COVER STORY

How older Americans are embracing independence and redefining what it means to age alone

BY SARI HARRAR

ILLUSTRATIONS BY JON KRAUSE

At 102, Mildred Kirschenbaum plays canasta and mah-jongg weekly with friends, sips her favorite vodka-and-tonic cocktail (“It’s medicinal,” she quips) and trades stocks online. Living alone in Boca Raton, Florida, Kirschenbaum became a social media sensation at age 99, dispensing tart advice about aging via TikTok and Instagram.

“I want to be alone,” says the retired travel agent, a widow for 19 years. “I like my own company.” Recent health issues have challenged her independence—but not completely. She stopped driving this year, but she did renew her driver’s license.

Kirschenbaum’s story is unique, and yet she represents a growing trend in America of people from different backgrounds and circumstances who are aging solo.

Twenty-one percent of U.S. adults age 50 and older—that’s 24 million people—now live alone, without a spouse or partner or anyone else under the same roof. And their numbers are growing fast.

This extraordinary upswing in aging alone is unprecedented, says Elena Portacolone, a professor of sociology at the Institute for Health & Aging at the University of California, San Francisco. “It’s a reality check that times have changed. For many, it’s about living your own life, following what is important to you. But our social supports have not kept up with the needs of those aging alone.”

In 1950, just 9 percent of all U.S. adults lived by themselves. Now 1 in 5 Americans ages 50 to 54, about 1 in 3 ages 55 to 74 and half of those age 75-plus are aging on their own, according to U.S. Census data. By 2038, the majority of people age 80 and older—about 10 million—will be solo agers, Harvard University experts estimate.

Fueling this phenomenon are big changes in how Americans live, love and age, says Portacolone. These include lower marriage rates, more gray divorces and marital separations, greater longevity and less poverty, along with older adults’ desire to age in place, an increase in childlessness and smaller, more far-flung families. There’s a gender gap among solo agers, too. In 2023, 1 in 3 older women and about 1 in 5 older men lived alone, according to federal government statistics. Women live longer but are also more likely to stay single after being divorced or widowed. A 2022 study from Bowling Green State University found that men 55 and older are more than twice as likely as women to remarry—and other research suggests they’re choosing younger spouses.

Despite their numbers, solo agers are often misunderstood and even invisible. “Older adults who live alone are generally healthier, more cognitively capable and more socially connected than the broad group of older people living with their spouse or adult children—because they have to be,” says Dr. Sachin J. Shah, an assistant professor at Harvard Medical School. “The other side of the coin is, they’re more vulnerable when anything happens because they don’t always have the support of others.”

WHAT SOLO AGERS SAY

Until recently, “our knowledge of the experience of older adults living alone has been limited,” says Portacolone, the author of groundbreaking research about solo agers with cognitive decline and dementia. And while some receive support from relatives, friends and neighbors, she says that many solo agers with thinking and memory problems are virtually invisible. “Few people even know they exist,” Portacolone says.

So who are today’s solo agers? To find out, AARP interviewed dozens of solo agers and the experts now studying and assisting them. AARP also surveyed 503 solo agers from across the U.S. about their feelings and experiences. What we found defies stereotypes, reveals surprising strengths and uncovers some can’t-be-ignored challenges. What follows are five insights into the lives of this growing group.

1. Freedom and Autonomy Are Tops

AARP’s survey tapped into the full diversity of America’s solo agers. Participants were never-married, divorced, separated or widowed; ages 50 to 95; lived in cities, suburbs and rural areas; were racially and ethnically diverse; and had annual incomes ranging from less than $30,000 to more than $100,000. Forty percent had lived alone for 20 years or longer. One thing most agreed on: Living on your own can be exhilarating and deeply satisfying. “Oh, the freedom!” says Gayle Kirschenbaum, 70, a never-married, Emmy Award–winning filmmaker (and daughter of Mildred Kirschenbaum) from New York City. “I have flying dreams. They’re a metaphor for life. I don’t want anyone to hold me down.”

Heather Nawrocki, vice president of experiences and connections at AARP, says, “There can be a lot of joy in aging solo. Feeling the freedom to choose their own path, solo agers are the captains of their own ship. They can pursue their own interests. There’s a lot of positivity.”

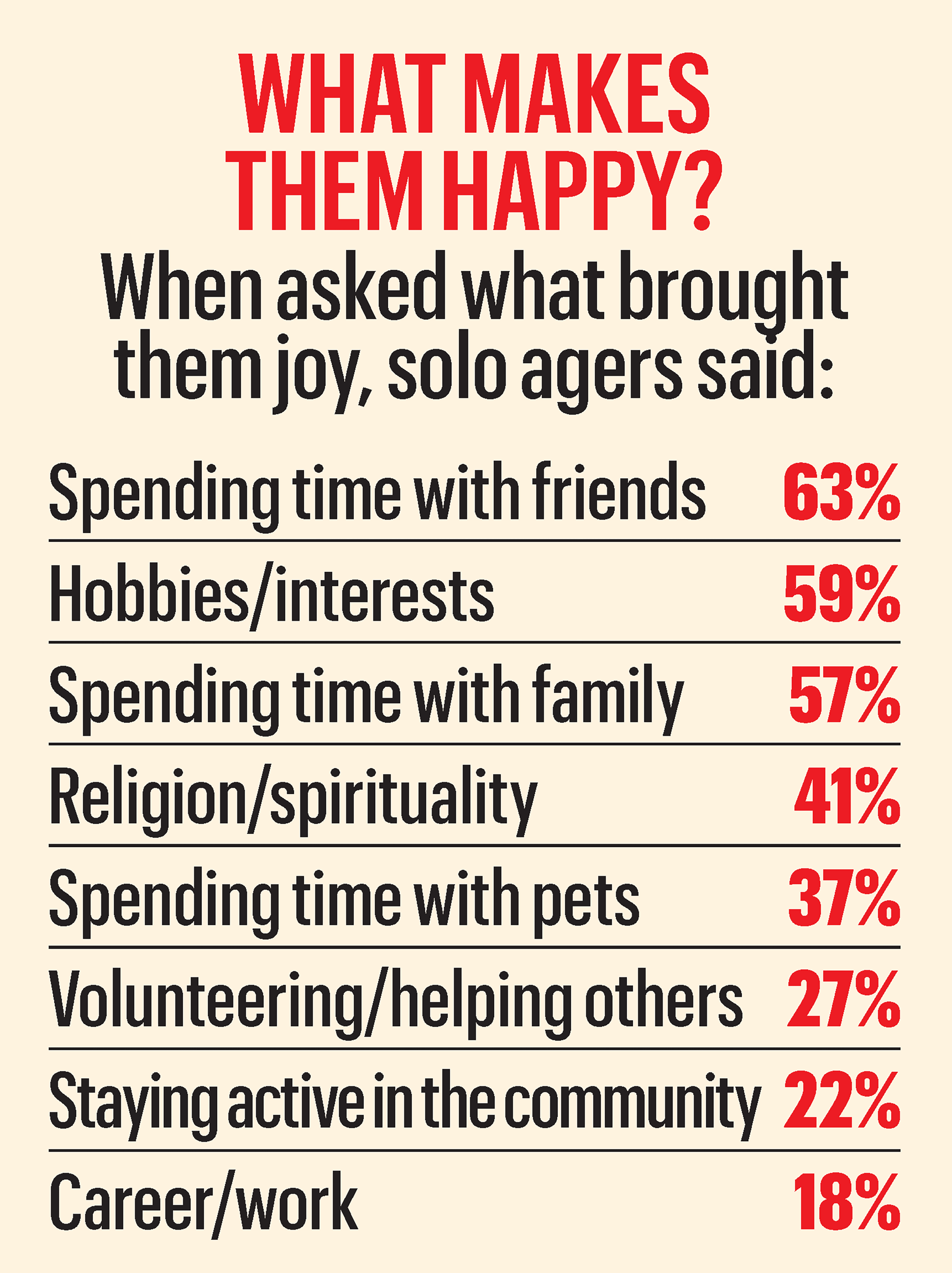

The best parts of solo aging? For 1 in 3 survey respondents, it’s freedom and autonomy; 16 percent said the best part is independence. “Solitude is blissful,” wrote one participant. “I can do what I want when I want,” noted another. “I can put my own needs first,” said yet another. They enjoyed small acts of independence, such as “I don’t have to share the [TV] remote,” “Drinking out of the orange juice container” and “No one to clean up after.”

And they’re savoring their accomplishments. This spring, Lester Shane, 73, directed the classic American play Picnic at the Sands College of Performing Arts at Pace University in New York City, where he’s a voice, speech and dialect coach. “I think the great advantage of solo aging is you answer to no one,” says Shane, who lived with a partner at one time and has dated on and off since then. “There’s great freedom in that.”

2. There’s Time for Pals

When H. Shellae Versey, an associate professor of psychology at Fordham University, tracked 890 African American female solo agers as part of a larger 2025 study, she and her coauthor found that these solo women were less likely to feel lonely than women in the general population with partners—and both groups gave their health similar ratings. “People still have the idea that getting older means being lonely, and that solo living would be associated with worse health, perhaps especially for Black women,” Versey says. “But if you’re still working, or you’re going to a bridge group or the local library or community garden, if you’re seeing people you know at the coffee shop and the grocery store, that’s very different from being isolated with nobody checking on you.”

Making time for social connections was a priority for many of AARP’s survey respondents. Sixty-three percent said spending time with friends brings them joy, and 51 percent said their social life is excellent or good. Women prioritized these social connections more than men did. “Of the top things for living a long life, number one is camaraderie with other people your age,” says Vicki Ivey, 83, a solo ager from Cheyenne, Wyoming, whose husband died in 2014. “Good friendships, laughing and doing activities together are so important.”

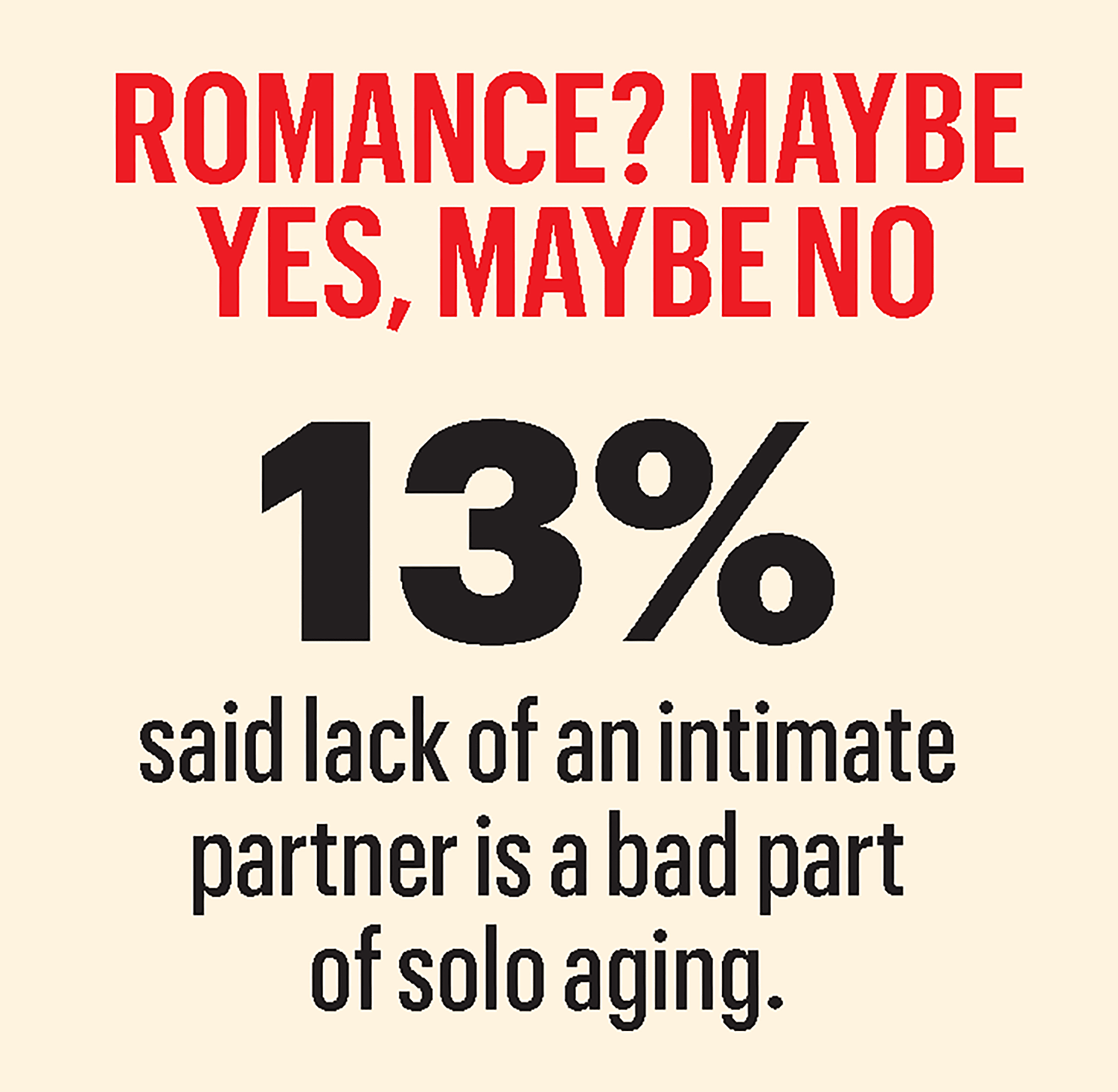

3. Friendship? Yes. Romance? Maybe, Maybe Not

Two in 5 solo agers in AARP’s survey said loneliness and isolation were the worst parts of aging alone. Few were looking for romance, with women even less interested than men. “I don’t want to date,” Mildred Kirschenbaum says. “A man needs someone in his life. A woman is more self-sufficient. She spends her life taking care of others, even if she works.”

Another recent national survey found just 27 percent of single older women and 43 percent of single older men are interested in dating. And dating apps? Forget it. Just 5 percent of adults in their 50s and 2 percent age 60 and older had used one in the past year, according to a 2023 Pew Research Center survey.

“I tried four different dating apps,” says Ruben Lopez Jr., 70, a solo ager living in Meridian, Idaho. “I always set my age group to at least 55 or higher, and to local searches only, but I was always getting likes from women in their 20s and 30s in other states. Almost every one looked like a fake account.”

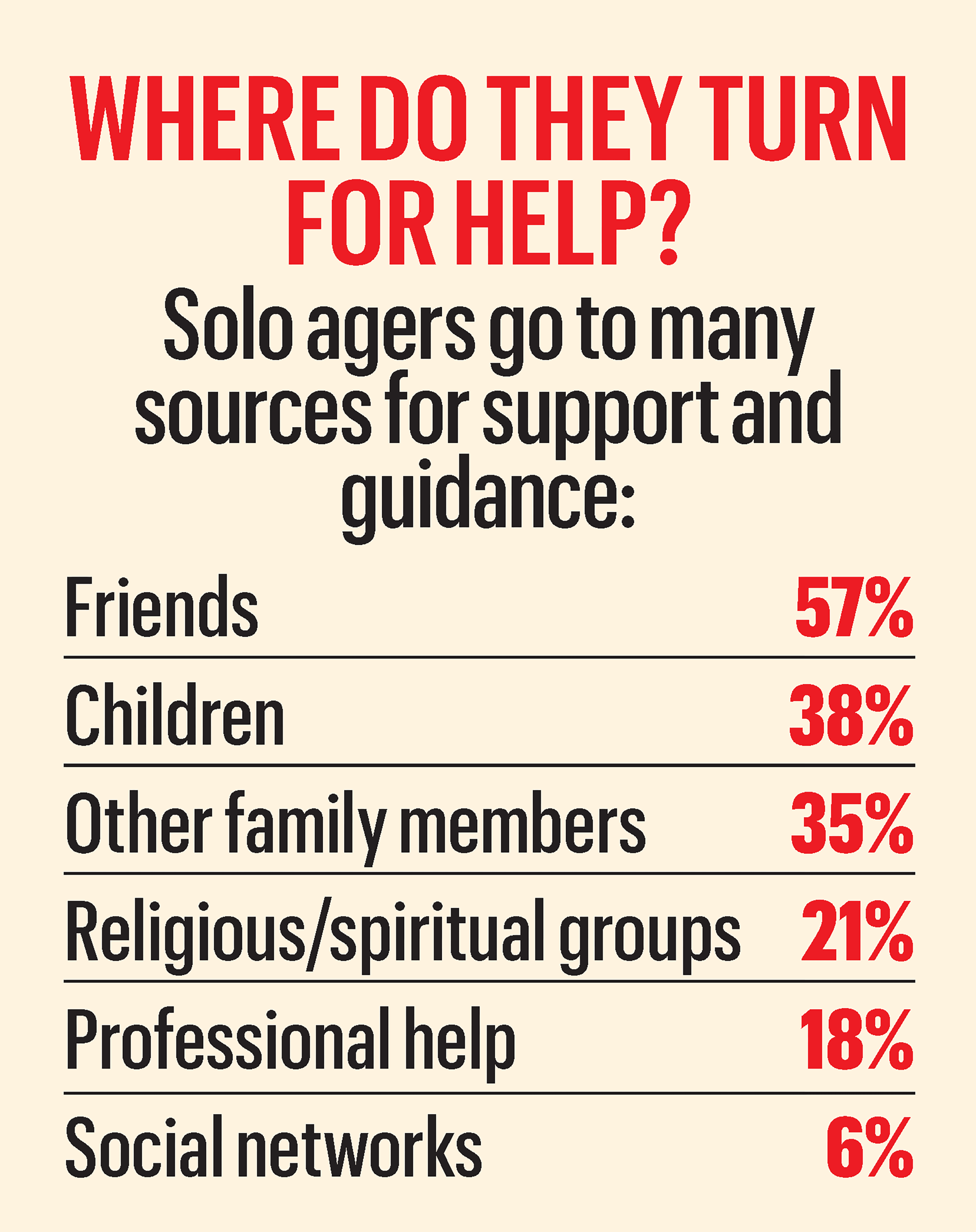

In contrast, 57 percent of solo agers turn to friends for support and guidance. “You never know when you help people just by being there and listening,” says Bernard Dailey, 77, a retired chemical engineer from Cheyenne, Wyoming, and a widower since 2021. He attends a local widows-and-widowers group on Tuesdays, is a member of a men’s bereavement group and recently joined the Audubon Society “just to try to get out more.” Dailey has coffee with friends on Friday afternoons and breakfast with another friend Tuesday mornings. “Just laughing together, getting out of yourself a little and being social sometimes is all you need,” he says.

One in 4 AARP survey respondents found joy in volunteer work, and 1 in 5 are involved in their communities. Solo ager James Ravenell, 72, of Orlando, Florida, has been calling older adults, many of whom are solo agers, three mornings a week since 2014 for the Red Cross of Central Florida’s Dial-A-Friend program. “I check on necessary things like their medication. If it’s cold out, I ask if their heat is functioning,” says Ravenell, a Navy veteran and retired maintenance worker. “If there’s a problem or I can’t reach them, I note it down and call someone, like a son or daughter, to go out and check on them. It’s a pleasure. They inspire me.”

Since 2015, Evelyne Michaud, 68, a solo ager living in Westchester County, New York, has been checking in on older solo agers through DOROT USA, a social service organization based in New York City that aims to ease social isolation for older adults. “I don’t consider it work,” she says. “The pleasure you have connecting and becoming friends is rich and valuable. We have conversations about everything.”

4. People on Their Own Need Social Networks

Solo aging has its challenges, too. AARP survey participants missed having someone around to help with “opening jars,” “household repairs,” “climbing a ladder” and yard work. Participants worried about being alone with an illness or injury. “In case of emergency, no one is there,” one said. “Afraid of a fall,” said another. “If you got sick, [there’s] no one to provide help,” said yet another.

One of Lester Shane’s top concerns for the future is the three flights of steps up to the rent-stabilized studio apartment he has occupied since 1973. There’s no elevator. “I just had a serious bout of sciatica,” Shane says. “Getting up and down stairs, carrying groceries, was difficult. I think about what I would do in the future if I can’t get around easily.”

Without a strong network of family, friends, neighbors and other caregivers, solo agers can face increasing difficulties, says Jane Lowers, an assistant professor in the Department of Family and Preventive Medicine at the Emory University School of Medicine.

“People aging solo are less likely to get all their care needs met as they get older, whether it’s help with transportation, household chores, basic health needs or mobility,” Lowers says. “Those little needs can stack up. If you can’t get to the doctor, medical conditions or even vision or hearing problems may go undiagnosed.”

In a 2021 UC San Francisco study of 4,772 solo agers, 38 percent couldn’t identify friends, family or neighbors to help them with daily needs. When a major health shock like a heart attack, stroke or cancer diagnosis arose, they were more likely to end up in a nursing home for a prolonged stay. “No one wants to think they’ll get sick and need help, but it’s an inevitability,” says lead researcher Shah. “To continue living independently, building social support can make a big difference.”

Kathryn Martin, 74, of Kannapolis, North Carolina, has been a solo ager since the death of her husband eight years ago. She has a seizure disorder and used to call 911 every time she felt a seizure coming on. “I would lie on the floor until they arrived,” says the retired textile mill worker. At $700 to $900 per ambulance trip, her medical debts skyrocketed. And she was developing memory problems.

A few years ago, Elder Orphan Care, a faith-based organization that aims to support older adults living alone, heard about Martin’s situation and offered help. Martin was matched with a volunteer “buddy,” Sandy Poling, 75, who negotiated payment plans with the ambulance companies, then worked with others from the organization to help Martin sell her childhood home and move into an assisted living center. Elder Orphan Care currently assists 35 “elder orphans” and plans to expand to 75 by the end of 2026. “We’re really big on relationships,” says Janna Syester, director of community programs. “Elder orphans are often invisible. There are a lot of people nobody knows are out there.”

Family may be estranged or live far away, she says. Friends may have died or have their own health issues, and neighbors may not realize the extent of their needs—or rarely see them outside their home.

One big and often unseen need: Like Martin, an estimated 4 million U.S. solo agers have cognitive impairment, Alzheimer’s disease or dementia, says Portacolone. “Many lack an advocate who can help them go to medical appointments and manage their medication and daily lives,” she says.

5. Handling Money Is a Major Concern

Survey takers also felt the pinch of financial worries. More than half of 50- to 64-year-olds described their financial situation as fair to poor, as did nearly 40 percent of those 65 and older. Among their concerns: “financial security,” “paying all the bills” and “worrying that I will run out of money.” Without a partner’s income and assets, 63 percent of older adults in poverty in 2021 were solo agers, according to the U.S. Census. Since they don’t share the costs of housing and utilities with a partner, solo agers are twice as likely to say their money doesn’t stretch to cover basic needs.

In a 2023 Mather Institute survey, fewer than half of solo agers had set up a financial plan, designated a health care advocate or established a power of attorney. Compared with married people, solo agers were half as likely to have talked with anyone about financial planning, a 2016 Northwestern Mutual survey found. “Solos don’t see themselves as the people being served by financial planners—TV commercials are all about saving for college and weddings and leaving your children a legacy,” says Allen Davis, a financial planner in Hadley, Massachusetts, who puts out a newsletter for solo agers and is finishing a forthcoming book with coauthor Mary Young to be called Financial Planning for Solo Agers: Manage the Six Hazards and Thrive. “They may be afraid—and don’t have a partner to nudge them,” Davis adds.

Without the built-in safety net of a loved one in the house or nearby, tackling the challenges of aging can be especially risky for solo agers with small incomes, says Paul Downey, the recently retired CEO of Serving Seniors in San Diego, California. “We have 13,000 clients. More and more live alone,” Downey says. “We see people who did everything right—they worked and saved, but something happens. Sometimes an illness comes along and uses up their life savings. Or their spouse has an illness, then dies or moves into a skilled nursing facility. Their partner is alone in a housing crisis that could lead to homelessness.”

It happened to John Conroy, 67, of San Diego. Despite a long-held hospital job, his retirement savings ran out and a legal dispute over a town house left him homeless for a year. During that time, he slept in parks and abandoned buildings. Through Serving Seniors and other social service agencies, he got a permanent place to live in July 2023. “It’s wonderful for me,” he says. “Like heaven.”

A long, independent life can pose challenges for the most resilient of solo agers. Mildred Kirschenbaum enjoyed decades of travel and, at age 101, a book tour. “If you’re up there in years, do yourself a favor,” she says. “Enjoy yourself. Don’t sit home.” But last spring, a bad case of the flu and a fall in her home left her homebound. Her daughter moved in with her.

In spirit, however, Mildred is still a contented solo ager. “Don’t be afraid of life,” she says. “No matter how old you are, there’s always something to learn.”

Sari Harrar is an award-winning reporter and a contributing editor to AARP publications who writes about health, public policy and other topics.

SOLO AGER SPOTLIGHT

Ruben Lopez Jr., 70

MERIDIAN, IDAHO

“I did not think I would be alone at this age.”

Ruben Lopez Jr. was stunned when his wife told him she wanted a divorce three years ago. “One of my first thoughts was, Wait a minute; it wasn’t supposed to happen this way,” says the retired U.S. Postal Service mail carrier. “I did not think I would be alone at this age.”

Like many older Americans who get divorced, Lopez adjusted his plans for retirement, finances and social life. “We were going to travel,” he says. “I was hoping to do that with a partner. I had to reset my life to decide how I wanted to live and what I wanted to do.”

In 2023, he moved from Southern California to Idaho, a place he’d visited often and loved for its scenery and skiing. He overhauled his diet, started walking several miles a day, lost 30 pounds and got off two blood pressure medications. Lopez’s healthy lifestyle makes backcountry exploring easier. “I’ve fixed up the back of my SUV so I can put my sleeping bag, mattress and coolers in there,” Lopez says. “I like traveling up into the mountains and camping overnight.” It’s a new life on a new budget. “I can’t do extravagant things,” he says. “The plan was we’d be married, we’d have our Social Security and pensions, and we also saved for retirement. We split that, but I had to settle some debt. I’m primarily living on a pension and Social Security.” Last summer and fall, Lopez scoured garage sales, thrift shops and ski shop sales for deals on skis, poles and boots so he can hit the slopes this winter. “I skied when I was younger, and I’m excited about getting back to it,” he says. “But at $100 for a lift ticket for a day, I won’t go that often.”

Dating? Maybe in the future, he says. An early dating experience ended abruptly, and distinguishing real women from scammers on dating apps is difficult, he says. He’s building a social life by playing his bass guitar in the worship band at a local church. “Most of my life I’ve played for worship at church,” he says. “You can meet people and develop friendships because the music comes first.”

Carlene Davis, 59

LOS ANGELES

“We all need a network.”

In 2012, Carlene Davis decided that solo aging works best when people aren’t aging alone. With a friend, she cofounded the California-based Sistahs Aging with Grace & Elegance (SAGE), focused on Black women as they age.

“I was the caregiver for my mother and father in my 20s and 30s,” says Davis, a consultant for nonprofit organizations and vice president of strategy and evaluation at the California Black Women’s Health Project. “After they passed away and became ancestors, I started thinking about my own aging journey. I’m an only child. I don’t have children, a husband, sisters or brothers. If I needed the type of care I provided to my parents, I don’t have the traditional safety net. If something happened, there’s not a mini-me.”

But, she thought, she could build a network with her friend and cofounder, Kiara Pruitt. “I realized I needed to be intentional about what my aging support system could look like,” says Davis. “That led to conversations with my friends, then to community conversations and to SAGE.” The mission: joining together for healthy, active, socially connected and financially secure later lives. SAGE’s 2,000 members share aging experiences, engage virtually and in person, and meet up at events, including summer reunions with educational sessions covering everything from aging in place to caregiving to dating.

Davis savors her single life. She has traveled extensively in Europe, Australia, South America and Africa, where she has done volunteer work. And she has launched other community projects through the California Black Women’s Health Project, including the Sankofa Elders Project, aimed at empowering older Black adults to advocate for community solutions to health disparities.

“Solo aging gives you the autonomy to center your own needs,” she says. And she is keenly aware of the importance of creating a safety net of friends who are like family to her. “You won’t have spousal benefits to enhance your savings or an adult child to contribute to your care,” she notes. “Our health care system has standards and policies, but it won’t advocate for you like a loved one would. We all need a network.”

Vicki Ivey, 83

CHEYENNE, WYOMING

“We’ve seen everything.… That’s what makes us as strong as we are.”

A new social life began for Vicki Ivey when she walked into the Cheyenne public library in June 2014 for a meeting of the Cheyenne Widows and Widowers group. Her high school sweetheart and husband of 54 years, Dale, had died earlier that year. A friend she’d met at a hospice support meeting suggested the group. And soon the pair were at the center of a bunch of adventurous women.

“People liked being around us because we liked to laugh,” says Ivey, a former beautician and gift shop owner. “I had a Ford Explorer you could fit seven people in. I took them to Estes Park for the weekend. We went to Fort Collins to eat out and to Snowy Range to see the beautiful trees.”

She has noticed a special resilience in solo agers—including herself. They grieve for lost spouses and marriages that spanned decades. (“When I was alone, I would miss Dale more than anything,” she says. “It took me three years to get over missing him so much.”) At the same time, a lifetime of experience has given them the grit to keep going. “Our generation, we’ve seen everything,” Ivey says. “Us people born during and right after World War II, we’ve seen bad times, we’ve seen sad times and we’ve seen good times. We have the full spectrum of what life’s about. That’s what makes us as strong as we are.”

That grit has helped Ivey through recent uterine cancer treatments, months of recovery, lasting weakness in her hips and a knee problem that makes walking difficult. Ivey’s three children live an hour or two away in Colorado. It’s a close-knit family. But for now, she’s staying in Cheyenne. “My kids would love if I moved closer to them,” she says. “But they don’t want to push me to move. They know I’m having a lot of fun with my friends here.”

Leon Christensen, 84

SAN DIEGO, CALIFORNIA

“People know they can come in and talk.”

At 65, Leon Christensen crashed to the floor of his apartment. “One minute I was fine; the next, it was lights out,” says Christensen, now 84. It was a hemorrhagic stroke—a bleed in the right side of his brain. Never married, the former music producer, computer programmer and handyman had always lived alone. “Nobody found me for four days,” he says. Neighbors eventually found him and summoned help. “I was taken to the county morgue at Mercy hospital in San Diego,” he says. “Luckily, the night attendant noticed I wasn’t dead.”

He regained consciousness a month later in the hospital and slowly recovered over the next year and a half—then lived with a friend before moving to a residence run by the social services agency Serving Seniors San Diego. Here, he says, solo aging is the norm. “Almost everybody is living alone,” he says.

Christensen describes himself as a natural loner who enjoys his own company but also likes having friends around. He grew up on a Nebraska farm, then moved to Omaha at age 16. He relocated to San Diego because “it’s paradise. We have fine beaches.” Family is far away. “Most of my relatives are on the East Coast that I haven’t seen in more than 20 years,” he says. “My parents and brother have passed away.”

The stroke left him partially deaf, legally blind and mostly paralyzed. He uses a motorized wheelchair and has the use of his left hand. “I’m a natural lefty,” he says. A caregiver helps him with shopping, banking and other errands; Serving Seniors San Diego provides meals every day. There’s bingo downstairs, and his neighbors often visit. “When my door is open, people know they can come in and talk,” he says. “I’m available.”

Joy Frank-Collins, 50

COLUMBUS, OHIO

“I’m the responsible one now.”

When her husband was diagnosed with acute lymphoblastic leukemia in late 2022, Joy Frank-Collins remembers thinking, I cannot be a widow. I don’t know how. Her husband, Ethan, died in September 2023 at age 49 from a rare complication after a bone marrow transplant. “Ethan was determined to be the best cancer patient anybody’s ever seen,” she says. “We literally never expected him to die.”

The couple raised two sons during a nearly 24-year marriage. “Ethan and I were just starting our second act,” Frank-Collins says. “We were sort of empty nesters, with our youngest in college and our older son starting law school.”

It took more than a year to begin processing her grief. “You’re in caregiver mode, fight-or-flight mode. I’m still coming out of that,” she says. But shortly after her husband’s death, Frank-Collins had to take charge of money matters and find a way to pay the bills on her salary alone. Ethan, the primary breadwinner, had taken care of all the family finances. “He was balancing the checkbook up until the day before he went into the intensive care unit,” she says. “I really didn’t know how I’d figure it all out. One of the hardest things about aging alone is that there is no division of responsibilities whatsoever. I’m the responsible one now.”

Inside a folder of income tax documents set up by Ethan, she found a four-page list of information about their accounts—and advice her husband had left behind for his family. That advice gave Frank-Collins the courage to move forward, including asking for a raise at work. She got it.

visit aarp.org/soloager to watch a video of Frank-Collins.

Prepare Yourself for Solo Aging

Take these steps to ensure your safety, happiness and autonomy

BY SARA ZEFF GEBER

I have been writing and speaking about solo aging for more than 10 years, prompted by witnessing friends and colleagues support their aging parents—taking them to medical appointments, managing their finances, stocking their refrigerators, calling them for check-ins and doing much more. As a woman without children, I asked myself, Who will do that for me? For solo agers, the answer lies in robust planning in three essential areas: financial, legal and social.

FINANCIAL

▶︎ Live within your means. Create a budget in which your expenditures do not exceed your income. Working with a nonprofit credit counselor, a financial planner who works on an hourly basis or another financial adviser can provide insight and guidance.

▶︎ Continue working as long as you can. In doing so, you will delay tapping into your savings, and your Social Security payment will continue to increase until it reaches its maximum at age 70. In addition, you can bank more money for future expenditures.

▶︎ Plan for long-term care. If you do not have long-term care insurance or sufficient savings to cover future care, ask your financial adviser what you need to do now to qualify for government-funded long-term care in your state later on.

LEGAL

▶︎ Appoint a health care proxy. Authorize someone to make medical decisions for you if you are ever unable. Consider family members, a younger friend, the child of a close friend, a professional fiduciary or a private guardian. Once you’ve chosen a proxy, have a detailed discussion about that person’s role and your expectations.

▶︎ Give someone you trust a financial power of attorney. This lets that person—a relative, friend or professional—manage your finances if you can’t. Ensure that they have access to the passwords for your accounts. If it’s not the same person as your health care proxy, make sure the two will be able to work together. And remember: These are the key documents solo agers need to avoid court-appointed guardianship or conservatorship.

SOCIAL

▶︎ Decide where you will live. Explore options such as home sharing with a friend and senior living communities. Think about proximity to transportation, health care and shopping.

▶︎ Stay connected and engaged. Get together often with friends and neighbors. Continue working or volunteer your time and talent to a cause you believe in.

▶︎ Practice good habits for your health. Choose doctors and dentists who respect your autonomy. Participate actively in decisions about medications, vaccines and screening tests. Have your ears and eyes tested regularly. Consider joining a gym for both fitness and social interaction.

Sara Zeff Geber is the author of Essential Retirement Planning for Solo Agers.

FROM TOP: JESSICA PONS; MATT NAGER; PHILIP CHEUNG; MADDIE MCGARVEY