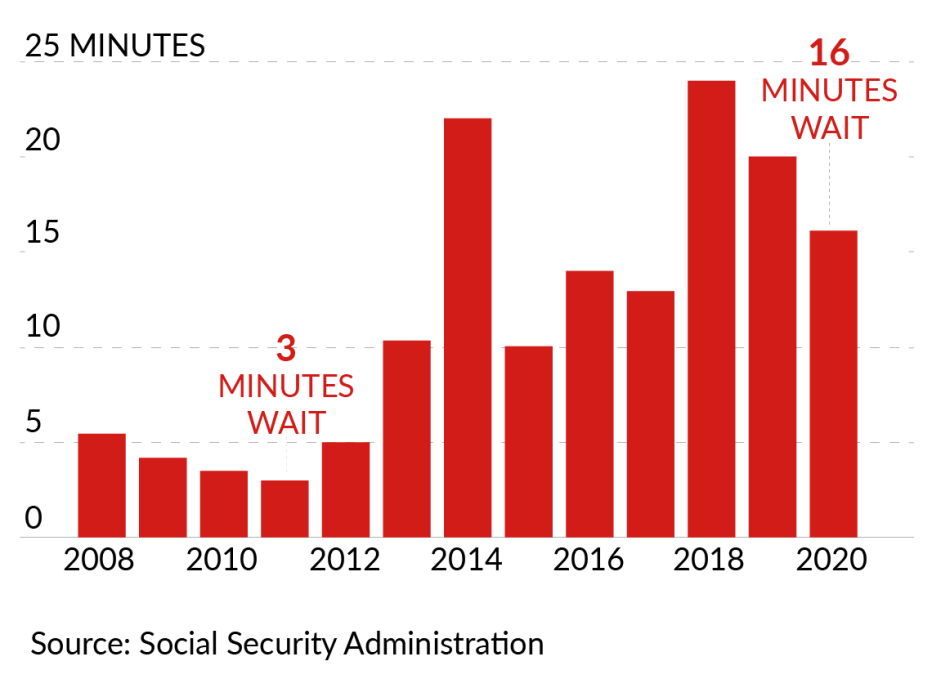

While there’s no hard data on complaints about SSA service, the SSA does release data on wait times for callers. In fiscal year 2011, someone trying to reach Social Security by phone had to wait three minutes to be connected with a representative; in fiscal 2020, the average wait was 16 minutes. The delays were worse in 2018, when a caller would wait an average of 24 minutes to speak with someone.

As to complaints, the anecdotal evidence is plentiful. Nationally syndicated columnist Tom Margenau, former director of the Social Security Administration’s public information office, wrote on the topic last August, noting that “almost every day I hear from readers who have been misled by an SSA representative.” Another popular money columnist, Liz Weston, also recently reported about older Americans’ frustrations with service from the SSA. And AARP routinely hears complaints from members about their difficulties getting help from the agency.

COVID-19, which led the SSA to temporarily shutter its 1,200 field offices, isn’t helping matters. The pandemic has exacerbated previously existing customer service challenges, including conflicting advice and long wait times, says Joel Eskovitz, director of Social Security and savings at the AARP Public Policy Institute. “You have [28,000] people working remotely,” adds Mary Beth Franklin, a certified financial planner and the author of Maximizing Social Security Retirement Benefits. “You have to ask: How good are their computer systems and how good are the connections?” (The 1,200 field offices may reopen this spring. “We anticipate that the field offices will restore increased in-person service to the public, without an appointment, in early April,” an SSA press officer said in January.)

According to the SSA, shortening phone-wait times since 2018 point to an improvement in service. But with roughly 10,000 boomers reaching retirement age every day, the workload for customer service staff will only increase. Is the agency equipped to handle it?

More Social Security Answers

What Is a My Social Security Account and How Do I Sign Up?

Social Security Trust Funds Could Run Short by 2034 as Pandemic Takes Toll

10 Social Security Myths Put to Rest