Staying Fit

Dena Bunis

Voters have made it clear that having access to affordable health care is among their top concerns, and politicians are finally responding. In recent months, several health care reform bills have been introduced in the U.S. Senate and House of Representatives. All share the goal of helping more people get coverage at a lower cost, but each reaches that objective in a different way.

Several things to keep in mind:

- Nothing big is likely to happen soon. The legislative process has barely begun on these bills. Few hearings have been held, and we don't yet know the cost or impact of most of these ideas.

- Congress is split politically. With Democrats in control of the House and Republicans in the majority in the Senate and in charge at the White House, don't expect any major action on this before the 2020 election.

- Meanwhile, the Affordable Care Act (ACA) remains law (though court challenges continue), Medicare and Medicaid will carry on as is, and most workers will still get health insurance through their employers.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

So why pay attention to these proposals? Because you will hear a lot about them as the 2020 presidential and congressional campaigns move into high gear, says Tricia Neuman, a Medicare expert at the nonpartisan Kaiser Family Foundation. Democratic presidential candidates will be talking about which approaches they most favor. And Republicans will be asked whether they still want to repeal the ACA and how they would replace it.

For the record, AARP has not taken a position on any of the major overhaul proposals and will not do so before they are fully examined. But AARP intends to hold true to its position that any changes cannot erode benefits or harm Medicare, and that they should benefit all Americans over age 50, both in terms of reducing costs and improving access to care, says David Certner, AARP's legislative counsel and legislative policy director.

Here are answers to several questions about the current health care reform debate.

Wasn't the ACA supposed to provide insurance for all Americans?

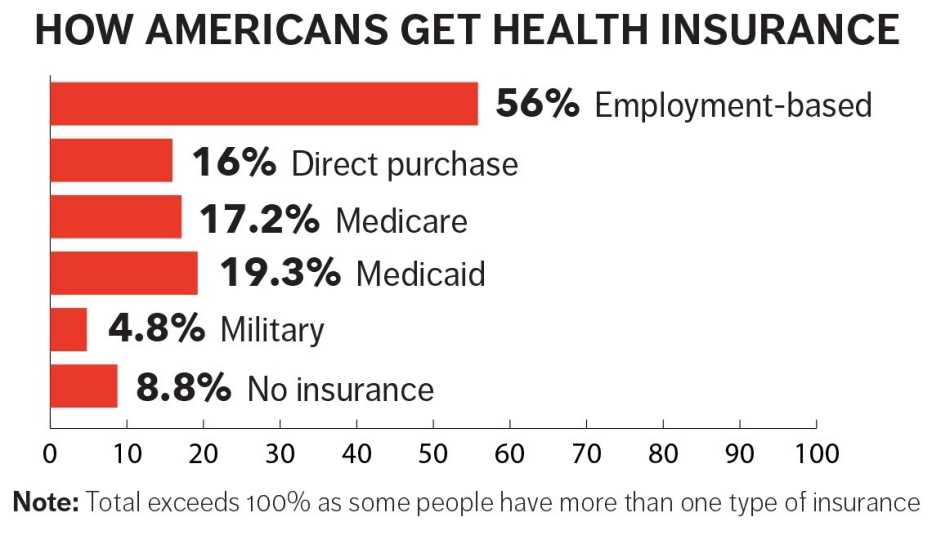

While the number of uninsured has declined since the ACA became law, 8.8 percent of Americans still had no health coverage as of 2017, according to the U.S. Census Bureau. “One of the issues with the ACA is that premiums for health insurance can be unaffordable” for people who don't qualify for subsidies, Neuman says. “The idea is to provide a more affordable option for people."

Can you summarize the types of proposals being discussed?

There are three main categories:

- Single-payer proposals (also called “Medicare for all” plans) would replace the entire health insurance complex with a single government-operated health care program, such as those in Canada, Great Britain and Norway. While you might have the ability to pay for private health care, those using the single-payer system would face little to no cost for all medically necessary services as well as dental, hearing and vision. However, taxes would need to go up substantially to cover the cost of government-run health care for all, and also would lead to a major restructuring of America's health insurance industry from how it operates today.

- Public option proposals are designed to improve on the ACA. The underlying concept: Give Americans who cannot afford or get access to high-quality insurance through the private marketplace an option for lower-cost, public-sponsored insurance.

- Medicare buy-in proposals would provide those over a certain age — usually 50 — the option to buy into the program, but otherwise would leave today's health insurance system as it is.

I'm on Medicare. What would happen to me under these plans?

It depends. Some of the proposed reforms would leave Medicare untouched, though some would have the secretary of Health and Human Services negotiate prescription drug prices with manufacturers as a way to lower medicine costs.