Staying Fit

Most people who enroll in Medicare Part B, which covers doctor visits, diagnostic tests and other outpatient services, pay a standard monthly premium, $174.70 in 2024. But if your household income is above a certain amount, you may have to pay more than the basic monthly fee. If the government says your monthly tab is going to be higher, there are ways to appeal that decision.

The added charge, known by the acronym IRMAA (income-related monthly adjustment amount) was included in the 2003 Medicare Modernization Act, designed to help financially stabilize the program. According to the Centers for Medicare & Medicaid Services (CMS), about 8 percent of Medicare beneficiaries are subject to these higher premiums.

“The idea is that people with higher levels of income should be paying more,” says Alex S. Seleznev, a wealth management specialist and certified financial planner.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

CMS decides each year how much higher-income Medicare recipients will have to pay; the Social Security Administration (SSA) determines who must make those added payments.

The added charge is based on a beneficiary’s modified adjusted gross income (MAGI), which is your total adjusted gross income plus any tax-exempt interest that you report on your federal 1040 tax form. For example, individuals with annual incomes of $103,000 are subject to a higher premium in 2024, while the income threshold for joint filers is $206,000.

Here’s the tricky part: The SSA doesn’t use your most recent tax return to figure out whether you have to pay higher premiums. It looks back two years. That means the income on your 2022 tax return — filed in 2023 — will determine what you’ll have to pay in 2024.

Depending on your annual income, the amount you’ll have to pay above the standard Part B premium could range from $66.90 to $419.30 a month next year. The high-income charge also applies to Part D prescription drug coverage, and those extra charges could range from $12.90 to $81 a month, also based on your 2022 income. Part D plan premiums vary widely, depending on what plan you pick and where you live. These surcharges apply whether you are enrolled in original Medicare (Parts A and B) or a Medicare Advantage plan.

If the SSA decides you will have to pay a higher premium, the agency will send you a letter telling you how the surcharge was calculated, what to do if you believe the information used to calculate the premium adjustment is incorrect and what to do if your income has been reduced or you’ve had what the government calls a “life-changing event.”

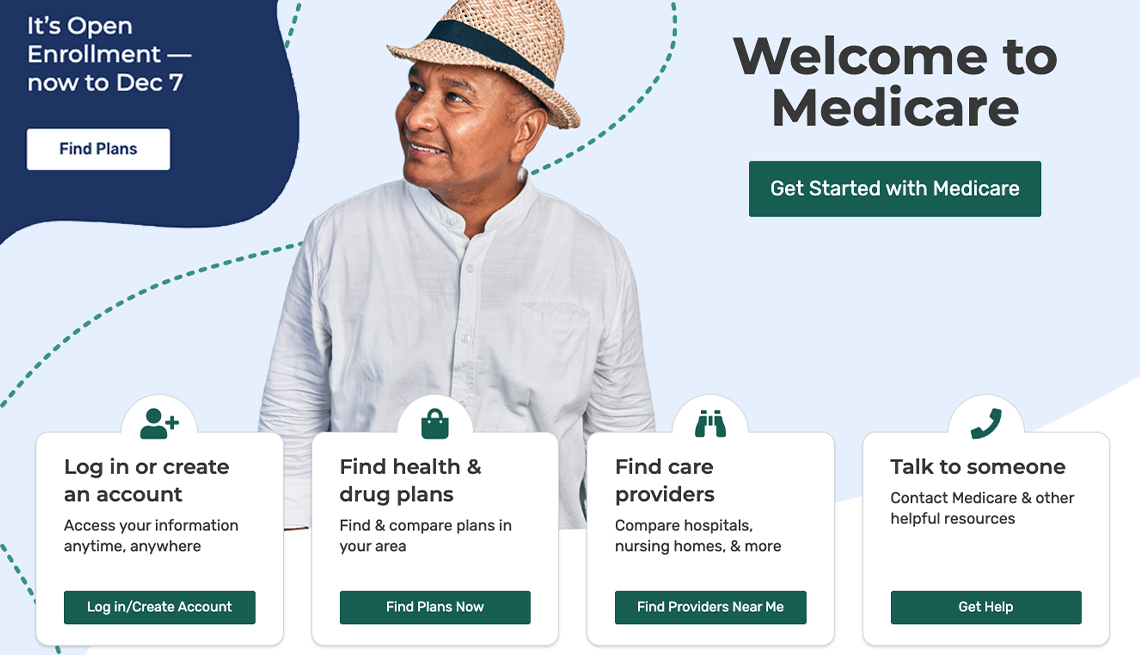

To discuss your case, you can visit an SSA office or call the SSA toll-free number (800-772-1213). To request that your payment adjustment be reconsidered, you’ll need to file a Medicare IRMAA LIfe-Changing Event form (Form SSA-44).

More on Medicare

Most Medicare Advantage Premiums Won’t Increase in 2024

About half of all Medicare beneficiaries will be enrolled in MA plans next yearWill Original Medicare Survive the Medicare Advantage Boom?

New enrollees increasingly opting for the private insurance alternative to the federally-run programAARP Exclusive: Interview with CMS Administrator

Original Medicare should be here to stay