AARP Eye Center

CLOSE ×

Search

Popular Searches

Suggested Links

Keeping Oregonians informed, engaged and active

AARP Oregon advocates for what is important to our members and older Oregonians. With the help of our legislative advocate volunteers, AARP members, staff leadership, and in concert with our partners, we worked tirelessly to advocate on a broad range of issues to improve the lives of older Oregonians and their families.

No matter where you are in the caregiver journey, these local agencies and organizations can help make the process easier

The names of the first 10 Medicare drugs whose prices the federal government will negotiate directly with manufacturers were released Aug. 29. Popular but pricey blood thinners, diabetes medications, cancer treatments make historic list.

MAR 19, 2024

The three-part series is designed to support communities at every stage of the cycle process, whether you are launching, assessing, creating an action plan, moving toward implementation, or just getting un-stuck.

AARP is here to help you take on today – and every day. From sharing practical resources, to holding fun activities and events, to lobby days at the Capitol, AARP is providing opportunities to connect and help build an even stronger Oregon. We hope you’ll join us!

NeighborWalks is back for a new season!

Whether you’re a teenager or older adult, having a way to get where you are going safely and easily is one of the best ways to maintain independence. AARP Driver Safety offers multiple programs to help millions of people stay safe on the road – whether it’s as a driver or as a passenger. These programs are available for anyone but are designed specifically for those age 50 and older, to help them refresh their driving skills, learn about new vehicle technology, and monitor their driving behavior.

A recent AARP Oregon survey of voters aged 40-plus found 55 percent have seen or experienced age discrimination at work; of those respondents, 88 percent think it’s common. Such findings are motivating AARP Oregon to push legislation to strengthen the state’s workplace age discrimination law.

Our State, Our Future: Help shape the future of Oregon. Learn about our legislative priorities, get local race information, and join our fight to protect Social Security.

Oregon: Find upcoming election dates, registration deadlines and options for voting, such as voting by mail, voting in person or voting with a disability.

A regular round-up of updates and information from the State Director, staff, and volunteer leadership.

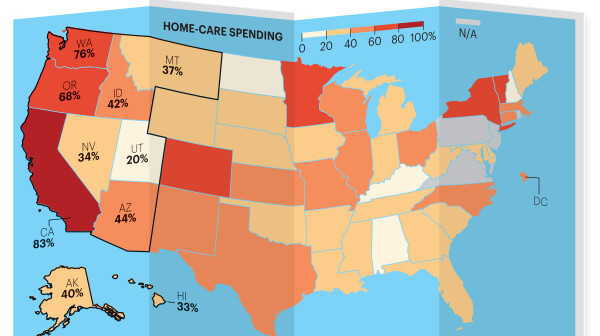

For the first time since AARP began publishing the Scorecard in 2011, more than half of Medicaid long-term care dollars nationwide for older adults and people with physical disabilities went to home- and community-based services instead of nursing homes and other institutions.

Save Energy Webinar

AARP volunteers are a crucial part of our organization. They bring a lifetime of experience, passion for the well-being of their community, and a desire to serve.

Search AARP Oregon

Connecting you to what matters most, like neighbors do. Find events, volunteer opportunities and more near you.

Sign Up & Stay Connected

Sections

About AARP Oregon

Contact information and more from your state office. Learn what we are doing to champion social change and help you live your best life.