Staying Fit

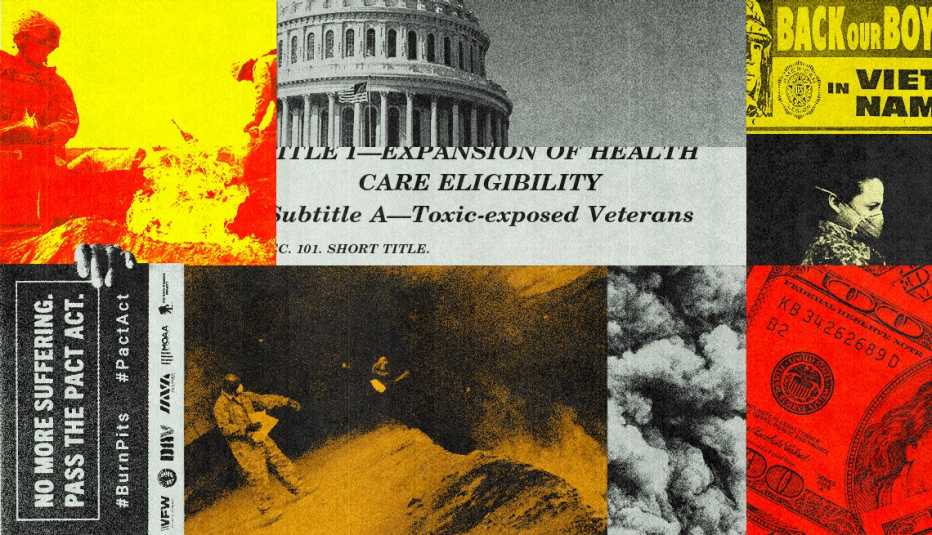

A new AARP survey suggests that many veterans are not aware that PACT Act claims can be filed for free, making them more susceptible to fraud.

The findings echo a warning from the Department of Veterans Affairs’ (VA) about an increase in PACT Act scams targeting veterans through email, phone and social media to gain access to their benefits or file claims on their behalf.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

The PACT Act, made law in August 2022, expanded health care and benefits to an estimated 5 million veterans exposed to toxins during the Vietnam, Gulf War and post-9/11 eras. That means “older veterans are usually those who are targeted [by such scams],” says Charles Tapp II, chief financial officer of the Veterans Benefits Administration.

AARP survey results

AARP found that nearly two-thirds of service members don’t know they can get free help with filing a PACT Act claim. Being unaware of these free services makes veterans vulnerable to predatory tactics con artists use to reach veterans and steal their benefits or charge them phony fees for filing a claim on their behalf.

One in six veterans surveyed said they received a call from someone offering PACT Act filing assistance, often from someone claiming to be from the VA. This is another red flag because the VA does not conduct phone outreach campaigns regarding benefits, it told AARP. It only calls a veteran if it requires clarification on a pending claim.

One in 10 veterans who received a phone solicitation said they were guaranteed a lucrative payout, another clear sign of a scam, according to AARP experts.

The survey included 887 veterans ages 18 and older and was conducted from April 28 to May 4, 2023, with a margin of error of plus or minus 4.2 percentage points.

How to avoid PACT Act scams

- Never pay for help with filing VA benefits or obtaining military records.

- For help with filing a claim, refer to the list of veteran service organizations (VSO), agents and attorneys who are accredited representatives by the VA.

- If someone calls claiming to be from the VA, hang up and contact the VA directly at 1-800-827-1000.

More From AARP

FTC: Con Artists Stole $400 Million from Military Community in 2022

Veterans likely among the most targeted group in the country

Is the Postal Service Texting You — or a Scammer?

Criminals pretend to be delivery services, smishing for personal info and moneyUnderstanding Health Care Benefits for Veterans

Everything you need to know about VA and insurance coverage as a civilian