Staying Fit

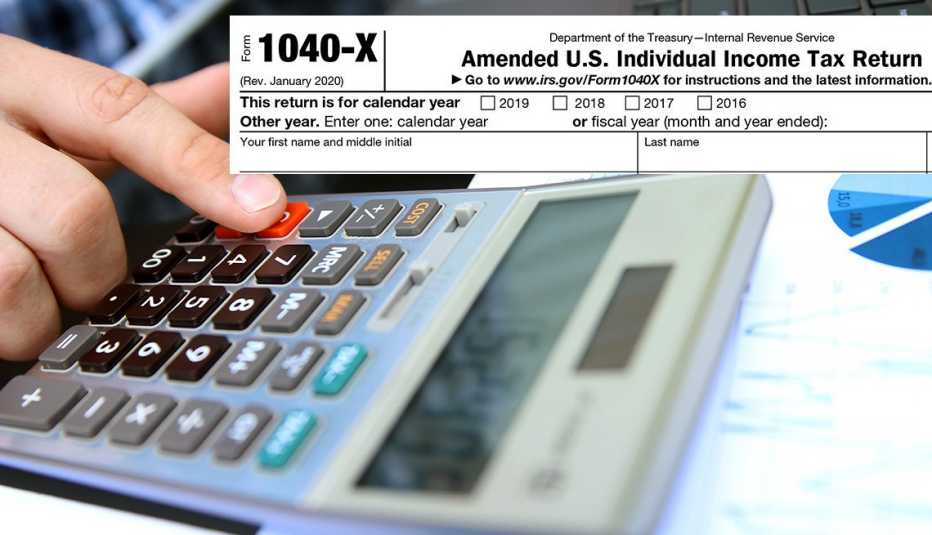

Unless it's a birthday or anniversary, you probably don't circle May 17 on the calendar. Thanks to the COVID-19 pandemic, however, May 17 is the deadline for filing federal income tax returns for 2020 and paying your tax bill. If you haven't filed your tax return by then, you can file for an automatic extension — but you still have to pay the taxes you owe by midnight on May 17.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Getting an extension to file your return

What if you're still sorting through receipts for tax deductions, or the dog ate your W-2 form? Don't worry. The Internal Revenue Service (IRS) will automatically grant you an extension to file your tax return by Oct. 15. All you need to do is submit Form 4868.

You can file electronically via IRS e-file from your home computer or have your tax preparer do it for you. Want to file by paper form? Go right ahead. Just make sure it's postmarked by May 17.

If you live outside the U.S. and Puerto Rico, you're allowed two extra months to file your return and pay any amount due without requesting an extension. The same is true for those in military or naval service outside the U.S. and Puerto Rico. However, you'll still owe interest on payments made after the regular due date.

If you're on active military inside a combat zone, taxes are one thing you don't have to worry about — yet. You have 180 days after you left the combat zone, plus as many days you're in the combat zone. If you leave the combat zone on May 30, for example, you have 180 days to file and pay your taxes, plus the 13 days you're in a combat zone after May 17.