Staying Fit

| If you are diagnosed with cancer, which expert should you see first?

1. A medical specialist

2. A money manager

Surprisingly, option two might give you the best hope for surviving the disease with your health — and your wealth — intact. Not only are cancer patients 2½ times as likely to declare bankruptcy as healthy people, but those patients who go bankrupt are 80 percent more likely to die from the disease than other cancer patients, according to studies from the Fred Hutchinson Cancer Center in Seattle. “For many patients, when they get the bills, it can be as bad as some of the side effects of the disease or the treatment,” says the center’s Gary Lyman, M.D.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

What makes cancer such a financial killer? Average costs for treatment run in the $150,000 range. The reasons aren’t mysterious. Cancers occur at the cellular level, with abnormal cells dividing and spreading. Containing the cancer and killing those abnormal cells without damaging nearby healthy cells often requires a range of treatments over an extended period of time — lengthy radiation, complicated surgeries, costly chemotherapy, plus other strong medications to supercharge your immunity.

New cancer treatments emerge routinely, but with new hope comes even more cost: 11 of the 12 cancer drugs that the Food and Drug Administration approved in 2012 were priced at more than $100,000 per year. Compare that with, say, treating heart disease. Cardio procedures and medicines are well established, and a big part of the solution is lifestyle changes — eating well, exercising and reducing stress. That’s why treating a heart attack may cost around $39,000.

Yes, insurance covers much of cancer’s medical costs. With a good policy, a patient is probably looking at a bill of more than $4,000 in deductibles and copays in a year before costs are fully covered. Medicare patients will have lower deductibles but may still be on the hook for thousands in copays. The costs of treatment itself, though, are only part of the story.

Cancer's untold toll

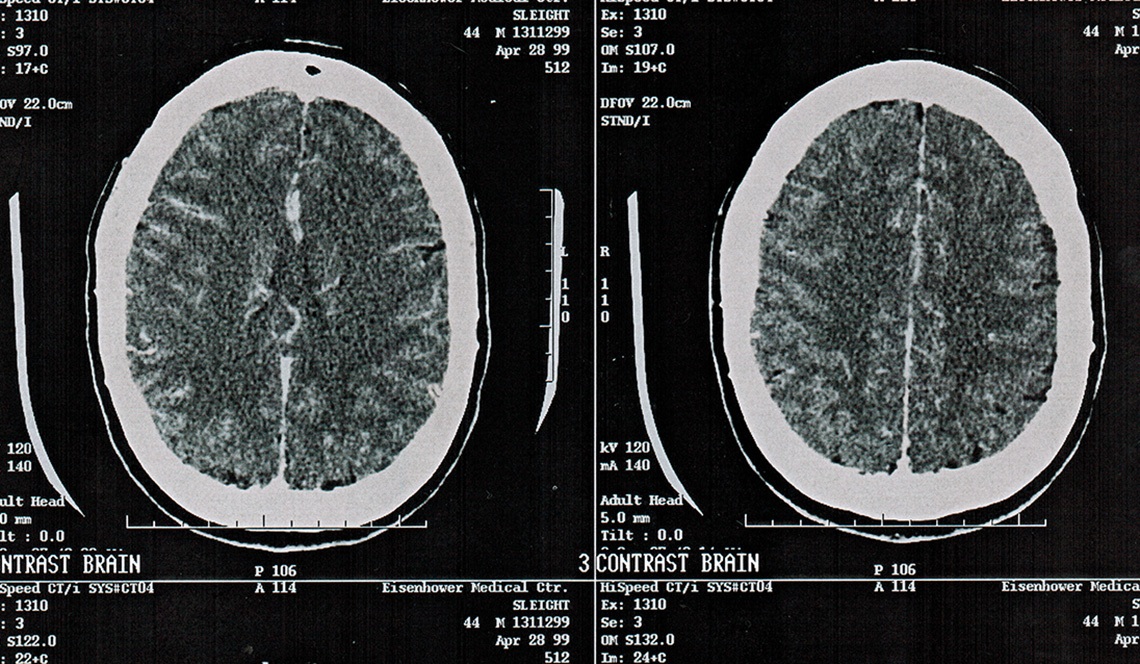

Cancer has tried twice to defeat VJ Sleight. And twice it has won, financially.

Now 63 and living in the Palm Springs, Calif., area, Sleight was diagnosed with breast cancer in her early 30s and again eight years ago. Both times Sleight had insurance, and she’s pretty savvy about money, yet both times she went broke.

The first time cancer struck, in September 1987, Sleight had just left a mortgage-industry job and a boyfriend and had moved to Huntington Beach, away from most of her friends and family.

Is there ever a convenient time for a deadly diagnosis? Not really, but this surely wasn’t it.

Back in the health insurance dark ages, companies could deny coverage of “preexisting conditions.” So when Sleight found a lump during a self-exam in the shower, she resisted seeing a doctor. A positive diagnosis would disqualify her from health insurance. She stayed mum, signed up for a private health plan and then sweated out the 90-day waiting period for coverage to kick in. So her cancer got a head start on the three-decade war it has waged against her.

Not long after Sleight applied for her private insurance policy, she discovered that she was also eligible for a COBRA plan from her old job. Soon she was covered by two policies, so all her medical bills were taken care of. Even so, she had to scrimp and save to pay the premiums. And she went deeply into debt.

Seeing a money manager soon after your diagnosis might give you the best hope for surviving the disease with your health — and your wealth — intact

Sleight’s story is a common one. If testing and treatments were the only costs associated with cancer, insurance could likely save patients from severe financial distress. But they also must grapple with loss of income during several months of treatment and recovery, plus any expenditures for travel and lodging at a cancer-centric health facility. And then there are the follow-up tests, which persist for years and are equally efficient at piling up copays and deductibles.

“I was self-employed as a Realtor,” Sleight explains. “And because of my treatment, I couldn’t work full time.” Medical costs may have been covered, but she still had to pay the rent, the electric bill, her car expenses — racking up bills easily in the five figures. Because she’d had a job recently, she had the appearance of financial stability, which made getting benefits tricky. “I couldn’t get food stamps,” she says. “I couldn’t get welfare. And that’s what I’ve always felt: I’m not poor enough. I’m not rich enough. I’m not sick enough.”

Eventually, Sleight placed a newspaper ad to sell her furniture and anything else of value. She scraped together a few thousand dollars, moved into a studio apartment and relied on handouts — a thousand for car repairs from a friend, a monthly mercy stipend from her parents, “free” rent from a friend who would later sue her for nonpayment. She maxed out seven or eight credit cards.

Sleight ended up undergoing surgery, though not the radical mastectomy that had been planned. Follow-up care included three chemo drugs administered by injection. The treatments went on for nine months. “I owed $30,000 at the end of it,” she says. “I was dead-ass broke. So I sent a form letter to all the people I owed money to: ‘I’m going through cancer treatment. This is all I can send you.’ They got $5 or $10 a month, and it took me seven years to pay that off.”

At least she was feeling well enough to resume working in the mortgage industry, which put her back into the black.