Staying Fit

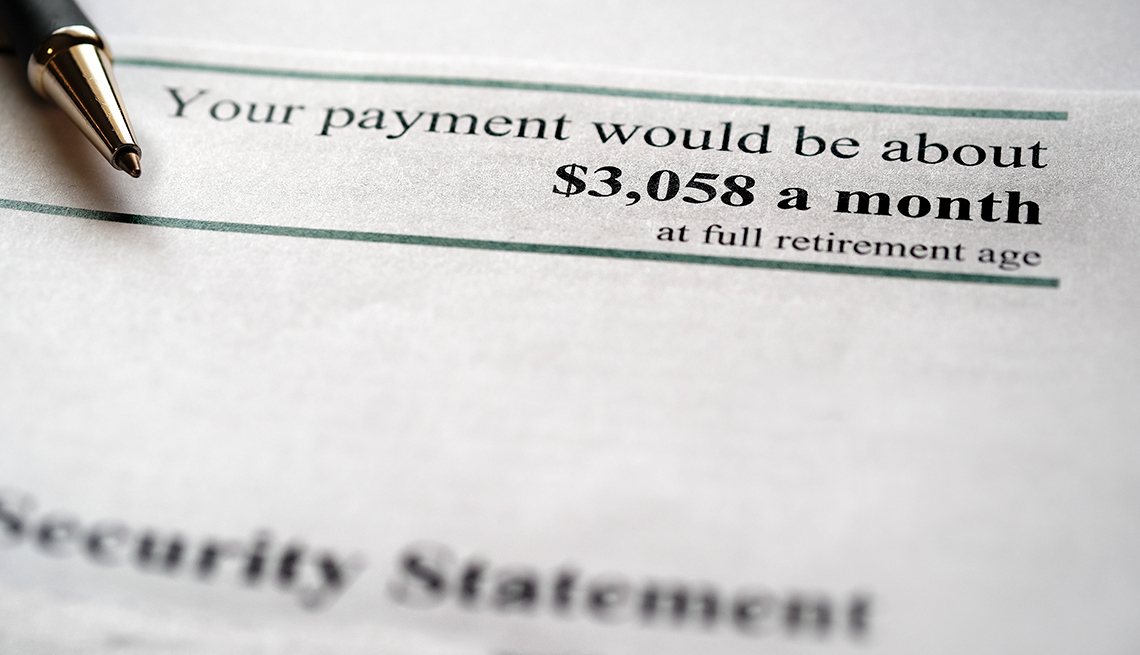

Most people know that the longer they wait to collect Social Security retirement benefits, the more they’ll bring home each month. But even though they could receive up to 77 percent more by delaying their claim until age 70, most Americans opt to start drawing benefits well before that.

“The idea of taking Social Security payments early is a deliberate one,” says Joel Schiffman, head of strategic partnerships at global investment management firm Schroders, which recently released its latest annual survey on older U.S. investors’ retirement plans.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

According to the study, 86 percent of older Americans who have not yet retired know they will get bigger payments if they delay Social Security, “but only 11 percent say they plan to wait until age 70 to tap into it,” Schiffman says.

Leaving Social Security income on the table may not be ideal in the eyes of retirement experts and financial planners, but it’s common practice for older Americans.

Nearly 30 percent of workers start receiving Social Security at 62, the minimum claiming age and the most popular one, according to a July 2022 Congressional Research Service report — even though it means getting up to 30 percent less than the full retirement benefit calculated from their lifetime earnings history. Well over half claim before their full retirement age (currently between 66 and 67, depending on year of birth), and less than 10 percent wait until 70, when they could lock in their maximum benefit.

Those early filers cite myriad reasons for their claiming decisions, experts say. Here are six of the most common rationales, and some grounds for rethinking them.

1. Social Security will run out of money

A big fear among working Americans is that they will pay into Social Security for decades, only for it to be bankrupt by the time they can collect. Nearly a third of respondents to the Schroders survey cited concern that the program would run out of money or stop making payments as the reason they won’t wait until 70.

The counterargument: Social Security is largely funded by the payroll taxes the vast majority of Americans pay on their work income. It won’t run out of money as long as it keeps collecting those taxes.

Social Security may have to reduce benefits in the near future unless Congress acts to shore up its finances. After years of running surpluses, the program is now paying more in benefits each year than it collects in revenue, making up the difference by tapping into cash reserves in its trust funds. Those reserves will be exhausted by 2034, according to the most recent projections by Social Security’s trustees.

But that doesn’t mean the end of the program, says Denny Artache, a financial adviser at Artache Financial Group in Jupiter, Florida. “Even if they do nothing," he says, "Social Security will have enough to pay about 80 percent of [retirement] benefits until 2095.”