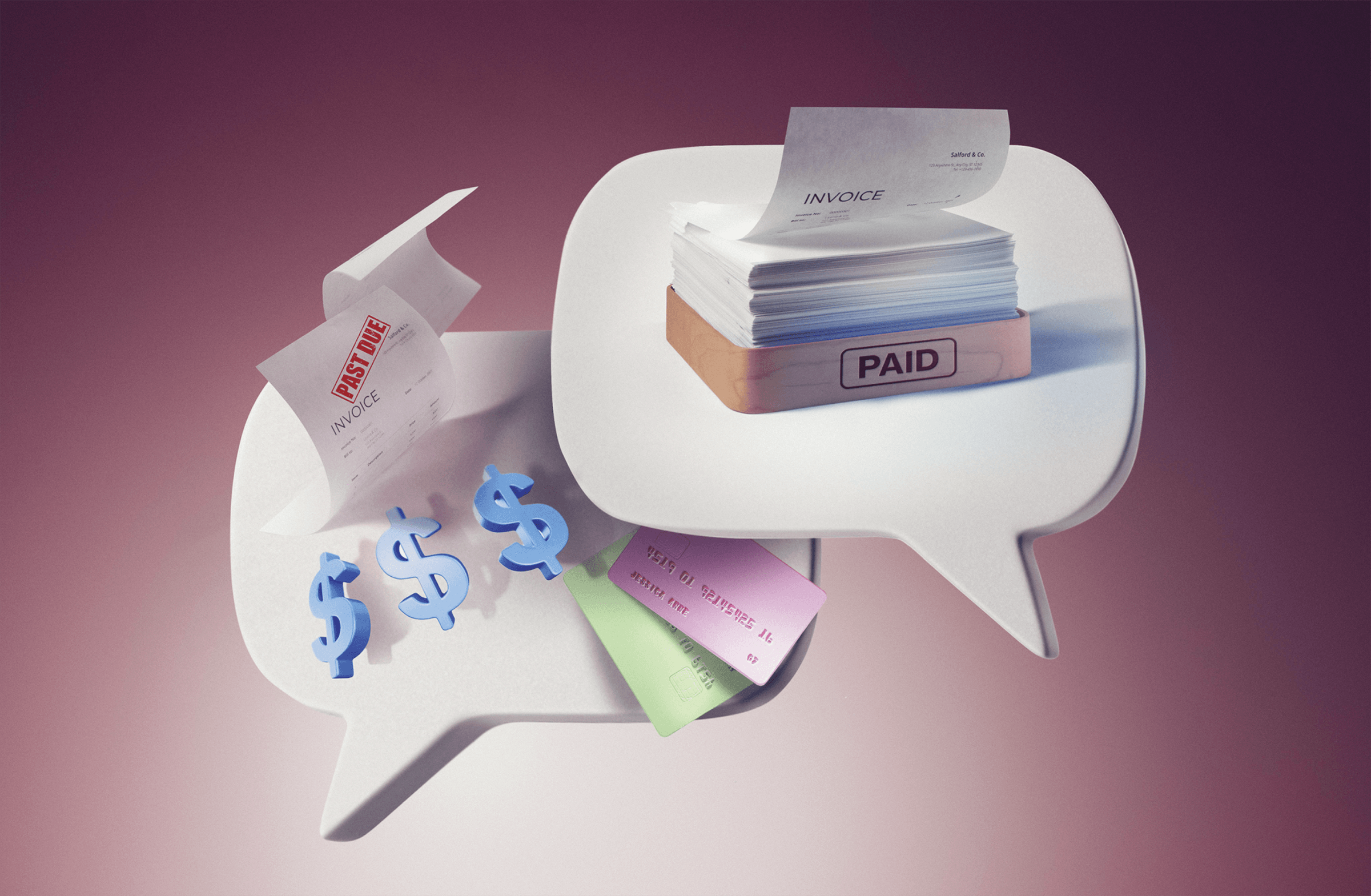

FEATURe STORY

Money Stress and How to Tame It

Inflation, the cost of health care, employment insecurity and an uncertain safety net: There’s no shortage of reasons to feel financial anxiety these days. But these coping strategies can ease the pain.

Photographs by C.J. Burton

PART 1

Attack Your Financial Fears

Have a money problem that’s so big you don’t know where to begin? We show you the first steps to solving some of the weightiest issues people in their 50s face—and how to handle what comes next

By Tamara E. Holmes, Karen Hube, Claire Leibowitz and Kerri Anne Renzulli

“I’M AFRAID THAT SOCIAL SECURITY WILL BE GOING AWAY IN A FEW YEARS.”

START HERE: Don’t let panic about Social Security rush you into claiming before you need to. “Social Security isn’t disappearing,” says Jenn Jones, AARP vice president of financial security and livable communities. Claiming benefits before full retirement age, however, can permanently reduce your monthly payments by up to 30 percent. That’s a bigger cut, she points out, than the 19 percent reduction in benefits that recipients face if Congress doesn’t shore up the Social Security trust fund by 2034. Visit aarp.org/WeEarnedIt, if you haven’t already, to join AARP in its fight to have Congress protect Social Security.

WHAT COMES NEXT: Start considering what it means to you to live comfortably in retirement. Review your savings, get a clear picture of your expected income, and sign up at ssa.gov/myaccount to get a benefits estimate.

While you can’t control the future of Social Security, you can control your finances right now, says Sana Haque, senior financial adviser at Gianola Financial Planning in Worthington, Ohio. Work to save more and spend less. Talk with a financial planner to learn where you can invest your money, and how your other savings, including IRAs, 401(k)s and brokerage accounts, can soften any potential blows from a smaller Social Security safety net. “It’s not going to be zero dollars in 2035,” she says.

“I OWE A LOT MORE IN TAXES THAN I CAN PAY.”

START HERE: File your tax return even if you can’t include a payment. “A lot of people want to put their heads in the sand and not file because they can’t pay, but the penalty for not filing is 10 times more than the penalty for not paying,” says Matt Metras, an enrolled agent at MDM Financial Services in Rochester, New York. The IRS charges a 0.5 percent monthly penalty on unpaid taxes and 5 percent if you don’t file a tax return. So if you owed $2,000 and failed to file or pay, you’d get a monthly $110 charge. If you filed without paying, your monthly penalty would be $10.

WHAT COMES NEXT: After you file, the IRS will send you a bill. Take action to avoid collections, which gives the IRS the right to seize your assets. The most common approach is to go to irs.gov/paymentplan to set up a payment plan for your unpaid taxes—either a six-month short-term plan or a long-term plan for up to 10 years. If you can’t pay over 10 years, ask the IRS to accept an offer in compromise for a lesser amount. Or, if you can’t pay now but think you will be able to later, the IRS may agree to delay collections.

Penalties and interest accrue on unpaid taxes, but you can request that the penalties be waived. “If you have been compliant for the last three years, they may wipe them off your account,” Metras says. This year, in fact, penalties for failing to pay will be waived automatically for taxpayers who haven’t already been penalized over the past three years. Interest, however, generally can’t be abated, Metras says.

“MY HOUSE GOT DAMAGED IN A STORM, BUT THE INSURANCE COMPANY IS LOWBALLING ME.”

START HERE: Review your homeowners policy to be sure you fully understand your coverage limits, deductible, exclusions and any appreciation adjustments. Standard homeowners policies do not cover flood damage. Problems caused by named storms, hurricanes, wind and hail may be excluded or modified with a higher or separate deductible.

If your insurer’s figure for a claim seems low compared to your estimate, ask for an explanation of how it was determined and the adjuster’s line-item estimate, which shows how they calculated repair costs and depreciation.

WHAT COMES NEXT: If you’re covered and you disagree with the insurer, gather evidence to support an appeal. Get repair estimates from independent licensed contractors and highlight any discrepancies between their totals and the adjuster’s report. Include a detailed inventory of the damaged property, as well as videos, photos, receipts, appraisals or maintenance records that show the quality and condition of the home and items before the storm. You can also request a reinspection.

Also consider hiring a licensed public adjuster, who will negotiate with the insurer on your behalf. In return, the adjuster will receive a percentage of the settlement, typically 10 to 15 percent, says Jaeson Taylor, a regional vice president at Sill Public Adjusters. You can find one at napia.com. Alternatively, you can invoke the appraisal clause in your policy. Under this arrangement, you and the insurer each hire an independent appraiser to total the loss; if they can’t agree, a neutral umpire will resolve the dispute. You’ll pay half the umpire costs as well as your appraiser’s fees.

“I’VE GOT A PILE OF CREDIT CARD DEBT, AND MY CREDIT SCORE IS SINKING FAST.”

START HERE: Give your budget a reality check. It can be easy to lose track of your expenses, especially with automatic payments and subscriptions happening behind the scenes, says Mandy Kelso, head of financial education at TD Bank. For example, Kelso and her husband thought child care was their biggest budget killer but were surprised to learn that their car insurance and home insurance had doubled over the previous two years. Other categories that are skyrocketing include groceries, health care, electricity and natural gas.

WHAT COMES NEXT: Once you examine your budget and cut back where you can, try to lower the interest rate on the debt, perhaps by consolidating it into a personal loan or seeing if you can transfer the balance to a card with a zero-interest transfer offer (understand clearly the terms and fees before you do). You might also contact your creditors and see if they’ll lower your rate, says Barry S. Coleman, vice president of program management and education for the National Foundation for Credit Counseling. A nonprofit credit counseling organization, which you can find via nfcc.org, can help you set up a debt management plan and may be able to negotiate lower interest rates and better repayment terms on your behalf, for a fee. The Federal Trade Commission recommends checking out an agency with your state attorney general or local consumer protection agency before working with one.

“MY SPOUSE IS OVERSPENDING WILDLY, AND I CAN’T STOP IT.”

START HERE: Find a quiet time alone with your spouse. Open the conversation by sharing what you’ve noticed or how you’re feeling, recommends financial therapist Rick Kahler, coauthor of Coupleship Inc.: From Financial Conflict to Financial Intimacy. Keep statements focused on yourself—for example, “The credit card bill is higher than usual this month, and I’m worried we may need to start taking money from our savings.” Ask your partner to tell you about some of their expenditures and listen closely, says Kahler: “Fully understanding why they spent what they did could shift your perspective.” Showing your partner credit card statements or other receipts and how that’s impacting the budget may also help them see a change is needed, he adds.

WHAT COMES NEXT: To help rein in the buying long-term, Kahler recommends jointly establishing new parameters around spending. It could be agreeing to discuss purchases larger than $100 before buying, or allotting each partner a monthly amount to spend, no questions asked. You could also set a monthly dollar limit on problem areas like dining out or assistance to other family members. Apps like Honeydue, Monarch and Quicken Simplifi can help you keep track.

Whatever rules you decide on, check in each month to see if the agreement is still working for both of you. If your spouse ignores the new limits repeatedly, you both may need help from a professional—a financial adviser, financial therapist or marriage counselor.

“I NEED A NEW ROOF, BUT I’M AFRAID A CONTRACTOR WILL RIP ME OFF.”

START HERE: Check that any contractor you’re considering is licensed, insured and in good corporate standing, says Ernest Brown, former president of the Construction Lawyers Society of America and CEO of Ernest Brown & Company. You can find licensing requirements and rules for contractors in your state at the construction trade website Procore (procore.com/library/contractors-license-guide-all-states). Many states have online portals that allow you to look up a contractor’s license status and see complaints or disciplinary actions. Look into the contractor’s previous work and reputation, but be aware that images and testimonials can be faked. If you don’t know anyone who’s used the company before, it’s even more important to look up the company’s lawsuit history. Lots of local courts allow you to search their case database by name and may even provide suit specifics.

WHAT COMES NEXT: Ask at least three contractors for bids, which should include a detailed breakdown of the work and pricing. Avoid contractors who don’t allow others to bid or say you don’t need permits, since this is almost always false, warns Brown.

Before any work starts, have a signed contract in place that states the scope of the work, payment schedule, project timeline, warranty length, insurance coverage, dispute resolution process and terms for subcontracting. Beware of “no money down” payment terms, says Brown; they’re often used by unscrupulous companies that charge high interest or other financing costs. And don’t pay the full cost up front; interim payments should match the percentage of the project completed. If the contract contains anything iffy, negotiate a change or drop the contractor.

“I’M 52 AND I’VE BARELY SAVED ANYTHING FOR RETIREMENT.”

START HERE: First, adjust your retirement vision to fit your circumstances. Since you got a late start on saving, “you probably can’t have everything you want, but you can have something,” says Mary Clements Evans, founder of Evans Wealth Strategies in Emmaus, Pennsylvania. Identify your biggest priorities—maybe one is being able to visit the grandkids once a year—and be willing to compromise on things that are less important to you.

WHAT COMES NEXT: Once you have your new vision, work on funding it. Use these prime working years to accumulate as much as you can and take advantage of catch-up rules that let you contribute more to retirement plans now that you’re in your 50s. Also, look for places to trim your budget so you can save more. Some employers offer free retirement planning advice as a benefit, which could help you improve upon your plan.

As you age, there will be other steps you can take. If you wait until you turn 70 to collect Social Security, for example, you’ll receive a larger check than if you start collecting at 67, when you reach full retirement age—and a much larger check than if you claim as early as 62. Finally, reframe the idea of working longer. You may come up with a business idea or find a part-time job that will bring you satisfaction for years to come.

“I NEED A MEDICAL PROCEDURE THAT I CAN’T AFFORD.”

START HERE: If you’re worried about out-of-pocket costs because your insurance denied coverage for part or all of your needed service, file an appeal. People with healthcare.gov insurance plans succeeded in reversing prior authorization denials 44 percent of the time in 2023, according to KFF, a health policy research nonprofit. Review your plan’s appeal instructions and ask your medical provider for any information that could help you challenge the denial. Nonprofits like the Patient Advocate Foundation offer appeal guidance. Or you can try CounterforceHealth.org, a free AI-based service that crafts customized appeal letters and gathers supporting research.

Consider applying for Medicaid too, since this state-administered program covers many medical costs for low-income households.

WHAT COMES NEXT: Ask your provider for help. The Affordable Care Act (ACA) requires nonprofit hospitals to offer free or discounted health care, also known as charity care, to patients who need it. Some states also have laws mandating when free or reduced services must be given. Learn about your state’s policies at dollarfor.org/state-charity-care-laws.

Some providers may reduce your cost in exchange for prepayment or an interest-free repayment plan. “Health care organizations would rather get a little less over a longer period or less still with an up-front single payment than write off the bill as a loss,” says Deb Gordon, director of the Alliance of Professional Health Advocates and author of The Health Care Consumer’s Manifesto.

“THE RISING COST OF FOOD IS BUSTING MY GROCERY BUDGET.”

START HERE: Make a shopping list ahead of time and stick to it, advises Lisa Lee Freeman, the AARP Bulletin’s Live Well for Less columnist: “The impulse purchases are really what kill people.” Sticking to a list can help you stay on budget, she says, though she adds that it’s OK to add items on sale that you know you will use, can easily store and will finish before their expiration dates.

WHAT COMES NEXT: At the market, says Freeman, buy generic brands, which come with more savings. Stores like Aldi and Lidl also carry private label foods at a lower cost. Websites like Misfits Market and Imperfect Foods and apps such as Too Good to Go and Flashfood sell low-priced food that would otherwise get tossed for a number of different reasons, such as being cosmetically flawed.

You can also apply for SNAP benefits online or at your local state office; visit nutrition.gov for more information. If you qualify, you will receive an EBT card that is loaded monthly and accepted at most grocery stores. To learn more about resources at your local food bank, call 211 or visit feedingamerica.org to find the one closest to you.

“THERE ARE LAYOFFS AT WORK, AND I MIGHT LOSE MY MEDICAL COVERAGE.”

START HERE: Ask your benefits department how long employer-sponsored medical insurance would last after a layoff. “Coverage varies by employer, but it often runs to the end of the month, though it may end immediately or last longer,” says Vincent Birardi, senior wealth adviser at Halbert Hargrove in Long Beach, California.

WHAT COMES NEXT: Consider these three options, all of which are typically available as long as you sign up soon after you’ve lost your coverage. First, if you’re married and your spouse has employer-sponsored health insurance, you can enroll in your spouse’s plan within 30 days of being dropped from yours. Second, you can continue your employer’s medical coverage for 18 to 36 months under the law known as COBRA—you have 60 days to apply—but you would pay both your and your former employer’s share of the premium. Third, you can secure individual coverage—again, within 60 days—through the ACA’s Health Insurance Marketplace at healthcare.gov.

“I’M STILL PAYING MY STUDENT LOANS, WITH NO END IN SIGHT.”

START HERE: The stark reality is that student loan borrowers between the ages of 50 and 61 owe, on average, $46,790 per borrower. However much you owe, the first thing to do is find out if your loans will be affected by the One Big Beautiful Bill Act passed last summer, says Kyra Taylor, staff attorney at the National Consumer Law Center. For example, as a result of the legislation, Parent PLUS borrowers—people who took out federal loans for their children’s education—must consolidate their loans before July 1, 2026, and enroll in an income-driven repayment plan before July 1, 2028, if they want loan payment amounts contingent on what they can afford to pay. Visit studentaid.gov to find out about other changes.

WHAT COMES NEXT: Once you know if any deadlines apply to you, make sure your loan servicer has your right contact information so you can be updated on additional changes, Taylor says. Also, assess your health: If you have a medical or mental health condition that prevents you from working, you could be eligible for total and permanent disability discharges. If you’re confused about your repayment options, you may be able to get advice from local legal aid organizations or financial counseling centers. “At the end of the day,” says Taylor, “the biggest goal is not to default.”

Tamara E. Holmes has written about money and careers for publications such as USA Today, Working Mother and Essence. Karen Hube is a veteran financial writer and a contributing editor for Barron’s. Claire Leibowitz is an associate editor of AARP THE MAGAZINE. Kerri Anne Renzulli has worked at Newsweek, Money and CNBC.

PART 2

The Power of Talk

The right conversations with the right people can calm your money worries

By Laura Petrecca

WHEN IT COMES to money stress, talk isn’t cheap. It has real value.

New research indicates that opening up about your money worries can help reduce anxiety—even if your audience comprises strangers on the internet, and even if you get no advice in response.

Communicating about money requires organizing your thoughts, explains Matt Meister, an assistant professor at the University of San Francisco and coauthor of a recent paper on money stress. And that process, he says, can lead to a greater sense of calm.

“It’s not that you have to share a spreadsheet or your bank information with somebody,” Meister says. “Just generally talking through this type of thing can have real and pretty quick benefits.”

But whom should you talk to about your money problems, and how can they help you? Follow these guidelines for more productive conversations.

FRIENDS AND RELATIVES

If someone in your life might be of help, the first step is to let go of any shame or taboo you feel about discussing money problems. “Silence only increases financial stress,” says Ramiro Marmolejo, a financial planner and founder of Financial Rubrics in San Antonio. “When people finally talk through their finances, it’s remarkable how much anxiety disappears.”

Do this:

▶︎ BE SELECTIVE. Decide if you want support or advice, then explain your needs. Also, pick the right confidant. If you want solutions, “don’t go to your big feelings person,” says Jonathan Kolmetz, a financial planner and licensed mental health therapist in Houston. Simply need someone to listen? “Don’t go to your problem solver,” he says.

▶︎ SET EXPECTATIONS. Give a preview of the topic and how long you think it will take to discuss. For instance, you could say to a spouse: “I’m feeling anxious about college costs. Do you have 30 minutes after dinner to talk about this?”

▶︎ MAINTAIN PERSPECTIVE. “Good advice is rooted in your goals and circumstances,” says Jordan Gilberti, founder of Sage Wealth Group in Tampa, Florida. “If it sounds too easy, too extreme, or doesn’t consider your full picture, that’s a red flag.”

ONLINE FORUMS

Meister and his coauthors found that online posts were especially effective at easing stress. Writing, he hypothesizes, gives you a greater sense of control than speaking: You can slow down, edit your thoughts and decide what to share.

Do this:

▶︎ BE CHOOSY WITH COMMUNITIES. The internet can be filled with unsympathetic commenters, criminals and terrible advice. Look for online groups that screen new members and have active moderators, suggests Andrew W. Lo, a professor of finance at the MIT Sloan School of Management.

▶︎ DON’T SHARE IDENTIFYING DETAILS. Discretion reduces your risk of getting scammed, and of losing your anonymity. “If you’re putting something out there about your mother, sister-in-law or pay raise, who’s to say that could not be seen or found?” asks Kolmetz.

▶︎ FILTER ADVICE. Alongside support and solidarity might come advice that’s inappropriate or fraudulent. “People have their own biases, personal circumstances and life experiences,” Gilberti says. Assume that any offer to connect you with an investment or help manage your money is a scam.

FINANCIAL ADVISERS

Talking to a professional may be the right choice when your stress involves major financial decisions that can benefit from specific expertise, including major life transitions like divorce, retirement or estate planning.

Do this:

▶︎ VALUE COMPATIBILITY. Meet with different advisers to learn about their credentials, experience, services and fees. AARP’s Interview an Advisor guide at aarp.org/interviewanadvisor can help you select the right professional.

▶︎ MATCH THE EXPERTISE TO YOUR SITUATION. Along with good rapport, you need someone who has experience helping clients with the challenges you face. An adviser who works mostly with wealthy doctors, for example, might not be a good fit for a schoolteacher.

▶︎ AVOID THE HARD SELL. “Helpful advice centers around education and empowerment,” Marmolejo says. “Harmful advice pressures you toward a quick decision or a single product that claims to solve everything.”

THERAPISTS

For stress that can’t be relieved by informal chats or professional financial guidance, you might want to talk through psychological issues at the root of your troubles.

Do this:

▶︎ FIND A MENTAL HEALTH PROFESSIONAL. Is money stress damaging your relationships? Does it hang over your whole life? Are you spending compulsively? Consider turning to a trained, licensed professional such as a psychiatrist, psychologist or clinical social worker. Ask friends or medical and professional providers for referrals.

▶︎ CONSIDER A SPECIALIST. If your issues aren’t traumatic, you might consult someone in the small but growing field of financial therapy, which straddles finance and mental health. Therapists include mental health professionals focused on money issues and financial advisers particularly interested in the psychology of money. You can find a directory of practitioners at financialtherapyassociation.org.

Business journalist Laura Petrecca was formerly the Money section editor at USA Today.

PART 3

How to Be a Calm Investor

A market historian shares what he’s learned about surviving scary times

Interview By penelope wang

IF YOU want to navigate today’s financial uncertainty, a knowledge of economic history can help. Someone with that knowledge is William Bernstein, an investment adviser and author of The Four Pillars of Investing and other books about investing and financial history. He’s been honored for his work by the premier global association of financial analysts, and he regularly speaks at industry conferences. We asked him what history has to teach us about managing our finances.

Q: With the stock market at record highs, should we be worried about a downturn?

There are warning signs to consider. We have a government that is encouraging speculation in investments such as crypto or certain stocks. We’ve never seen that before in the U.S., except perhaps with 19th-century railway speculation. I’m hearing people boast that they’re 100 percent in stocks, which is the zeitgeist you see at market tops. For the past several decades, we had an independent Federal Reserve that helped keep a lid on inflation at a cost to the economy. Now we seem to be returning to the ’60s and ’70s, when presidents tried to dominate Fed chairs to keep rates low. Back then, we had Lyndon Johnson clashing with William McChesney Martin Jr. and Richard Nixon browbeating Arthur Burns. Those efforts did not work out well, as inflation eventually soared.

But the warning signs don’t tell you when it’s time to sell. Bubbles can last a long time, and some other type of event may cause markets to drop. Of course, no one should try to time the market. But a long-term perspective on investing history helps you identify the warning signs and make sure you’re prepared to ride out crashes, which are inevitable.

Q: What is the best way to protect your finances in a downturn?

The most important lesson that I’ve learned is that you don’t design your investment portfolio based on normal stock and bond returns. You design it with the worst-case scenarios in mind, such as the stock market downturns in 1929 or 1981 or 2009. History shows that the worst returns may happen only 2 percent of the time, but that 2 percent outcome can wreck your finances, especially if you panic and sell at the bottom.

The second most important thing I’ve learned is that compounding is magic, and you should never interrupt it. It’s essential to leave your money invested to grow over time. And what’s most likely to interrupt compounding? Panicking and selling in a worst-case scenario.

That means you should hold a portfolio that is much more conservative than you might think, since you’re more likely to stick with it in tough times. If your ideal portfolio is, say, 60 percent in stocks and 40 percent in bonds, you may want to shift closer to a 55-45 or 50-50 mix, depending on your circumstances.

Q: What is the biggest risk that could derail our finances?

The biggest risk to investors in almost any historical period is inflation. We’ve all seen what’s happening in Argentina today or, in the last century, Germany’s Weimar Republic, when inflation ran rampant. Even the United States has had some really scary periods, including after World War I and during the ’70s, when inflation hit double-digit rates.

A good way to make sure your retirement income keeps up with inflation is to include Treasury Inflation-Protected Securities, or TIPS, in your portfolio. These Treasury bonds are designed to track inflation as measured by the consumer price index. You can buy TIPS through a brokerage firm. You can build a ladder of TIPS, with maturities in every year, which is what I’m doing. A free website, TIPSladder.com, can help with that. But if you prefer to keep things simple, you can opt for a TIPS mutual fund. It’s best to keep TIPS in a tax-sheltered account, since interest is paid monthly and you will pay federal taxes on the inflation adjustment.

Q: How can you reduce financial stress during market upheavals?

You have to plan for them. There will always be times when the markets don’t deliver the returns you expected. They may even collapse. It’s hard not to react emotionally and be tempted to sell if you see your portfolio drop 40 percent or 50 percent, as happened in the global financial crisis of 2007–2009.

To help lower that anxiety, you need to be keeping enough money in safe assets to cover your spending needs during a downturn. That way, you’ll be able to sleep at night knowing you can pay your essential living costs, such as mortgage, gas and groceries, despite drops in the stock market.

Your risk isn’t just what might happen to your investment portfolio in a downturn or recession, but also the possibility that you might lose your job. That argues for building an emergency fund of one or two years of expenses, if you can. You should keep that money in a safe, accessible place, preferably one with a government guarantee, such as a high-yield bank savings account or Treasury bills.

Penelope Wang is an award-winning personal finance journalist who has worked at Consumer Reports and Money magazine.

ERRATIC INCOME FROM A START-UP

In my 50s, I launched Thrive! Resumes, a writing service. My income swung wildly, going from zero one month to $10,000 the next. It was terrifying to have no steady paycheck.

Then I began to treat my venture like a real business. I saved during “feast” months and paid myself a modest, steady salary. I learned to live like a grad student: no eating out, for instance. Now I’m financially stable, and I never worry about paying the bills. —Joni Holderman, 67, Myrtle Beach, South Carolina

RETIREMENT SAVINGS ERASED

When my employer, Enron, collapsed in 2001, so did my retirement nest egg, which was in company stock. I couldn’t find work in my field; I was in my 50s, without a college degree, and ageism and racism didn’t help. I worked temp office jobs. I moved out of my apartment into subsidized church housing, cut my food budget and shopped at thrift stores.

At 62, I started taking $1,200 a month in Social Security. I later earned bachelor’s and master’s degrees in organizational social work. Now I volunteer at a community center’s after-school program. I live simply—and gratefully—one day at a time. —SistaFabu Modupe, 76, Houston

THE COST OF DEMENTIA

When my wife, Linda, started experiencing dementia, she asked me to not put her in a nursing home if I could help it. In late 2023, though, she stopped recognizing me. She was afraid of me. Her physician suggested I hire a full-time caregiver. I’d wanted to retire, but I kept working so I could afford that. When her caregiver had to take eight weeks off, I got time off from work but no pay. I started depleting savings. Caregiving is costing me $41,000 a year.

At the same time, I really enjoy that my wife can stay around things familiar to her. Our family and friends visit her weekly. She gets a big smile on her face. That’s very important. —James Parker, 60, Alleghany County, Virginia

Portrait illustration by Michelle Kondrich