Staying Fit

Are you a foodie? A football fanatic? A fan of Pope Francis? There's something for everyone on Instagram, the video- and photo-sharing platform that debuted 10 years ago. Be careful, though, because amid the coronavirus outbreak, consumer advocates are sounding an alarm about fraudsters lurking on social media sites including Instagram, which boasts more than 1 billion users worldwide.

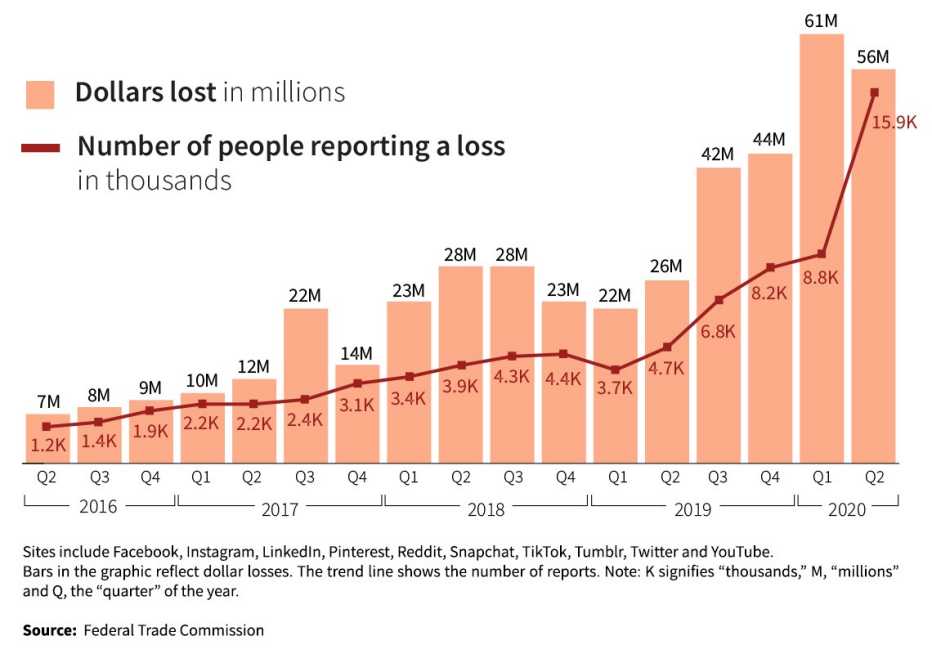

Lately there's been a record-shattering number of complaints to the Federal Trade Commission (FTC) about scams that arise on social media platforms and rip people off for millions. The FTC says online shopping frauds were the most common type of social media scam in the first half of the year; in many cases, people ordered goods that never arrived. Such cases were followed, in descending order, by romance scams and impostor scams involving businesses, people supposedly in need or government agencies.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

FTC: More Scams Start on Social Media

Among the FTC's findings:

- There were nearly 16 million complaints about scams that started on social media sites from April through June, and losses of $56 million. The figures reflect a 13-fold increase in complaints — and eightfold jump in losses — compared to the same period in 2016.

- During the first half of 2020, there were nearly 25 million complaints in total with $117 million in losses, compared to $134 million in overall losses last year.

"Scammers go where the people are — or they're already there waiting for the people to come,” says Emma Fletcher, an FTC program analyst. “Like so many ways that [bad actors] reach people — whether it's phone, email or text — it's just another way to reach people without a lot of costs, while being able to remain anonymous."

More From AARP

Your Real Friend May be Phony on Social Media

How to spot impostors on Facebook Messenger, Instagram

8 Tips to Scam-Proof Your Life During COVID-19

Crooks capitalizing on the crisis want your cash and personal dataAvoiding Scams on Popular Social Media Networks

How crooks use platforms to connect and steal