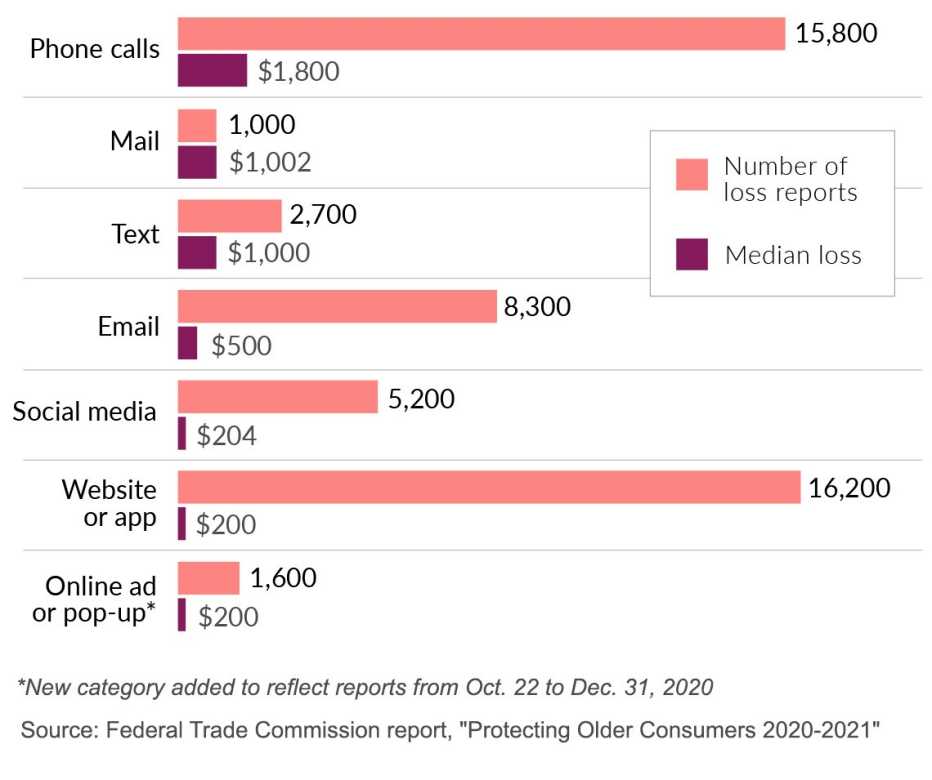

7. Online ads or pop-ups, a new category added in late 2020, $200 median loss, (1,600 reports collected from late October through December)

Phone Scams Costly to Adults 60-Plus in 2020

Scammers reach out in many ways, but last year the median loss last year was greatest when they phoned consumers.

Tip of the iceberg

When crooks dial for dollars, so to speak, what’s especially troubling is that among adults ages 80 and older, the median individual loss to such fraud was $3,000. For those ages 69 to 79, it was $1,500.

See more Health & Wellness offers >

The findings are in a report released Oct. 18 called “Protecting Older Consumers 2020-2021.”

The figures represent “only a fraction of older adults harmed by fraud” because the vast majority of such crimes are not reported, the FTC noted. Moreover, only about 45 percent of the data from its Consumer Sentinel Network, where the data arises, stated the complainant’s age in 2020. Several law enforcement agencies and the FTC’s private partners, including AARP’s Fraud Watch Network helpline, send on reports to the sentinel network.

AARP’s Amy Nofziger, who oversees AARP's helpline, says people of all ages can be victims of fraud so it’s critical that family and friends work together toward prevention.’,

Keep ‘refusal script’ near your phone

To help deter phone scams, Nofziger suggests placing a “refusal script” near your phone or a loved one’s. It could state: “I do not give personal information over the phone. I do not buy gift cards.”

Last month AARP previewed other highlights from the FTC’s report given to the U.S. Senate Special Committee on Aging. A major takeaway was that romance frauds were far and away the costliest to adults ages 60-plus. What are sometimes called “sweetheart scams” led victims to lose $139 million out of overall losses of $600 million to this age cohort last year.

Other key findings in the FTC report:

- Overall, adults ages 60-plus were substantially less likely to report losing money to fraud than adults ages 20 to 59. But when those 60 and older do lose money, they tend to report losing much more than younger adults.

- Adults 80 and older reported losing a median of $1,300 to all frauds. Those in their 70s had a median loss of $650. Those in their 60s had a median loss of $449.

- Older adults are whipsawed disproportionately by certain scams. They were nearly five times as likely as younger adults to report losing money to a tech support scam; nearly three times more likely to report a loss to a prize, lottery or sweepstakes scam; and more than twice as likely to report losing money to a friend or family impersonator scam.

Katherine Skiba covers scams and fraud for AARP. Previously she was a reporter with the Chicago Tribune, U.S. News & World Report, and the Milwaukee Journal Sentinel. She was a recipient of Harvard University's Nieman Fellowship and is the author of the book, Sister in the Band of Brothers: Embedded with the 101st Airborne in Iraq.