Staying Fit

Financial problems may be an early warning of Alzheimer's disease and related dementias, according to a study published in JAMA Internal Medicine.

The research, conducted by Lauren Hersch Nicholas of the Johns Hopkins Bloomberg School of Public Health and others, examined the health and financial records of 81,364 Medicare beneficiaries living in single-person households. Those with dementia were more likely to have missed bill payments up to six years before being diagnosed. They were also more likely to have subprime credit ratings up to two and a half years before diagnosis.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

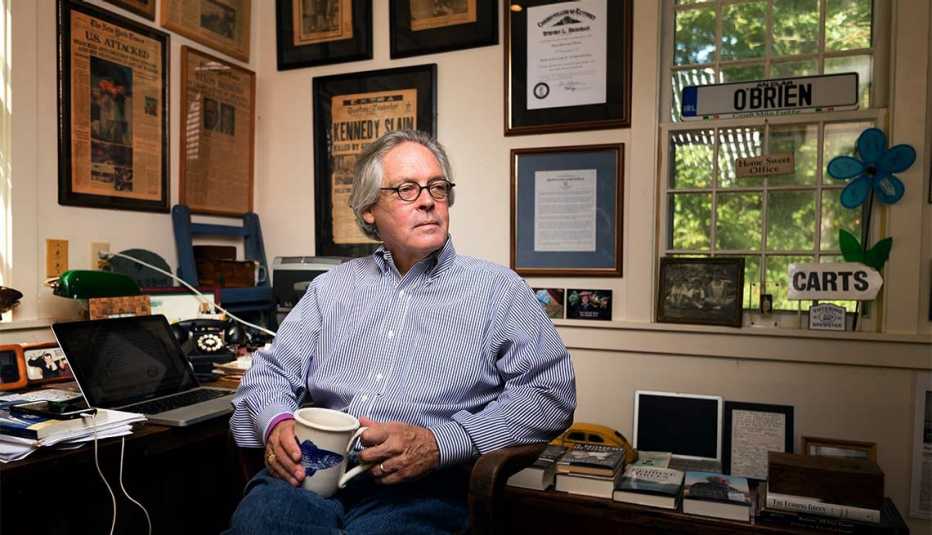

"We were hearing a lot of anecdotes about patients who didn't even know that they had dementia when some of these adverse financial events were happening,” says Nicholas, a health economist and lead author of the study. “Then the whole family might find out when they'd lost a home or a business, or suddenly a new scammer had been added to other accounts and was taking their savings. We were interested in whether that was actually a common occurrence or whether these news stories were a few isolated events."

Other studies have suggested that cognitive impairment leads people to overestimate their abilities — which, in turn, often leads to financial difficulties and susceptibility to fraud. If undiagnosed dementia leads to costly financial errors, the study says, earlier diagnosis could be valuable even without effective treatments or cures.

The study, published Nov. 30, used Medicare claims data and credit data from the Federal Reserve Bank of New York/Equifax Consumer Credit Panel. Deteriorating credit was marked by payment delinquency — paying a bill 30 or more days late — and declining credit scores. A credit score below 620 is considered subprime, meaning it has a higher default risk than those above 620. The sample included those living in single-person households in the second quarter of 2018 (or the year of their death) and born before 1947.