Staying Fit

The Rev. Rose Thompson has lived in her home for 25 years, in an apartment building in Laurel, Maryland. Suddenly last December, she was in danger of losing it.

Thompson and her neighbors received notice that the building had been sold and that the new landlord was instituting a steep rent hike. “My rent was $875 a month, and the letter said the new rent would be $1,600,” says Thompson, 65. “It said we had 60 days to move out if we didn’t sign the lease for the new rent.”

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

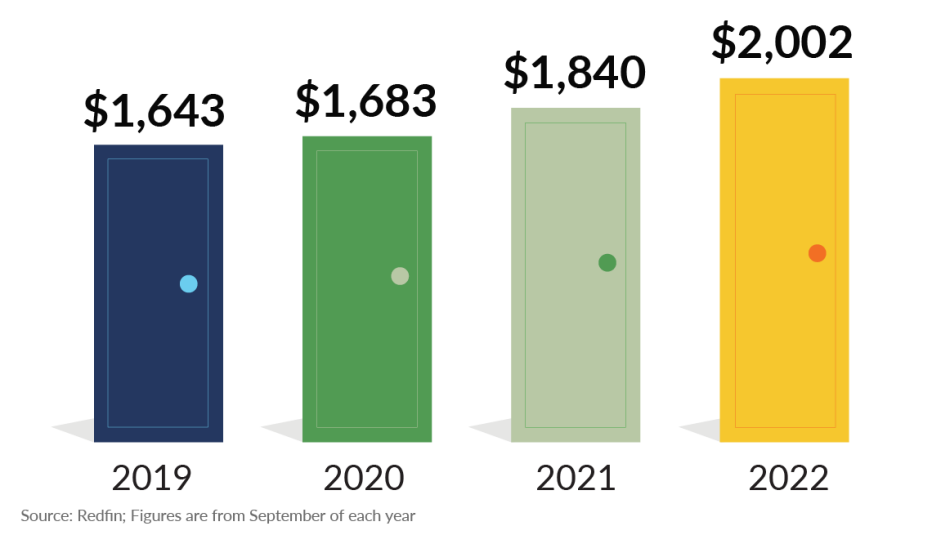

Being forced to move because of surging rents in the past year has become a common occurrence across America. In 2021, the average rent was 17.6 percent higher than in 2020, according to Apartment List, an online rental listing and data-collection business. And the rates have continued to accelerate this year; in October, the average rent was another 5.9 percent higher than a year earlier. Given that the median rent in the U.S. is over $2,000, according to Redfin, that means many Americans are paying roughly $360 per month, or nearly $4,300 a year, more for their apartments than they were just a few years ago.

The causes of this are many: a housing crunch; landlords looking to make up for revenue lost during the pandemic, when some rents were temporarily frozen and evictions weren’t allowed; and gentrification, in which investors seek to push settled residents out to make way for renovations and higher rents.

The impact of all this can be particularly harsh for the 30 percent of Americans over 55 who rent their homes. “We’re seeing more calls for help from older adults when the rent is due and the money isn’t available,” says Linda Couch, vice president of housing policy for LeadingAge, an association of nonprofit providers of aging services in Washington, D.C. One course of action normally would be to refer such callers to organizations that offer subsidized housing, but “some senior housing communities have even closed their waiting lists because the wait was too long.” Waits for affordable housing typically last two to five years, Couch says.

Thompson found help from CASA. The immigration and housing advocacy organization facilitated a meeting among the new landlord, officials from the city of Laurel and five tenants. The landlord agreed to lower the new rent to $1,350, which was still an increase of 56 percent. The city provided a subsidy with funds from the American Rescue Plan to bring the rent down to $1,000 per month. “The problem is that this is a short-term solution,” says Jorge Benitez-Perez, lead organizer for the local CASA chapter. “When the lease ends next March, the tenants will be at the mercy of the landlord again.”