Staying Fit

Cybercrime complaints soared to a record high last year, when total losses surpassed $4.2 billion and losses to those 50 and older exceeded $1.8 billion, according to FBI data for 2020.

The nearly 792,000 in overall reports from all ages was a 69 percent jump from 2019. The increase was blamed on crooks who exploited the COVID-19 pandemic for financial gain. “In 2020, while the American public was focused on protecting our families from a global pandemic and helping others in need, cybercriminals took advantage of the opportunity to profit from our dependence on technology to go on an internet crime spree,” said the FBI's Paul Abbate, a 25-year veteran who is the bureau's deputy director, its second-highest official.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

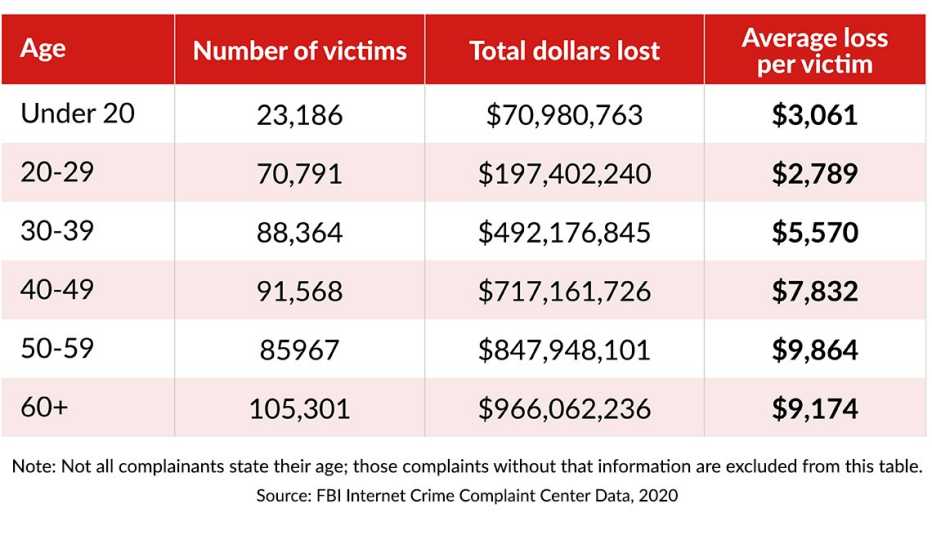

Cybercrime victims in their 50s had highest average loss last year

A record number of complaints to the FBI’s Internet Crime Complaint Center were made in 2020, the year the pandemic erupted.

Total complaints numbered nearly 792,000. Complainants were not required to state their ages, but more than 465,000 of them did. Here’s a look at their age ranges and total and average losses:

Older victims hit hardest

Americans age 50 and older suffered a major blow from cybercrime last year, according to the FBI 2020 Internet Crime Report. While not all complainants revealed their age, here are some key statistics that emerged among those who did.

- The more than $1.8 billion in cyberfraud losses reported by men and women ages 50-plus represents a 27 percent hike from a year earlier.

- This group filed 191,268 cybercrime complaints in 2020, for a 61 percent year-over-year increase.

- The average dollar loss in this group was $9,484, 21 percent decrease from 2019, when the mean was $12,011.

- Reports of cybercrimes involve both individual consumer and businesses losses. Losses from business email compromise (BEC) schemes continued to be the costliest kind of scam in 2020; there were 19,369 complaints, with total losses of approximately $1.8 billion. A BEC is a sophisticated scam carried out by criminals who compromise email accounts to conduct an unauthorized transfer of funds.

- Generally speaking, older victims are “targeted by perpetrators because they are believed to have significant financial resources.”

- Tech-support frauds were a particular bane to victims age 60 and older. These schemes see criminals defraud others by posing as technicians who will resolve an issue such as a compromised bank account or a computer virus. At least two-thirds of tech-support victims, who overall filed 15,421 complaints last year, were 60-plus. And they lost many millions of dollars.

Criminals deploy everything but the kitchen sink

Cybercriminals run the gamut. They may pose as fake “grandchildren” with phony emergencies who hit up real grandparents for cash. Or online Romeos or Juliets who promise love and marriage but want to get their hands on one thing: your money. Or e-commerce outlets that advertise having personal protective equipment for sale and accept payments, but never deliver.

More on money

9 Online Tools That Help You Stay Safe From Fraud

These services help you safeguard your identity, finances and personal dataGifts Cards Are for Gifts — Not Criminals

AARP survey finds some deceived into buying cards for strangers

Crooks Are Hungry for Your Grubhub and Instacart Accounts

AARP-sponsored study on identity fraud spots pandemic-era trend