THIS IS 50

Generation X-Mas

The holiday film debate goes beyond ‘Die Hard’

Every year, film fans ponder: Is the classic Bruce Willis action blockbuster Die Hard a Christmas movie? But the discourse shouldn’t end there. A number of popular movies from the ’80s and ’90s that aren’t traditional holiday fare are set in the yuletide season. Let’s open up this box and see what’s inside.

DIE HARD 1988

John McClane attends his estranged wife’s Christmas party in hopes of reconciliation before terrorists take everyone hostage.

HOLIDAY FACTOR: There’s a tree, a Santa hat and a “Ho, ho, ho!” The season is central to the story.

MERRY-METER

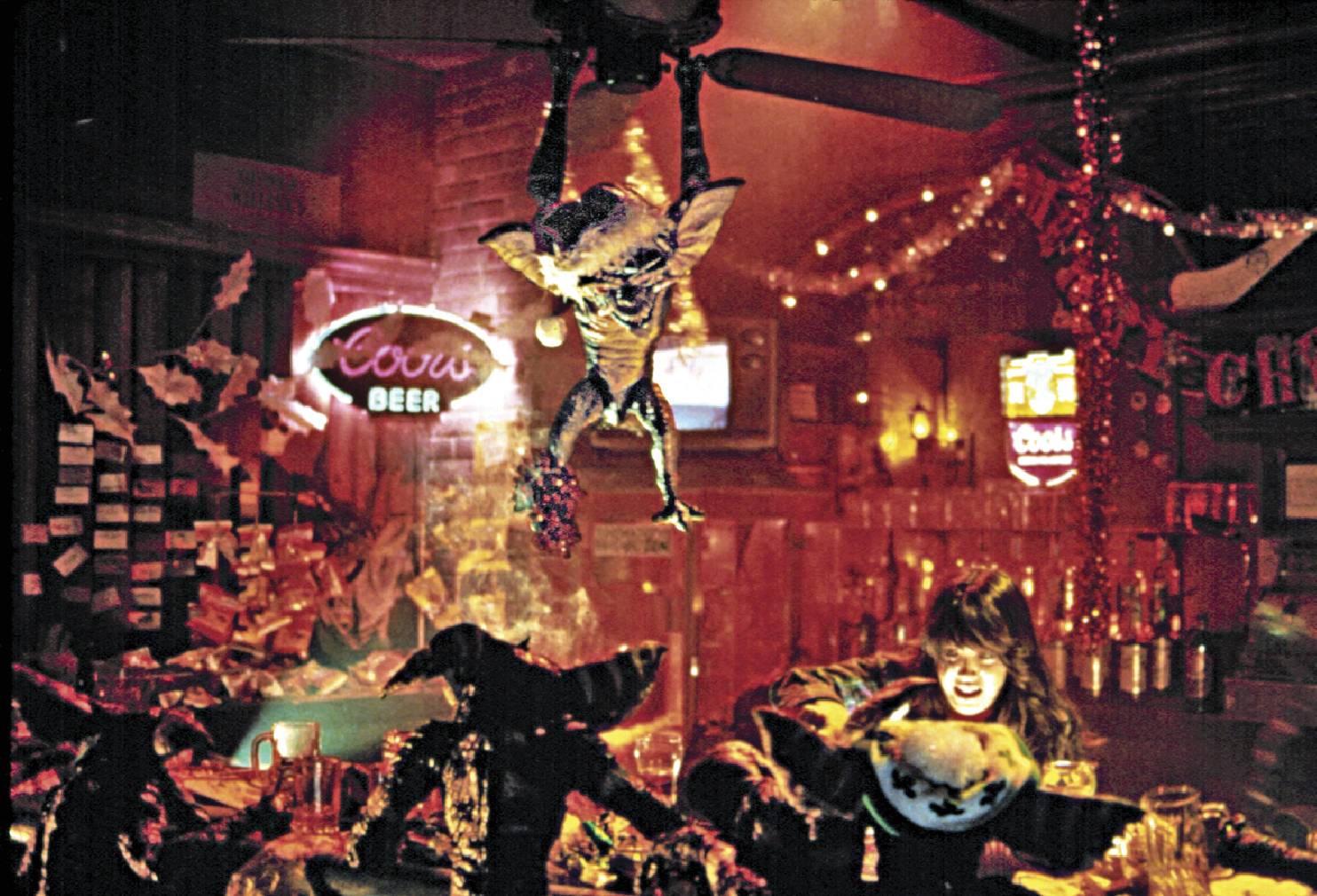

GREMLINS 1984

Billy gets a new pet but doesn’t follow three simple rules for care and feeding. Chaos ensues.

HOLIDAY FACTOR: This chilling tale of a Christmas gift gone wrong shows snowy streets and caroling. It’s a monster movie with yuletide joy.

MERRY-METER

TRADING PLACES 1983

A wealthy commodities trader and a street hustler swap roles in a sociological experiment.

HOLIDAY FACTOR: We get Dan Aykroyd in a dirty Santa suit. But Christmas is more of a backdrop; New Year’s Eve is more prominent.

MERRY-METER

HOME ALONE 1990

Young Kevin’s family leaves him solo for the holidays, and he defends his turf from criminals.

HOLIDAY FACTOR: Yuletide decor is in nearly every scene. Holiday tunes are on the soundtrack. And nobody wants to be alone at Christmas.

MERRY-METER

LETHAL WEAPON 1987

Mismatched detectives—one sad and lonely, the other a happy family man—must work together.

HOLIDAY FACTOR: The songs and trees are there—but more important, the characters display the heightened emotions of the holidays.

MERRY-METER

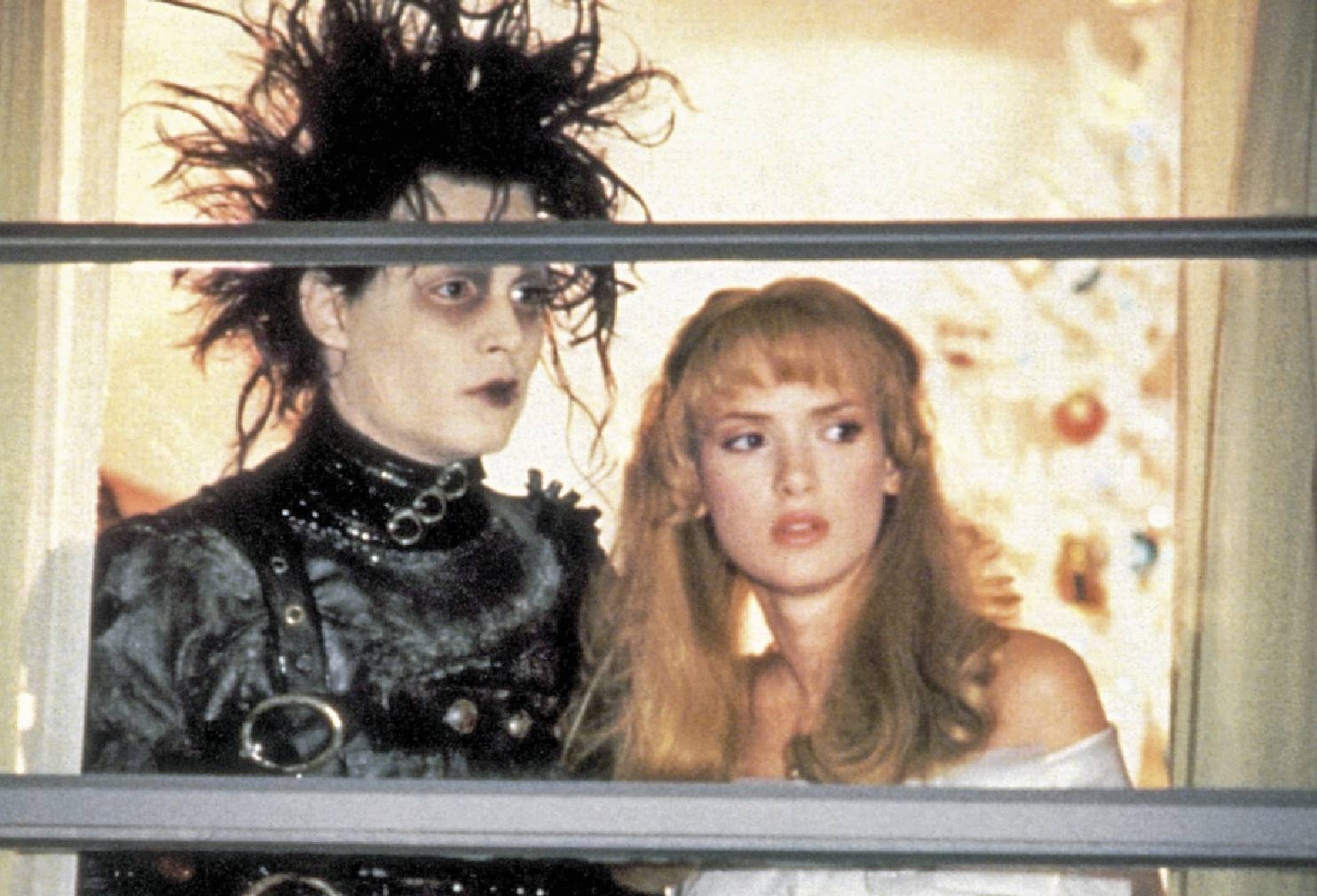

EDWARD SCISSORHANDS 1990

A soft-spoken humanoid with blades for hands leaves his Gothic castle for sunny suburbia.

HOLIDAY FACTOR: Snow (fake) and tree-trimming contrast with the darkness. And what a paper garland he makes! —Whitney Matheson

MERRY-METER

Will You Be Ready to Retire?

Here’s how to prepare when you’re 10 years away

ONCE YOU HIT your 50s, retirement starts to seem real—especially if you’re worried you haven’t saved enough money. Take charge of your finances during “pretirement”—the time when you’re closer to the end of your career than the beginning.

Run your numbers. Estimate your expected living costs in retirement—and whether your savings and expected income will cover them.

Turbocharge your savings. Commit to contributing the maximum amount to your retirement plan, remembering that workers age 50 and older are allowed to contribute more. This year, the maximum was $31,000 in a 401(k) or $8,000 in an IRA.

Wipe out high-interest debt. Resolve to pay down as much debt as possible. Target costly credit card debt first; then move on to personal loans and home equity loans.

Accelerate your mortgage payments. Retiring mortgage-free would lift a big monthly payment off your shoulders. If you pay half your mortgage payment amount every two weeks, you’ll end up making one extra payment per year.

Check your withholding. If you regularly receive a large tax refund, reducing the amount of paycheck withholding will free up money for contributions to your retirement savings or paying down debt.

Plan for long-term care. If you’re considering purchasing a long-term care insurance policy, you should look into it now, since rates increase the older you get. —Sandra Block

AARP and the Ad Council created free tools you can use to set and achieve your pretirement goals. Go to thisispretirement.org to try them out.

From top: 20thCentFox/ Everett Collection, Warner Bros/Everett Collection, Everett Collection, 20thCentFox/Everett Collection, Mary Evans/Warner Bros/Ronald Grant/Everett Collection, 20thCentFox/Everett Collection