Fraud Watch

IS THAT CLASS ACTION LAWSUIT A SCAM?

Avoid fraud—but don’t throw away legitimate opportunities for compensation

BY MATT ALDERTON

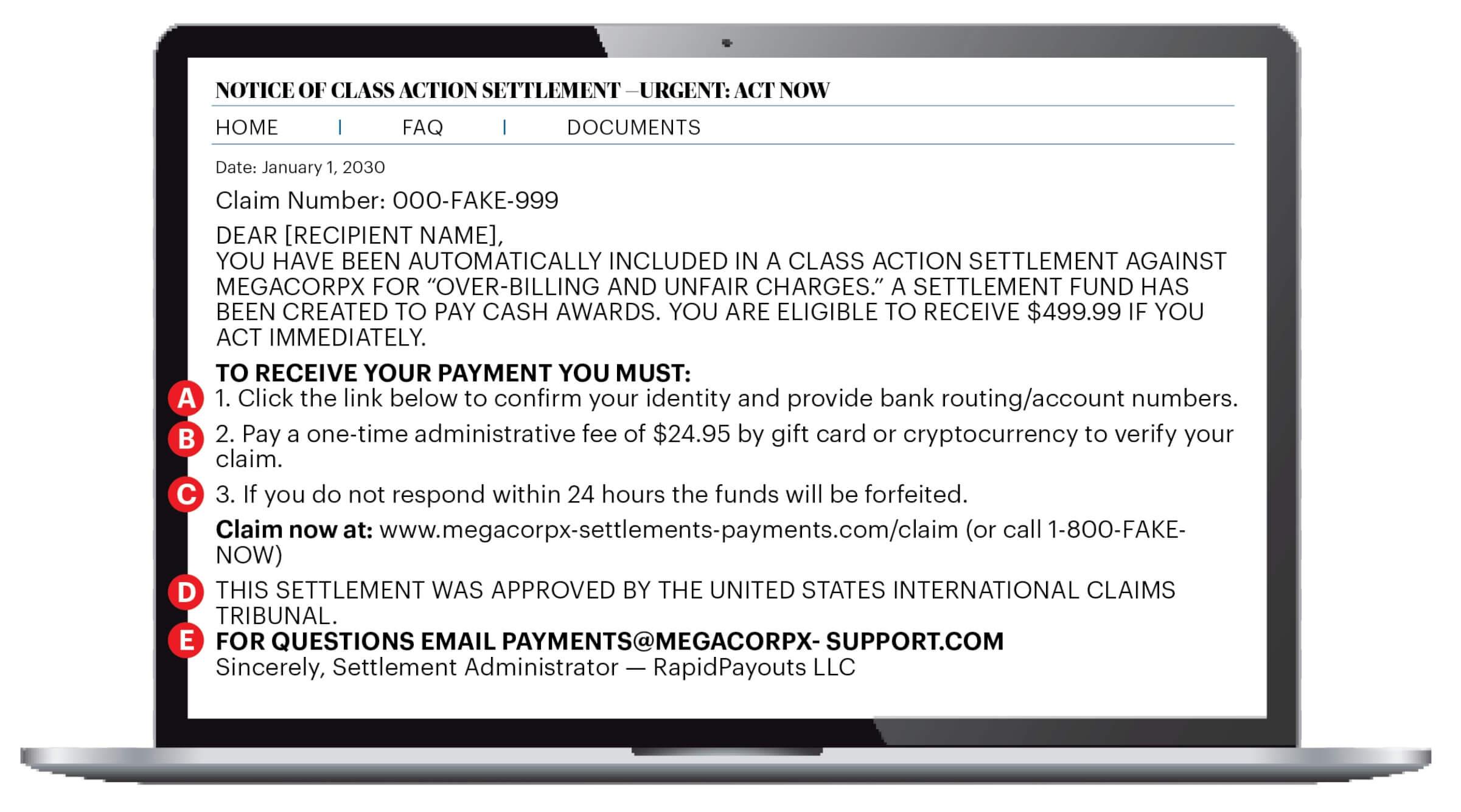

FAKE NOTICE RED FLAGS

A Requests for bank routing or account numbers: Real notices shouldn’t ask for this information for you to receive your payment.

B Demands for fees to be paid by cryptocurrency or gift cards.

C Urgent deadlines (“24 hours”): Legitimate settlements usually allow you weeks or months to respond.

D Nonstandard authority names (“United States International Claims Tribunal”), common in scams.

E Unprofessional email addresses or domain names (“payments@megacorpx-support.com”): These are most likely not the defendant’s real address or a court or administrator’s actual website.

Older Americans are swimming at all times in a sea of potential scams. So when an email or text arrives that promises a payoff from a class action lawsuit, the safe, savvy response for many is to hit the delete button.

Indeed, only 4 percent of people who receive class action settlement notices actually end up filing claims, according to the Federal Trade Commission.

But that could be costing you money, says Amy Nofziger, senior director of AARP’s fraud victim support team.

“Most callers to the AARP Fraud Watch Network Helpline [877-908-3360] about class actions have received a notice by email or mail stating they’re eligible to participate,” Nofziger explains. “Many initially believe it’s a scam. However, once we provide resources to help verify legitimacy, most feel more comfortable joining.”

One caller who received a letter indicating she was eligible for a class action settlement from California’s MarinHealth Medical Center, which had allegedly violated the privacy of visitors to its website by unlawfully sharing their personal information, was even told by legal experts it was a scam, Nofziger says. The caller eventually found a news release that confirmed the settlement was genuine.

In a similar case, an Illinois man received a letter about a class action lawsuit filed against an insurance company accused of making unsolicited telemarketing calls. He became nervous when he looked up the lawsuit but couldn’t find information about it. “Through further research, it was determined this was a class action that was moving through the courts,” Nofziger says. “It was legit.”

Still, there is good reason to be cautious, says Jer Nixon, a class action attorney at Simon Law in St. Louis. He says this is what a class action scam might look like: Criminals posing as attorneys could send fake “phishing” emails that mimic real class action settlement notices. When someone clicks on the email, their devices could become infected with malware, allowing the criminals to steal their personal information for use in identity theft crimes. Or scammers might tell victims they have to pay an administrative fee to receive their settlement, which the crooks inevitably steal.

Nixon suggests taking these steps to ensure a class action notification is real:

▶︎ If you receive a class action notice, look for the case name, then google it to find the official settlement website. Proceed with caution if there’s no settlement website.

▶︎ Check the websites of third-party aggregators that specialize in collecting and publishing information on class actions. ClassAction.org, ClaimDepot.com and TopClassActions.com are three examples.

▶︎ Avoid notices that request Social Security numbers or bank account information, and those with processing charges, filing fees or other upfront payments.

▶︎ If still unsure, contact the law firm or the lawsuit’s claims administrator, both of which should be listed on the settlement website.

While the risk of fraud is real, so is the potential reward of joining a class action suit.

“Let’s say you get a class notice that says, ‘Hey, you can file a claim and receive $100.’ Your options generally are to do nothing or to file a claim,” he says. “Either way, your rights to bring a future claim are the same—you lose them. So you may as well get some money.”

Matt Alderton is a Chicago-based journalist who has written several articles on fraud for AARP.

“Have questions about scams or need to report fraud?”

Call the AARP Fraud Watch Net-work Helpline toll-free at 877-908-3360.

Visit aarp.org/fraud watchnetwork for the latest fraud alerts, news, and tips.

GETTY IMAGES