In the News

SOCIAL SECURITY, MEDICARE FACE BIG CHANGES IN 2026

Social Security and Medicare changed in important ways on Jan. 1. Here’s a look at six major updates:

1. Cost-of-living adjustment (COLA). Inflation ticked up in recent months, resulting in a 2.8 percent COLA for 2026 for people receiving Social Security and Supplemental Security Income payments. That’s up from a 2.5 percent COLA in 2025. The Social Security Administration estimates that the average retirement benefit will rise by about $56 a month, from $2,015 to $2,071.

2. Medicare premiums. The standard monthly premium for Medicare Part B, covering doctor visits and outpatient treatment, increased almost 10 percent to $202.90, up from $185 in 2025. The Part B deductible rose to $283 from $257 before services are covered. And the Part A inpatient deductible is now $1,736, up from $1,676.

3. Social Security taxes. Most workers’ earnings are taxed at 12.4 percent to pay for Social Security, half paid by the employee and half by employers. Self-employed people pay the full 12.4 percent. The amount of income subject to this tax is being raised to $184,500 (up from $176,100 in 2025).

4. Tax relief. A new tax break for people 65 and older will reduce taxable income by as much as $6,000 for eligible taxpayers ($12,000 for couples). That deduction is phased out for people with earnings over $175,000, or couples with earnings over $250,000. AARP backed that provision in the One Big Beautiful Bill Act passed in July.

5. Social Security earnings test. Social Security applies an earnings test to beneficiaries who have not yet reached full retirement age (FRA), now between 66 and 67. In 2026, beneficiaries who will not reach their FRA during the calendar year will have $1 withheld from their Social Security payment for every $2 in work income above $24,480 (up from $23,400 in 2025).

6. Qualifying for benefits. The first step in qualifying for Social Security retirement benefits is having at least 40 Social Security credits. You accumulate up to four credits a year by paying Social Security taxes on the money you earn. That threshold is being raised in 2026: For every quarter in which you earn at least $1,890 in taxable work income, you’ll get one Social Security credit. The threshold per quarter last year was $80 lower.

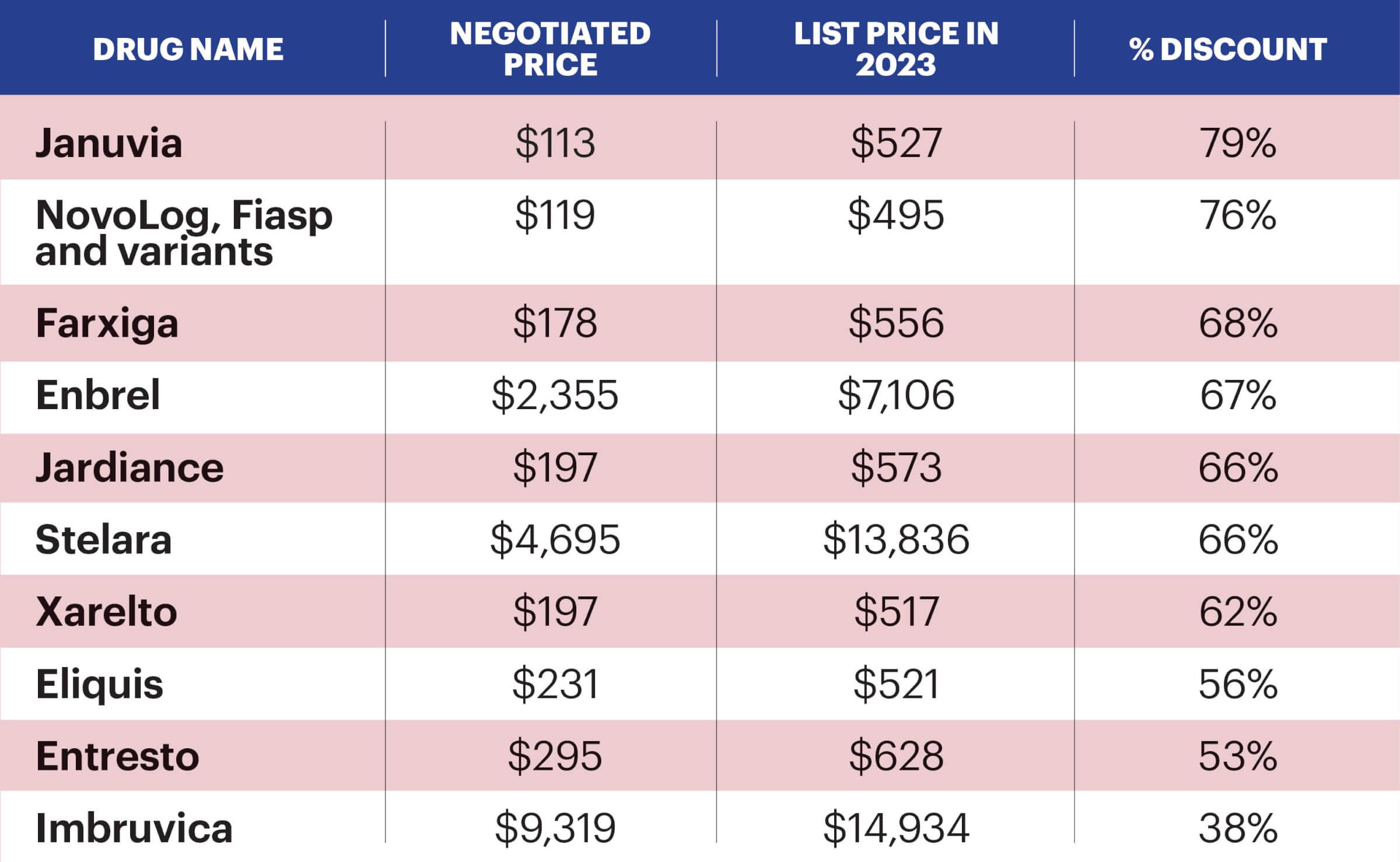

NEGOTIATED DRUGS FOR MEDICARE WILL FINALLY BEGIN

The first 10 Medicare Part D–covered drugs selected for price negotiations became available at reduced cost on Jan. 1, capping a yearslong effort by AARP and other advocates to stem high drug prices.

A law that required negotiations between drug companies and government officials passed in 2022. Here’s a look at the first drugs and savings.

White House Forecasts Significant Drug Price Cuts in the New Year

A deal struck late last year between the Trump administration and top producers of GLP-1 weight loss drugs like Ozempic and Wegovy is potentially big news for older Americans struggling with obesity, but experts say more details are needed.

Roughly 32 million American adults have used a GLP-1 for weight loss, including about one-fifth of women ages 50 to 64, says a recent Rand Corp. report.

Prescriptions for GLP-1 drugs can cost $1,000 or more per month. But federal officials announced plans in November to make these medications more accessible and affordable, including for people who have Medicare, which currently does not cover medications strictly for weight loss.

The administration’s deal with leading GLP-1 pharmaceutical manufacturers Eli Lilly and Novo Nordisk promises lower consumer prices through a new direct-to-consumer platform, TrumpRx, slated to launch in early 2026, as well as through Medicare and Medicaid.

The White House said in a November announcement that the cost of GLP-1 drugs will fall to roughly $350 a month when purchased through TrumpRx. The medications are all currently injectables, but if an oral GLP-1 called orforglipron is approved by the U.S. Food and Drug Administration, it will also cost about $350 a month. An initial dose of a pill version of Wegovy could cost $150 on the administration’s website, if FDA approved.

Medicare prices of Ozempic, Wegovy, Mounjaro and Zepbound would be about $245 a month, with copays for Medicare enrollees around $50 a month, officials say.

FDA TO REMOVE WARNINGS FROM MENOPAUSE PRODUCTS

Women weighing hormone therapies to treat hot flashes and other symptoms of menopause soon won’t see warnings on packaging about potential health dangers. The U.S. Food and Drug Administration has announced plans to remove the labels.

Since 2003, these labels have advised that hormone therapy may raise the risk of certain cancers and cardiovascular problems. But women’s health experts say that those dangers have been overstated and that for many women the benefits of treatment outweigh the risks, especially in the early years of menopause.

The FDA will work with companies to update labels “to remove references to risks of cardiovascular disease, breast cancer and probable dementia,” the U.S. Department of Health and Human Services said in a statement.

The changes will affect labels for so-called systemic therapies, like estrogen pills and patches, as well as labels for lower-dose vaginal products.

Health officials said the warning labels have deterred some women from treating symptoms. Research from AARP, published in 2024, found that only 15 percent of women surveyed had tried hormone therapy for menopause symptoms.

DON’T GO BANANAS.

Adding a banana to your smoothie may peel away health benefits. UC Davis researchers found that the fruit cut absorption of flavanols—compounds linked to heart and brain health—by up to 84 percent.

FROM TOP: CENTERS FOR MEDICARE & MEDICAID SERVICES; GETTY IMAGES (3)