Staying Fit

More than 8 in 10 retirees are confident they will have enough money to live comfortably throughout retirement, according to a recent Employee Benefit Research Institute (EBRI) Retirement Confidence Survey.

The numbers have not been so strong since 2005.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Eighty percent were “very or somewhat confident” in 2005, according to the report."We're finding we have worked our way back,” says Craig Copeland, EBRI senior research associate. “The trend is moving up."

Thirty-five percent are “very confident” this year, compared to 40 percent in 2005, the report says.

Retirees also appear to be “much more confident” in their ability to handle expenses in retirement, especially health care.

Asked if there is a retirement crisis, Copeland said, “The crisis can come if Social Security formulas are changed or the benefits are cut."

In fact, in its annual report released this week, the Social Security Board of Trustees said its two funds — the one that pays retirement benefits and the one that disburses disability payments — are projected to become depleted in 2035, one year later than projected last year, with 80 percent of scheduled benefits to be paid at that time, according to Stephen C. Goss, chief actuary of the Social Security Administration. The Disability Insurance Trust Fund reserves are projected to become depleted in 2052, compared with last year's estimate of depletion in 2032, with 91 percent of benefits still payable, Goss notes.

Meanwhile, most Americans believe they will work in retirement. Eight in 10 workers anticipate they will work for pay in retirement, when, based on retiree experiences, only 28 percent actually do, the EBRI report says.

Workers also expect they will work longer than retirees actually do, the report says. The median retirement age among retirees is 62, but workers say they expect to retire at 65.

In fact, more than 4 in 10 retirees stopped working earlier than they expected, the report says, most often because of a health problem or disability or changes within the organization for which they worked. “Workers may not be anticipating circumstances out of their control that can cause early retirement,” the report says.

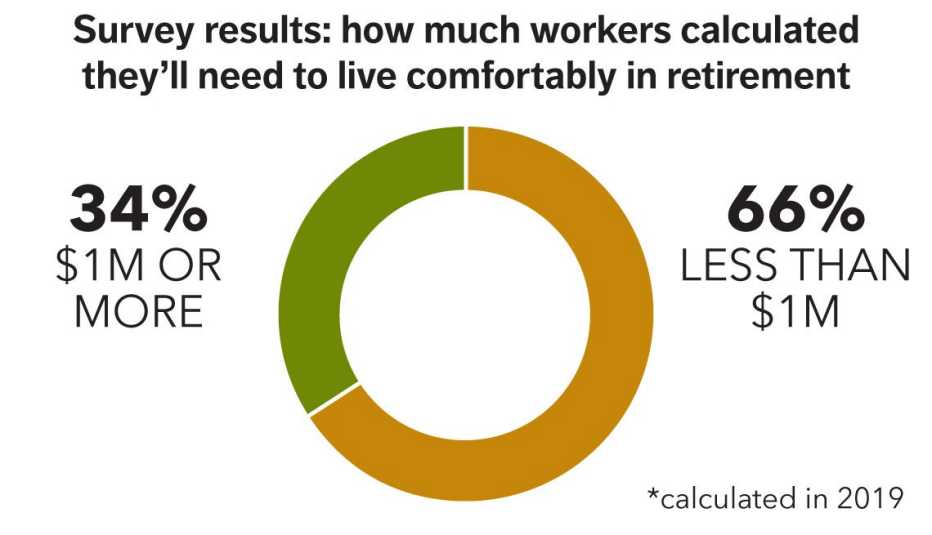

Among workers who tried to calculate how much they will need in retirement, 66 percent said they would need less than $1 million.