Staying Fit

Do you know me? I'm an ordinary sort. I might be your neighbor, your best friend, your spouse's cousin. Heck, I might even be you.

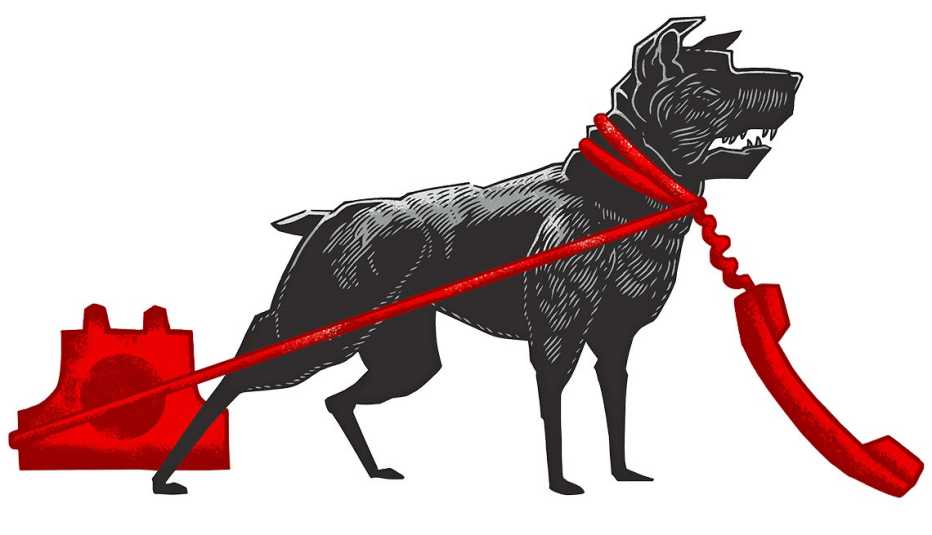

One problem: Crooks really like me.

Con artists make a dirty living identifying the people most likely to fall for schemes designed to separate honest folks from their cash. And while I might look overwhelmingly average, there are actually certain things about me that criminals target when choosing their next victim.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Here's a predator's profile of me.

Age: Let's just say over 55, shall we?

Home: I used to live in Grand Rapids, Mich., but now I live in South Florida. If you have ever lived through a Midwestern winter, you'll get it. But my fellow Floridians consistently lead the nation in per capita reports of being defrauded. There are a number of reasons for that; it's a state that has attracted more than its share of drug criminals who easily shift into cells of scam artists. There are more older people here, and statistics show that people my age are the most likely to be preyed upon by scammers. At least I'm no longer living in Michigan: The Wolverine state leads the nation in complaints about identity theft.

Quote: "I like living in the country." No offense to urbanites, but I prefer a quieter life and the charms of rural America. Federal regulators have found that this makes me more likely to be preyed upon with one of those lottery or sweepstakes schemes — you know, the kind that I should immediately see through because it sounds too good to be true but that still works well enough to keep an entire subspecies of predatory vermin occupied. My neighbor, a 70-something woman who lives alone and never went to college, is even more vulnerable.