Staying Fit

;Missing deadlines, delaying enrollment or choosing the wrong plan can cost you a bundle when it comes to Medicare. Here’s a list of 10 common mistakes new Medicare enrollees make and how to avoid them, according to the Medicare Rights Center, a nonpartisan, not-for-profit consumer service organization.

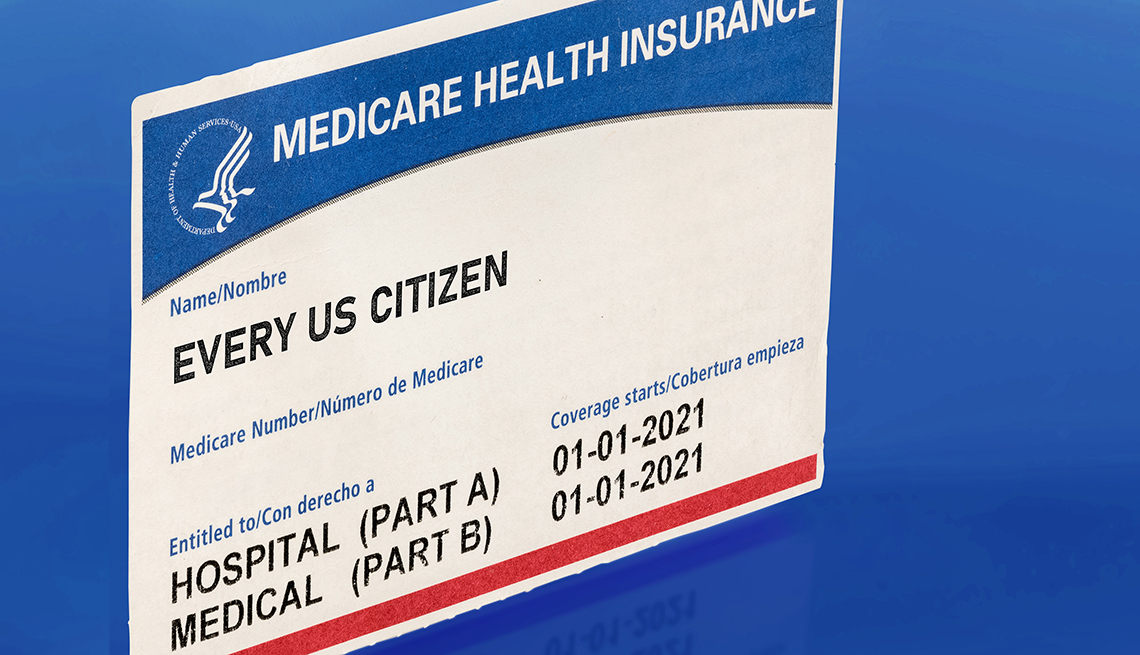

1. Not signing up for Medicare at the right time

Timing, as they say, is everything. It’s especially important when it comes to enrolling in Medicare . As you approach 65, you’ll want to enroll during what the government calls your initial enrollment period (IEP). This seven-month period goes from three months before the month in which you turn 65 until three months after.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

If you don’t sign up during your IEP, you will get another chance to enroll during Medicare’s annual general enrollment period, from Jan. 1 through March 31 of each year. However, because you enrolled late, your monthly premiums for Medicare Part B — which covers your doctor visits and other outpatient services—will likely cost you more. If you enroll at any time during your initial enrollment period, a special enrollment period or during the general enrollment period, your coverage will take effect the following month. Remember, if you sign up for Part B during the general enrollment period, you’ll still be subject to that late enrollment penalty.

2. Blowing the special enrollment period

If you are 65 or older, when you stop working and lose your health insurance coverage or when the insurance you have through your spouse ends, you’ll need to sign up for Medicare. Medicare has created a special enrollment period (SEP) that lets you do that without facing a late enrollment penalty.

Again, timing is everything. What many people don’t realize is that you can only use this SEP either while you are covered by job-based insurance or for eight months after you no longer have job-based insurance.

Note: Medicare does not count retiree health insurance or COBRA as job-based coverage. So, if that’s the insurance you have, you’ll need to reread mistake number one and sign up when you turn 65 or face that late enrollment penalty.

3. Delaying enrollment when your job insurance is second in line

Even when you have job-based insurance, some employers, depending on their size, can designate Medicare as your primary health coverage when you turn 65. And if you have retiree coverage or COBRA, those are considered secondary coverage.

If your job-based or other private insurance is considered secondary coverage, it will only pay for a medical claim after Medicare has paid its share. So, if your job-related insurance becomes your secondary coverage, it’s important to sign up for Medicare. If your job-based insurance is primary, then Medicare becomes your secondary coverage.

The way to find out if your job-based insurance is considered primary or secondary is to ask your benefits manager or human resources department, or seek help from 800-MEDICARE.

More on health

Medicare Launches Program to Help Doctors View Patient Data

Data at the Point of Care (DPC) program would provide a snapshot of enrollees' drugs and testsI turn 65 soon. When should I sign up for Medicare?

It depends on whether you or your spouse is still working

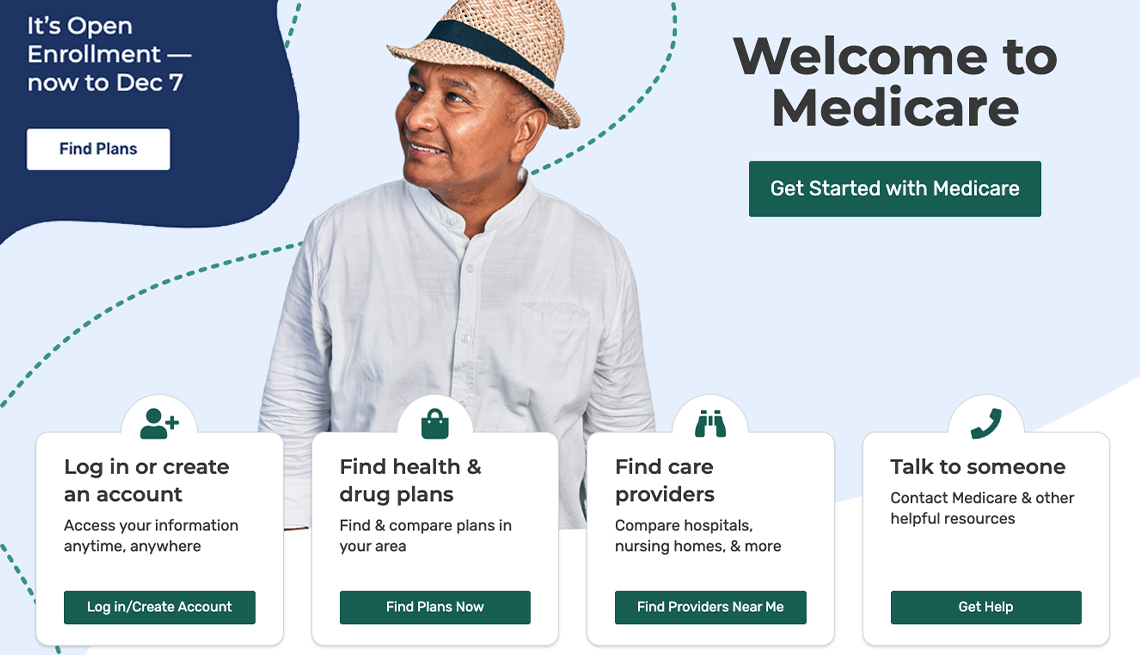

10 Steps to Take After You Sign Up for Medicare

Just enrolled? You can put your new Medicare coverage to good use