Countdown to Retirement: 5 Years

Pay down debt, make home improvements on the cheap and stay employed

Money

Are You Ready to Retire?

En español | Answer yes to any of these questions and it’s time to hit the panic button.

- You have months of unopened credit card bills piling up in the mail.

- You pray that your car passes inspection because you don’t have cash for new tires.

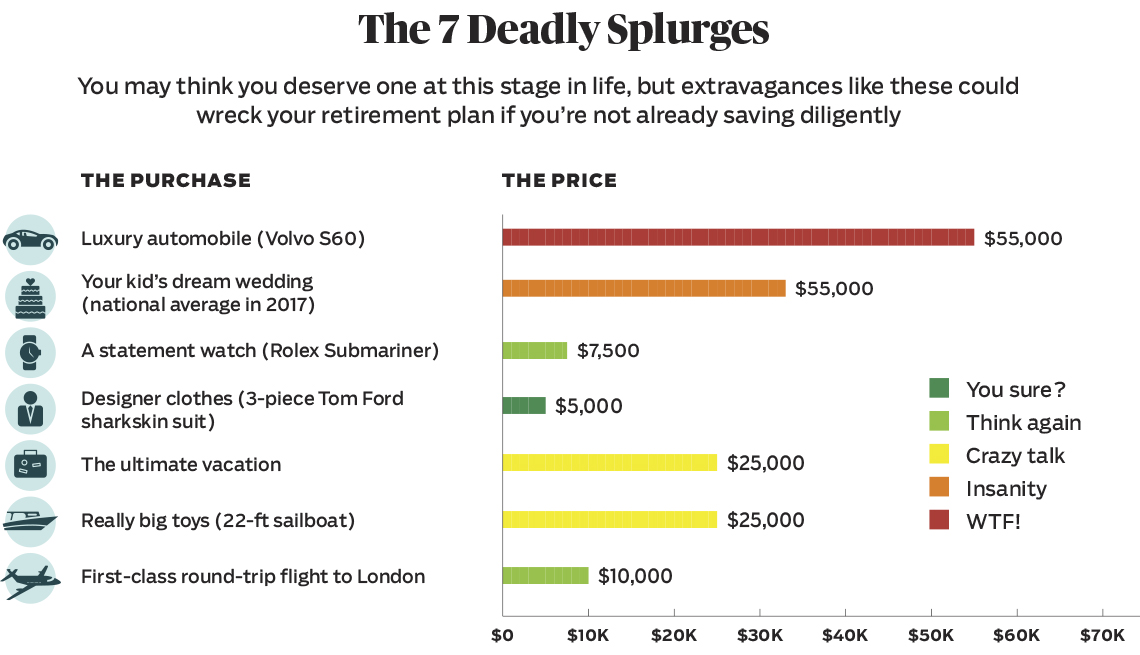

- You’ve spent more money on your wardrobe this year than you’ve put into your retirement account.

- Your retirement financial plan is to get by on Social Security.

- Your backup retirement plan involves lottery tickets.

Attack Your Debt

Because your income is higher now than it will be in retirement, you’ve got more elbow room to pay off what you’ve borrowed. Use it.

The key to success is a written plan, says Linda Jacob, a counselor for Consumer Credit of Des Moines, Iowa. “When it is in writing, you are more likely to follow it and complete it,” she notes. Take these steps.

- Set up a payment schedule The free site PowerPay (powerpay.org) helps you organize your debt payments and creates a calendar showing when each will be paid off.

- Create a written budget It should reflect the spending cuts you’ll need to make to direct more money to your debt payments.

- Write up a goal sheet Include the amount of debt you’re paying off and the date you’ll be finished.

- Face up to it Tape that goal sheet on to the inside of your clothes closet, suggests Jacob — “someplace you go to every day, so you are reminded why you are working so hard at controlling your spending.”

- Get help Try consulting a nonprofit consumer credit counseling agency, which can assist you in getting a handle on credit card and medical debt (maybe by consolidating debts or negotiating for a lower interest rate or reduced late fees). Find a counselor at nfcc.org or fcaa.org.

Do Home Improvement on the Cheap

Plan to move upon retiring? These low-cost tweaks could add thousands of dollars to your home’s resale value.

- Repainted cabinets Give your kitchen a fresh look by putting a new coat on your cabinets — an easy project that could cost you about $900 to $2,000, according to the website Porch ( less if you do it yourself).

- A bathroom mini-makeover A full remodel costs more than $10,000, on average, per HomeAdvisor. A less expensive way to spruce up a dated bathroom is to just replace the fixtures and accessories such as the sink, mirror and lighting.

- Fresh landscaping Homes that are well landscaped have a perceived value of 5.5 to 12.7 percent more, Virginia Tech research found. Design and construction for an average-size yard (1,200 square feet) would cost you $13,200, the site Fixr notes. Or do it yourself for less.

- Have a red door? Paint it black. A red front door is a perennial favorite that makes for an eye-catching entry, but a recent Zillow study showed that houses with black or charcoal gray front doors sell for $6,271 more than expected.

Work

How Not to Get Fired

- Write a new job description for yourself To avoid burnout (a career killer), focus on the duties that you’re good at, you enjoy doing and are valued most in your workplace, says Marty Nemko, a San Francisco-based career coach. Talk with your boss about ways you can double down on the areas where you contribute most. At this point in your work life, “don’t try to remediate weaknesses,” Nemko advises. “Build on strengths.”

- Map out the power structure Make a list of all the people who could affect your job security, Nemko advises. That includes not only your boss but also coworkers who have the boss’s ear. Then “create a reservoir of goodwill between you and people in power,” Nemko says. Depending on the person, that can mean helping on a project, complimenting someone on her ideas or just bonding over your local sports team.

- Keep learning Show up for trainings, workshops and conferences, both in person and online. Even asking colleagues to guide you through a problem helps, Nemko adds. “You’ve got to keep growing or you’re going to be seen as deadwood,” he cautions. Also, educate yourself about any special software that your company uses, suggests Illana Rosen, a career and life coach at Rosen College Consulting.

- Cross generations Become a mentor to a younger employee, suggests David Guydan, director of ESC Discovery at Empower Success Corps. It’s not merely the nice thing to do; you’ll be known as a helpful resource. And being in touch with junior colleagues will keep you current on developing technology and culture.

- Open up to change “Show your willingness to go along with new ideas,” Rosen says, “or come up with some on your own so you aren’t always the naysayer in the room when talk of change comes up.”

Social Security Q&A Tool

Find the answers to the most common Social Security questions such as when to claim, how to maximize your retirement benefits and more.