Staying Fit

Once a year, Medicare gives its nearly 66 million beneficiaries a chance to step back, review their coverage and make any changes that will help them get the best out of the federal government’s health insurance program for adults age 65 and over and people with disabilities.

But experts say too many enrollees overlook this annual opportunity to possibly save money and improve their coverage.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

“Most people don’t pay much attention to the open enrollment period and that can come at a cost,” says Tricia Neuman, senior vice president of the Kaiser Family Foundation and executive director of its Program on Medicare Policy. Neuman says beneficiaries can save hundreds or even thousands of dollars by, for example, finding a prescription drug or Medicare Advantage plan that better meets their needs.

When is Medicare open enrollment?

Medicare open enrollment starts each year on October 15 and ends December 7. You can make changes that will go into effect the following year. There are other important Medicare enrollment periods, including the initial enrollment period (IEP) around the time you turn 65 and a special enrollment period (SEP) if you lose employer-based health coverage after age 65.

Knowing when Medicare open enrollment starts is the easy part — how to start the process can be more daunting. Here’s practical advice on what to review about your coverage and what changes you can make. Your options are different depending on whether you are enrolled in original Medicare or a Medicare Advantage (MA) private insurance plan.

Original Medicare open enrollment basics

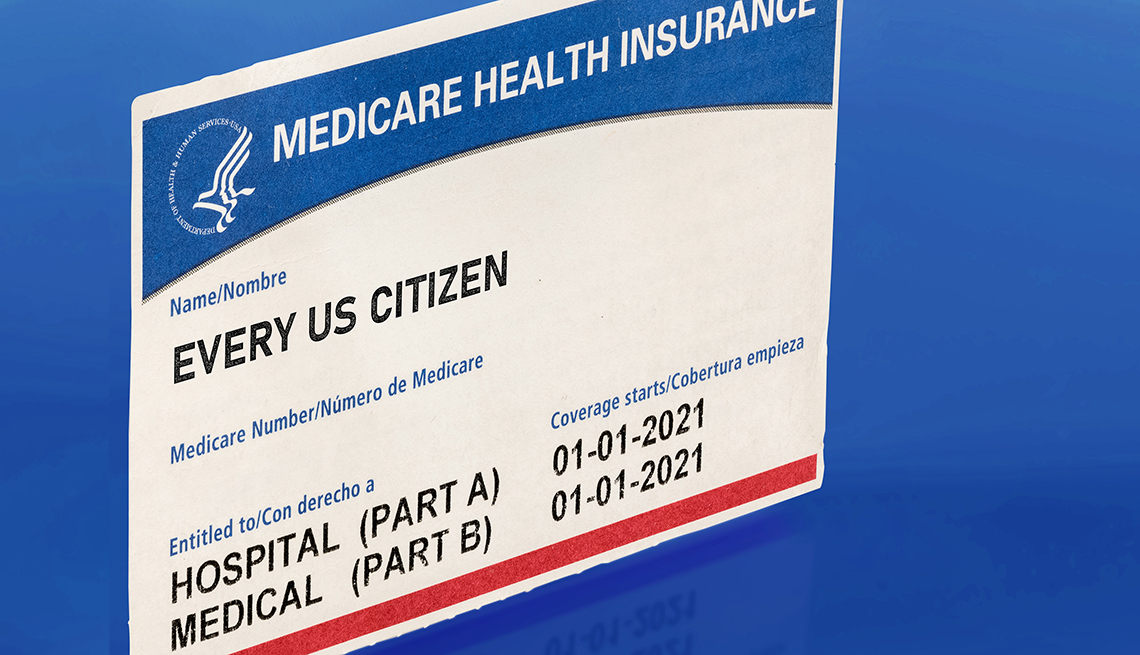

Original Medicare consists of Part A (hospital coverage) and Part B (doctor and outpatient services). You’ll also want to consider a stand-alone Part D drug plan that helps pay for prescription medications. There are monthly premiums for Part B and Part D; most people don’t pay a premium for Part A.

Doctors and drugs. Since Part A and Part B are standard for all Medicare beneficiaries, there’s nothing for you to change with this coverage. You can go to any doctor or facility that accepts Medicare. Part D plans vary, however, so this is an opportune time to review your drug coverage and change plans, or add a Part D plan if you don’t have one yet. You can even switch from original Medicare to a private Medicare Advantage plan during open enrollment if you choose. (More below.)

It’s also an opportune time to confirm that your preferred doctors and medical facilities will continue to accept Medicare in the new year. Odds are they will — experts estimate that more than 90 percent of doctors participate in the program and the vast majority of hospitals do as well — but it never hurts to ask.

Supplemental insurance. Original Medicare doesn’t pay for everything. Under Part B, for example, you are responsible for 20 percent of the cost of a doctor visit or lab test. Medicare supplemental insurance, also known as Medigap insurance, helps pay for uncovered expenses, including some copays and coinsurance. Supplemental insurance is optional and not subject to the open enrollment period. You can buy a Medigap policy at any time during the year. And you can change your Medigap coverage at any time during the year.

However, there’s something critically important to know about changing your Medigap policy: Insurers handling this coverage can’t turn you down for a policy within six months of your being eligible for Medicare, even if you have a chronic medical condition, are overweight, are a smoker or have any other illness. That’s called a guaranteed issue rule. But once that initial sign-up period is over, these companies can either refuse to sell you a policy or charge you a much higher premium. And that goes for your ability to change policies once you have one. There are four states — Connecticut, Maine, Massachusetts and New York — with laws that require insurers to sell you a Medigap policy all the time or at least once a year.

Neuman points out that if you do not have any preexisting conditions, you probably can change Medigap policies without paying more. It’s worth checking out if you aren’t satisfied with your current supplemental plan.

More on Medicare

10 Steps to Take After You Sign Up for Medicare

Just enrolled? You can put your new Medicare coverage to good use

Medicare Q&A Tool

AARP's Medicare Question and Answer Tool provides you with fast access to the answers you have about how the program works.How to Find and Enroll in a Medicare Advantage Plan

Follow our step-by-step guide to signing up online