Staying Fit

Older adults lost $600 million to fraud in 2020, when the pandemic fueled spikes in almost all top categories of fraud, federal officials say.

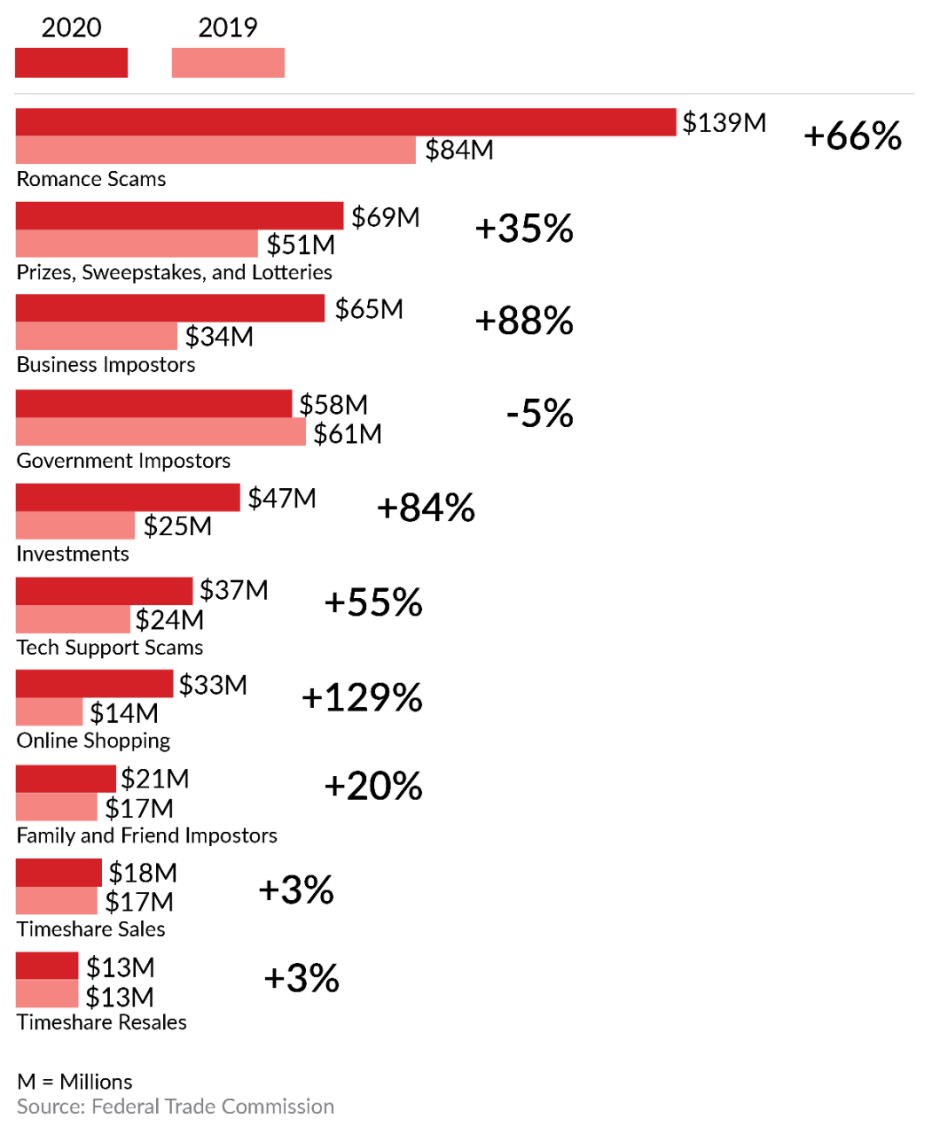

The figures are from the Federal Trade Commission, which noted that losses in many top categories of frauds spiked in 2020 compared to a year earlier. According to the FTC, online shopping scams rose 129 percent; business impostor frauds, 88 percent; investment frauds, 84 percent; romance scams, 66 percent; tech-support scams, 55 percent; sweepstakes and related frauds, 35 percent and family and friend impostors, 20 percent.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Losses in two categories — timeshare sales and timeshare resales — inched upward by 3 percent year-over-year, and in one top category, government impostor frauds, losses declined by 5 percent.

Here are the 10 costliest scams

For adults ages 60-plus, the costliest frauds last year involved:

1. Romance Scams $139 million in losses

2. Prizes, Sweepstakes and Lotteries: $69 million in losses

3. Business impostors, $65 million

4. Government impostors, $58 million

5. Investments, $47 million

6. Tech Support, $37 million

7. Online Shopping, $33 million

8. Impostor: Family/Friends, $21 million

9. Timeshare Sales, $17.4 million

10. Timeshare Resales, $13 million

There is no mistaking the pandemic’s impact on frauds impacting adults ages 60-plus, with losses of $104 million arising from some 26,518 complaints. The problems included undelivered protective gear, false claims about COVID-19 treatments and cures, and scams involving government relief programs, among others.

"As many seniors isolated early during the pandemic, “fraudsters saw an opportunity and they pounced.”

— Sen. Bob Casey, (D-Pa.)

Overall, there were 334,411 fraud complaints from adults 60-plus in 2020, up from 318,850 in 2019, when there were $440 million in losses for this group.

The findings were presented last week during a hearing held by the U.S. Senate Special Committee on Aging. Sen. Bob Casey (D-Penn.), committee chairman, and Sen. Tim Scott (R-S.C.), said in a joint statement that the coronavirus pandemic exacerbated risks for older people and made them “even more vulnerable to scammers and schemes.”

Fraudsters ‘pounced’

“Fraudsters saw an opportunity and pounced,” Casey said. “They preyed on the fear and uncertainty surrounding the disease, as well as the loneliness and isolation that resulted from the pandemic. People were longing for human contact and a friendly voice on the phone or a beckoning message on Facebook that became harder to turn away from.”