Staying Fit

Very rarely do total strangers tell me how much money they make. But this year, starting in February, 49 of them did.

That's because I volunteered for the AARP Foundation Tax-Aide program, which provides free tax-preparation services nationwide. In 2019, 35,000 Tax-Aide volunteers helped file returns for 2.5 million people — mostly older and low-income Americans. I've been a financial journalist for many years, so I've talked to hundreds of men and women about money. But as a first-time Tax-Aide volunteer, I had an opportunity to learn about people, their money and their taxes in a whole new way. Here's some of what I found.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Taxes scare us ...

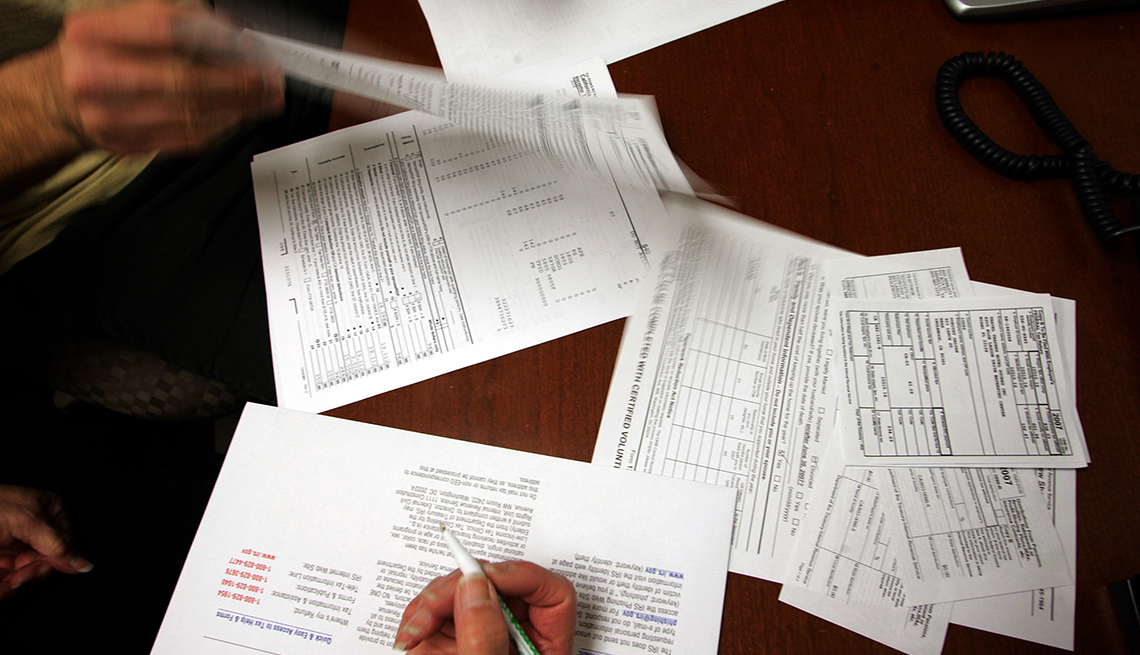

The New York City site where I worked served a variety of people. Some were in their 20s, others in their 80s. Some were retired; others held multiple jobs. But whoever they were, they were usually confused. I understand why. Tax forms and tax laws are confusing. How is anyone supposed to know, for example, the meaning of “A” and “AA” and “D” and “DD” in Box 12 of a W-2? It's a mystery.

No wonder people regard their taxes as a sort of explosive device — one that will blow up in their face if they make the slightest error. That includes the woman who told me, as I started her return on my computer, that she was a retired IRS examiner. “Let's change seats so you can do the return,” I said. No, she replied. It would make her too nervous.

… but they shouldn't.

If your financial life isn't complicated, your taxes aren't, either. Most of the people I helped didn't need to bring much paperwork: a Social Security form, a retirement income statement, maybe a couple of W-2s. I could complete most basic returns within a half hour, with data entry consuming most of that time. The 2017 tax law's big increase in standard deductions has simplified matters, too. If you're under 65 and filing as a single person, for example, the federal government now automatically exempts $12,000 of your income from income taxes. As a result, most people don't benefit from itemizing deductions, so they don't need to bring in a pile of receipts for medical expenses or charitable giving.