Staying Fit

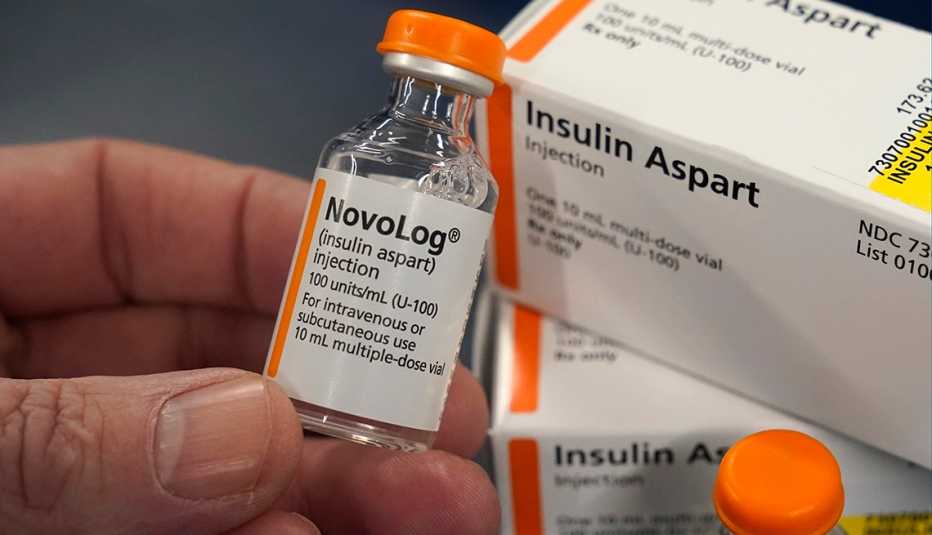

Had the new Medicare $35 monthly copay cap for insulin been in effect in 2020, 1.5 million older Americans would have saved an average of $500 that year for the medication, according to a new report from the Department of Health and Human Services (HHS).

Included in the department’s report is a state-by-state breakdown of how many Medicare beneficiaries who take insulin paid more than $35 a month for that medicine before this year’s cap took effect. The data also shows the average out-of-pocket savings they would have had if the monthly cap were in place in 2020.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Public opinion surveys consistently point to patients skipping or rationing doses of their medications because of cost. According to an October 2022 Kaiser Family Foundation poll, a third of respondents said they either didn’t fill a prescription or took less of a dose than prescribed because of the cost.

“No one should have to skip or ration their insulin because they cannot afford it,” HHS Secretary Xavier Becerra said in a press call Jan. 24 announcing the new findings. “These are the kind of savings that will give people a little breathing room.”

The insulin provision is included in a law enacted in 2022. The monthly out-of-pocket cap for Medicare beneficiaries who have original Medicare and get their insulin under a Part D prescription drug plan or who have a Medicare Advantage plan that includes drug coverage took effect on Jan. 1, 2023. For those who get their insulin through a pump that is covered under Medicare Part B, which covers doctor visits and other outpatient services, the monthly limit takes effect on July 1.

The states with the most Medicare enrollees who are expected to benefit from the cap are Texas (114,000 beneficiaries), California (108,000) and Florida (90,000). The states that the report says will see the highest per capita savings are North Dakota ($805), Iowa ($725) and South Dakota ($725).

HHS researchers looked at Medicare beneficiaries who paid more than $35 a month out of pocket for their insulin. Researchers said the number of people who will likely benefit is probably more than the 1.5 million, because about 800,000 people are enrolled in Medicare prescription drug plans that participate in the Part D Senior Savings Model. Begun in January of 2021, that program already had a $35 monthly out-of-pocket cap for some insulins. Another reason more people will be affected, HHS officials said, is because the Medicare beneficiary population is continuing to grow.

Here’s a look at how many Medicare enrollees who take insulin would have saved money had the $35 monthly copay cap been in effect in 2020 and how much they would have saved.

State |

Affected Enrollees |

Average annual per capita savings |

Alabama |

29,127 |

$439 |

Alaska |

1,026 |

$517 |

Arizona |

28,124 |

$540 |

Arkansas |

15,559 |

$598 |

California |

108,164 |

$339 |

Colorado |

16,085 |

$515 |

Connecticut |

11,444 |

$590 |

Delaware |

6,066 |

$446 |

Florida |

90,181 |

$476 |

Georgia |

45,625 |

$477 |

Hawaii |

3,703 |

$389 |

Idaho |

7,927 |

$606 |

Illinois |

59,718 |

$519 |

Indiana |

42,310 |

$541 |

Iowa |

18,834 |

$725 |

Kansas |

15,657 |

$650 |

Kentucky |

27,797 |

$453 |

Louisiana |

22,071 |

$412 |

Maine |

5,976 |

$530 |

Maryland |

21,052 |

$469 |

Massachusetts |

26,287 |

$504 |

Michigan |

66,726 |

$403 |

Minnesota |

27,128 |

$672 |

Mississippi |

15,366 |

$543 |

Missouri |

34,881 |

$523 |

Montana |

4,835 |

$602 |

Nebraska |

9,716 |

$677 |

Nevada |

10,769 |

$439 |

New Hampshire |

6,586 |

$536 |

New Jersey |

39,641 |

$511 |

New Mexico |

8,716 |

$443 |

New York |

75,601 |

$483 |

North Carolina |

56,921 |

$449 |

North Dakota |

4,527 |

$805 |

Ohio |

72,854 |

$502 |

Oklahoma |

19,556 |

$533 |

Oregon |

17,915 |

$591 |

Pennsylvania |

80,197 |

$543 |

Rhode Island |

4,678 |

$485 |

South Carolina |

31,235 |

$477 |

South Dakota |

4,568 |

$725 |

Tennessee |

39,562 |

$494 |

Texas |

114,242 |

$441 |

Utah |

11,393 |

$691 |

Vermont |

3,118 |

$691 |

Virginia |

36,461 |

$510 |

Washington |

28,063 |

$603 |

Washington D.C. |

650 |

$404 |

West Virginia |

12,656 |

$451 |

Wisconsin |

31,935 |

$628 |

Wyoming |

2,469 |

$647 |