Staying Fit

Last week, Fidelity upped the ante in the race to lower index fund fees by launching two stock funds with no fees. That’s not a typo — not low fees, no fees. The two funds are the Fidelity Zero Total Market Index Fund (FZROX) and the Fidelity Zero International Stock Index Fund (FZILX). Both own a very broad basket of U.S. stocks and international stocks, and there are absolutely no fees attached. Plus, there’s no minimum investment.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

The price tag is tempting. But are these funds right for you? I did some digging to help answer that question.

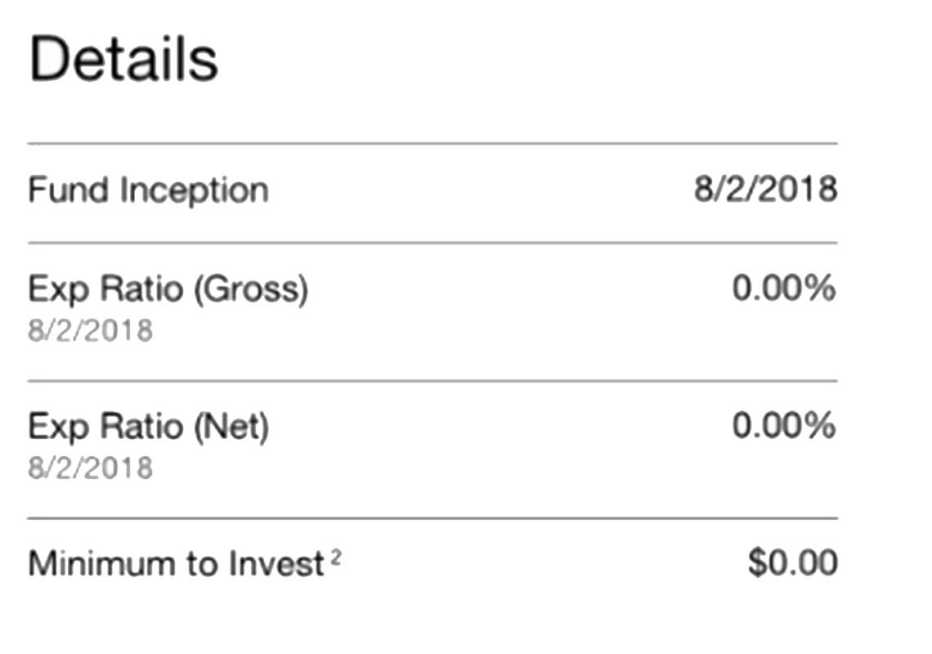

Despite my skepticism, Fidelity spokeswoman Nicole Abbott confirmed that I could literally buy one dollar’s worth of either fund and the fee would be zero. She explained that the firm is charting a new course in index investing that benefits clients of all ages — from millennials to boomers — and of all affluence levels and life stages. I did a triple take when I looked at this Fidelity chart:

My typical evaluation of any stock fund is based on two key criteria: maximizing diversification and minimizing expenses.

These funds are certainly diversified. According to Fidelity, the Zero Total Market Index Fund owns 2,500 companies, and the international stock fund about 2,300 companies. By comparison, the Vanguard Total Stock Market ETF (VTI) owns about 3,638 companies, and the Vanguard Total International Stock ETF (VXUS) about 6,149 companies. The Vanguard funds are more diversified, especially in international stocks, as Vanguard owns small-cap firms, whereas Fidelity excludes them.

Yet it appears that Fidelity holds the edge when it comes to fees. Fidelity’s 0.00 percent annual expense ratio is 0.00 percent, but Vanguard’s Total Stock ETF is 0.04 percent, and the company’s Total International Stock Index Fund is 0.11 percent.

Keep in mind that taxes are fees, too. When a fund sells stocks it holds, it can pass on a capital gain to the shareholders. Although no one knows just how tax efficient these two new funds will be, Elisabeth Kashner, director of ETF research at FactSet Research Systems, points to Fidelity’s existing index funds. She notes that the Fidelity Total Market Index Fund (FSTMX) generated 0.79 percent in capital gains last year, which “for high-bracket taxable investors, capital gains distributions cost over 0.19 percent in taxes.” So for taxable accounts, the Vanguard funds could still be the lower-cost option, though the Fidelity Zero funds win out for tax-deferred accounts such as IRAs.