Staying Fit

The cars we grew up with had little more complexity than a lawn mower. Accelerate to today, and the technical changes are almost unimaginable. Here are the rules of car care and how they've changed over the years.

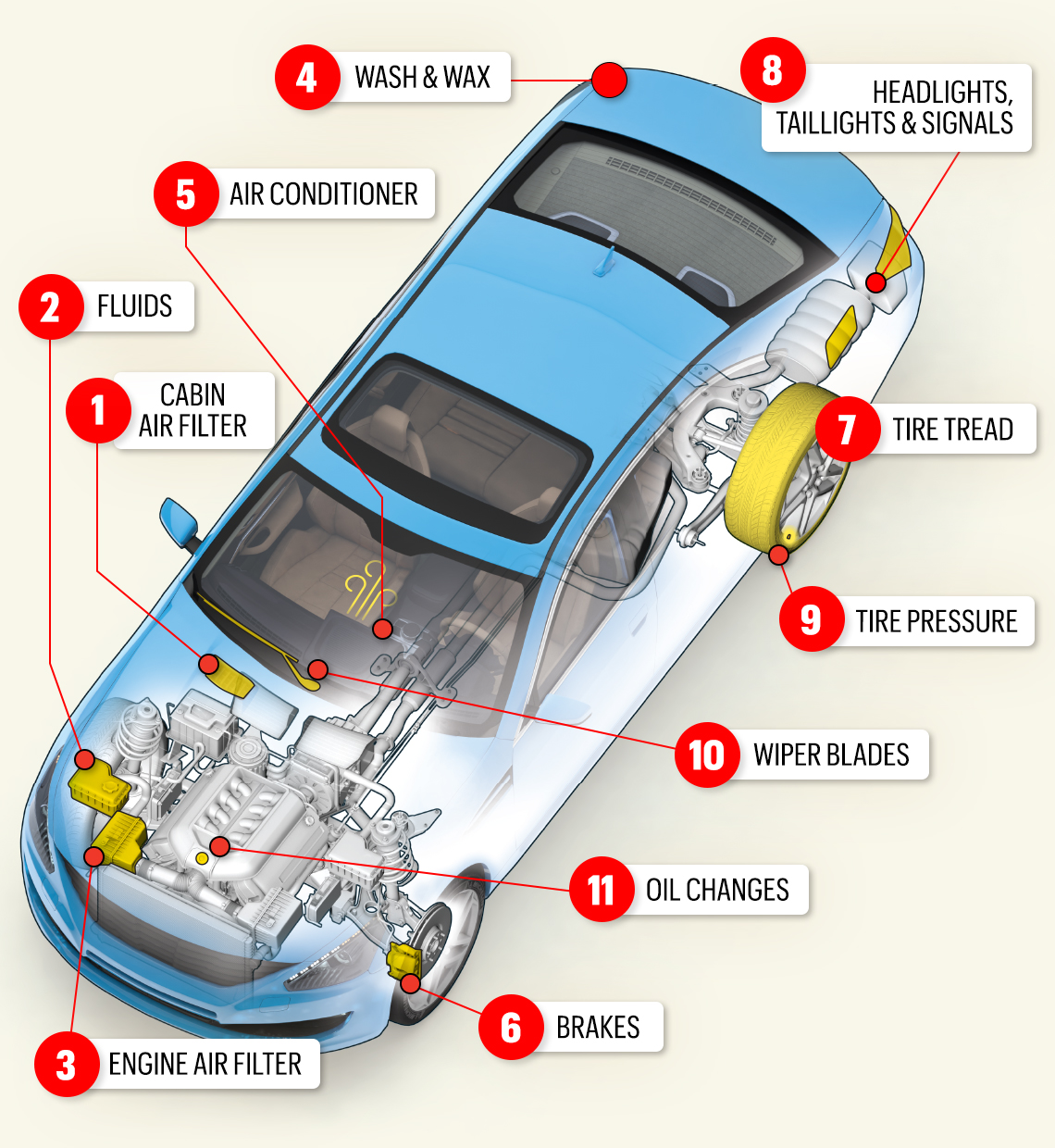

1. Cabin air filter

Then: What?

Now: Cabin air filters, made to improve interior air quality, only became common in 2000. The filter is tucked behind the glove box, under the dashboard or under the hood, and it needs to be replaced about every year. You can do this yourself, but you may twist yourself into knots to reach it.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

2. Fluids

Then: Dipsticks showed if you had enough oil and automatic transmission fluid. For brake, power steering and windshield washer fluids, you just eyeballed the reservoir. For coolant, you'd pop the radiator cap and look.

Now: Some cars no longer have oil and transmission dipsticks, relying on sensors to notify you if there's an issue. Hands off the radiator cap; instead, go to a separate reservoir tank under the hood that lets you see if the coolant is low. Mechanics top off all fluids during routine maintenance.

3. Engine air filter

Then: You'd pop open the hood, spin a wing nut, pull off the air cleaner cover and drop in a new filter.

Now: It's not quite so easy. You need to be careful not to damage the electronic air sensor wiring that is often built into the air cleaner housing. Figure on a new filter every year or two, depending on your driving.

4. Wash and wax

Then: Used dish soap and water, a sponge to wash, hose to rinse. Used a leather chamois to dry. Applied wax several times a year.

Now: The only right thing about the earlier way is the hose. The rest could dull and scratch car paints. Buy specially formulated car-wash soap (less harsh) and use a wash mitt and microfiber drying towel. And research whether ceramic coatings would work better for your car's body than conventional wax.

5. Air conditioner

Then and now: Needs attention only if there's a leak in the system. If a technician says you need a freon recharge, either there's a leak that should be fixed first or you're being scammed.