Unnatural Causes: The Texas Serial Elder Murder Case

How age bias helped a killer continue his spree

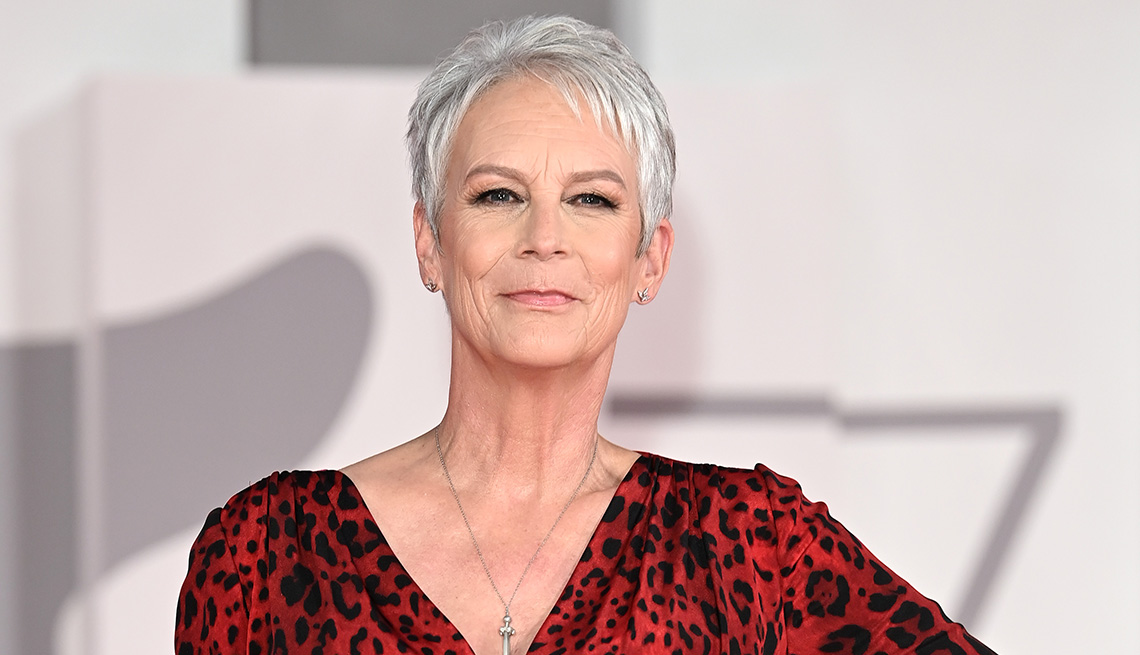

One Man's Obsession With Cracking Cold Cases

His drawings help families identify missing persons

Loving Families or Elder Abuse?

Give your 'verdict' in these real court cases

A shocking tale of love and abuse allegations

Stories From People Who Witnessed History

How they lived through extraordinary events

At Home