Staying Fit

Melvin Phillips remembers with great clarity the day in September 2011 he walked into a courtroom in the District of Columbia without knowing whether he would have a place to live when he walked out.

Phillips, a 63-year-old security manager and retired Army captain, still wrestled with demons left over from combat duty in Vietnam. Now he found himself in battle again, fighting to save the house that he and his brother Steven had lived in for decades.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

In 2009, Melvin and Steven started falling behind on the property taxes on the home, though neither of them realized it. "We thought we were current," Melvin says today. But then came a tax lien on the house and, in July 2011, a sale of the tax lien to Elm Capital LLC of Jericho, N.Y., a debt-collection operation that sometimes snapped up more than 100 liens at a time at the D.C. tax auction. Elm Capital had moved to seize the Phillipses' home through foreclosure.

Melvin recalls thinking that, once in Judge Joseph Beshouri's courtroom, he and his brother might be able to work out some kind of payment plan for their tax debt of about $8,000. But the grim reality of the situation set in when an attorney for Elm Capital approached him and asked, "Are you prepared to pay $15,000 today?"

A growing crisis

Although most foreclosures are triggered by homeowners falling behind on their mortgage payments, the number of foreclosures tied to delinquent tax payments is rising, according to the National Consumer Law Center, a nonprofit advocacy group. In what it brands "the other foreclosure crisis," the NCLC has estimated that U.S. property tax delinquencies may total $15 billion.

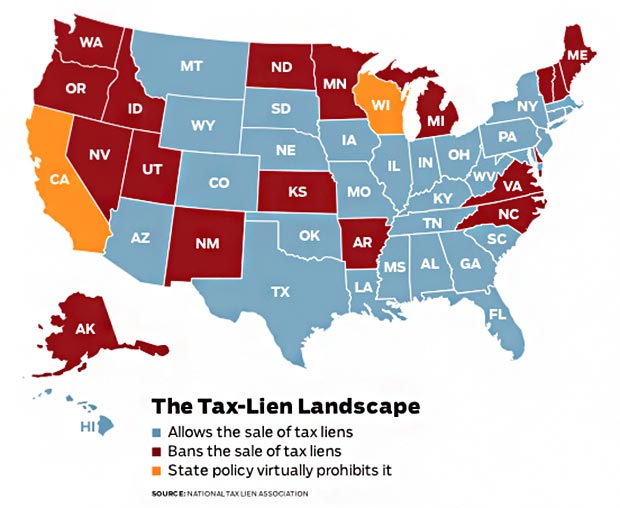

In 30 states and the District of Columbia, city or county governments have the legal authority to sell property-tax liens to private debt collectors, which can not only charge interest rates as high as 50 percent on the outstanding balances but also add legal fees and other costs they claim to incur in dealing with delinquent homeowners. If a homeowner doesn't settle up for the back taxes, penalties and fees within a certain period — from, say, six months in D.C. to up to four years in South Dakota — many jurisdictions allow the tax-lien holder to file suit to begin the foreclosure process to take ownership of the properties and resell them.

And, in some communities, it's not just property taxes that cause problems. Unpaid water, sewer and municipal fees lead to liens, which in turn can trigger foreclosures. And some municipalities add other fees — from "nuisance abatements" (when a city crew cuts weeds or mows overgrown grass, for example) to annual stormwater assessments — to property tax bills.

Some cities even off-load their tax debts to private firms for cash.

Last August, for example, the city of New Britain, Conn., agreed to sell all of its delinquent water, sewer and property taxes in a lump-sum deal with American Tax Funding Servicing, which paid the city with a wire transfer of $6.6 million.

Profit from pain

For all the heartaches that tax-lien sales have heaped on homeowners, they've proved a bonanza for some public officials.

More on money

How to File an Amended Tax Return

Get income tax refunds from previous years or fix mistakes